Enroll in Online Banking1

The easiest way for you to access, manage, and fund your account 24/7 is through online and mobile banking.2 Secure and convenient, it offers you the freedom to check your balance, deposit checks, transfer money, and more.

Deposit Money

Adding money to your new account is simple, and there are a number of ways to do it:

- Set up direct deposit to electronically deposit payroll or Social Security checks — and Early Pay3 from KeyBank may allow you to get your money up to two days sooner.

- Transfer money from another bank.

- Deposit checks right from your phone with mobile check deposit.

- Visit a branch.

Set Up Account Alerts

Get notified about account activity, protect yourself from overdrafts, and reduce your risk of identity theft and fraud by having account alerts sent to you by text,2 push notifications, or email.

Enjoy Relationship Rates and Benefits

Make the most of your new account and earn higher interest rates and more cashback.

Frequently Asked Questions

If ordered, debit cards will arrive in the mail within 5-7 business days after your initial deposit is made.

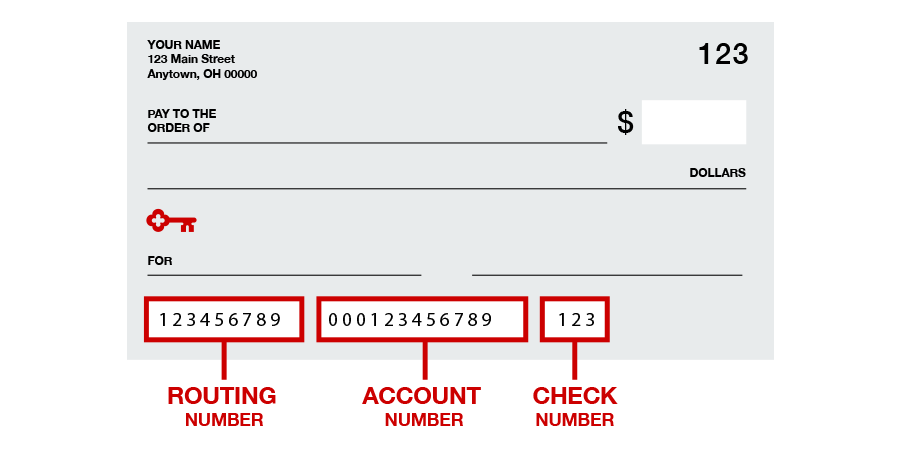

Order your checks easily in online and mobile banking, directly with KeyBank’s preferred check provider, Harland Clarke,4 online or by calling 1-800-355-8123, or by stopping in your local KeyBank branch. Please note that when placing a checkbook order directly with Harland Clarke, you will need your routing and account numbers.

You’ll find your KeyBank account and routing numbers in the Account Info and Settings menu when you log in to online or mobile banking and at the bottom of your paper checks.

KeyBank offers detailed information about overdraft fees and options available to avoid them. We're always available to help determine the best option for you.

You can send, request, or receive money with Zelle.1 After you’ve registered, simply add your recipient’s email address or mobile number, the amount you’d like to send or request, and add an optional note, then hit Confirm. To receive money, just share your registered email address or mobile number with a friend and ask them to Send Money with Zelle®.

Subject to terms and conditions in Service Agreement.

Message and Data rates may apply from your wireless carrier.

Early Pay is a service included with your KeyBank consumer deposit account in which KeyBank makes your eligible direct deposits available up to two business days early. Eligible direct deposits include certain transactions such as payroll, government benefits, or similar types of payments. The Early Pay service is dependent on when KeyBank receives information from the payer that the funds are on the way, this could vary, and you may not always receive your funds early. You cannot opt out of Early Pay.

KeyCorp is not affiliated with, maintained by, or in any way officially connected with Harland Clarke or any of its business units.

Zelle® and the Zelle®-related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.

Apple is a trademark of Apple Inc.

Google and the Google logo are registered trademarks of Google LLC.