Key Accounts Manager Complete User Guide

Complete User Guide Sections

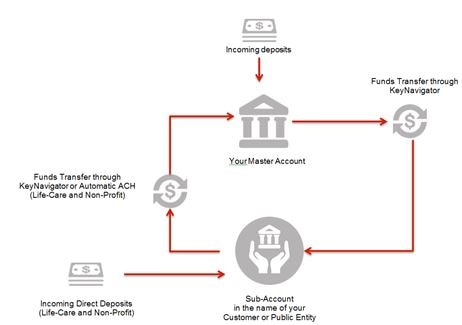

Key understands the importance of providing you with clear, easy to follow steps to set up your sub-accounts. The Key Account Manager (KAM) solution segregates client escrow funds into separate sub-accounts, each clearly identified by a unique account number, as well as your social security number or taxpayer ID number. Each sub-account is also linked to a single master account for disbursements.

1. Overview

The Key Multicurrency Account can help you reduce your international transaction costs and improve liquidity. Proceeds from the settlement of foreign receivables can be deposited directly into your account. Since no foreign conversion is required, payments can be credited to your account faster. If you have both currency-denominated payables and receivables Key’s multicurrency account can reduce foreign exchange rate risk by maintaining balances in multiple currencies to cover international payment obligations.

This guide will provide all the details you need for how to create and authorize your payments, as well as view your account activity.

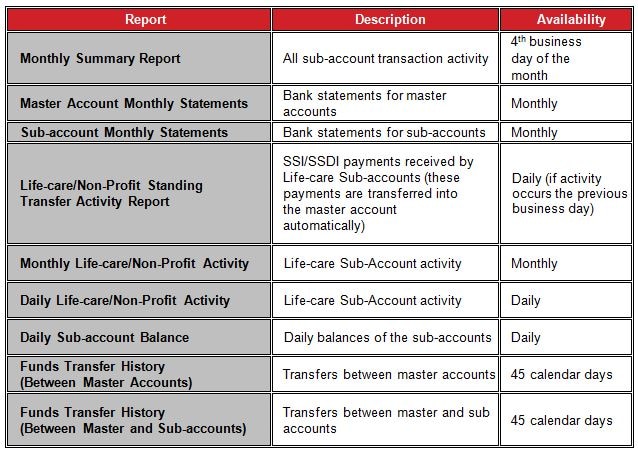

To further simply the process, you will receive a monthly summary report via KeyNavigator, our 24-hour internet based delivery channel. This report clearly describes all sub-account transaction activity and delivers the detail you need to reconcile efficiently and accurately.

You will also be mailed 1099s for sub-accounts with an accrued interest of $10 or more per year. Key Accounts Manager is backed by a dedicated support team, so you will have access to the answers you need, leaving any guesswork behind.

With Key Accounts Manager, you will also enjoy the convenience of spending less time on bookkeeping and paperwork, while you enjoy the added value of earning a competitive money market rate of interest on all of your sub-account balances.

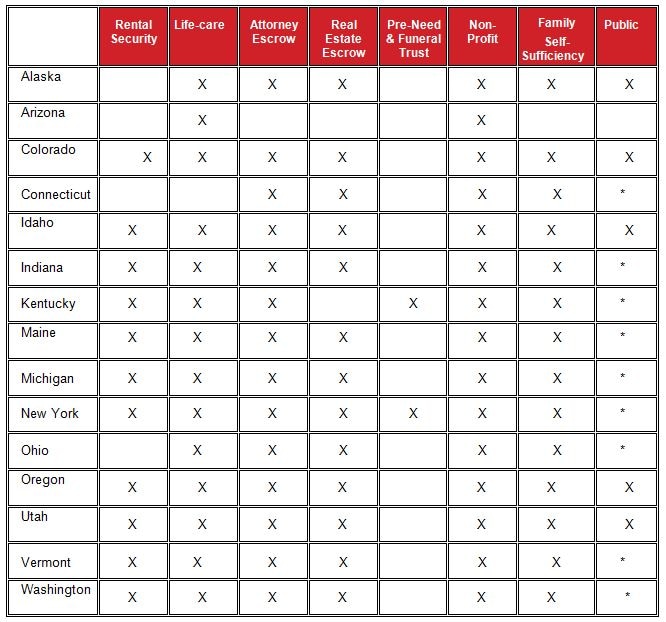

1.1 Industry and State Availability

Key Accounts Manager is available only for use in specific industries and for specific purposes.

Based on state laws and regulations, Key Accounts Manager can only be offered in certain states. The following grid shows Key Accounts Manager Version availability by state.

*Contact your Payments Advisor for availability.

1.2 Support

The Key Accounts Manager Support Team is available Monday through Friday, 8:00 a.m. – 5:00 p.m. ET. The Key Accounts Manager Support Team is not available on weekends or federal holidays. The Key Accounts Manager Support team can provide communications to you through secure e-mail or by phone.

- Phone: 800-361-4031

- Secure Email: Key_Accounts_Manager@keybank.com

- Mailing Address:

- KeyBank Key Accounts Manager

OH 01-51-2005

PO Box 5598

Cleveland, OH 44101-5998

- KeyBank Key Accounts Manager

Issues related to the usability of the Key Accounts Manager module on KeyNavigator will be handled through online alerts within the application.

To submit a request for a new sub-account, you must complete a new set-up template in Microsoft Excel (see screenshot of form in Appendix A). Be sure to complete all required fields, as indicated in section 2.1, Set-up Fields.

- If any requests cannot be processed, you will be contacted by the Key Accounts Manager Support Team

- Revisions to sub-accounts should be submitted on a new template

- New sub-accounts opened on the last business day of the month will appear on the next month’s Key Accounts Manager report.

2.1 Set-up Fields

- Date mm/dd/yy: Date you prepared the sub-account request

- Prepared by: Your name or the name of the person who completed the template

- Telephone Number: Your phone number or the phone number of the person who completed the template

- Master/Client Name: Name of the organization, which must be the same as the name on the Master Account

- Master Account Number: Your master checking account number

- Group Number: The group number assigned to you by the Key Accounts Manager Support Team and provided to you when your account was opened.

- Division: An optional field you may use for identification purposes

- Unit Number: An optional field you can define that can contain miscellaneous information

- Sub-Account Name: Sub-account holder’s name (individual or business)

- Title Line 2: Additional titling for a sub-account holder

- Sub-Account Deposit Amount: An optional field indicating the amount of the first deposit. If you are performing prefunding, you will use this field.

- Rental Security Pet, Garage, or Other Deposit Flag: An optional field that identifies the presence of additional fees. Enter P, G, O, or leave this field blank.

- New York Rental Security Year End Interest: for New York Rental Security only, enter A (C is not available)

- Sub-Account SSN/EIN/TIN: The tax identification number of the sub-account funds owner

- Sub-Account U.S. Citizen: Enter ‘Y’ if the sub-account funds owner is an individual, otherwise enter ‘N’.

- Tax ID Indicator: Enter 0 if the sub-account funds owner is an individual, otherwise enter 1 to indicate a business

- Pre-Need Only Irrevocable Trust Flag: For Funeral Pre-Need only, enter ‘Y’ if the sub-account is an irrevocable trust, otherwise enter ‘N’

- Non-Profit and Life-Care Only Sub-Account Date of Birth mm/dd/yy: The date of birth of the sub-account holder

- Additional Space for Foreign Address: An optional field to include additional foreign address information

- City: The city of the street address

- State, Possession, or Canadian Province Code: The state of the street address

- Zip Code: The zip code of the street address

- KeyBank Use Only: Country Code, leave this field blank

Key understands how important it is to provide you with clear, easy to follow reports for your treasury functions. Key Accounts Manager enables you to have a sub-accounting service that manages escrow deposits by linking multiple interest bearing sub-accounts to a single master funding account.

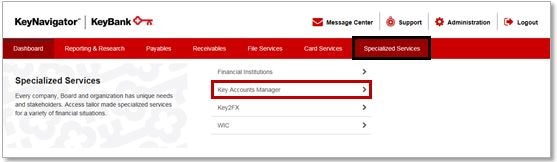

Key Accounts Manager provides comprehensive sub-account information at your fingertips. Reports can be viewed online, using KeyNavigator's Key Accounts Manager module.

3.1 Available Reports

The following reports are available through Key Accounts Manager on KeyNavigator:

3.2 Understanding Your Key Accounts Manager Reports

Key Accounts Manager reports are organized in up to five sections. Your report may not contain all five sections. These sections are:

- Section I: Division Closed Sub-Account Detail

- Section II: Division Year to Date Closed Sub-account Summary

- Section III: Division Open Sub-Account Summary

- Section IV: Division Year to Date Open Sub Account Summary

- Section V: Master Closed and Open Year to Date Summary

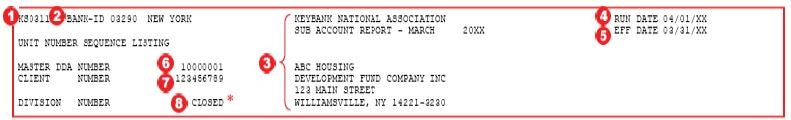

Header

The Division Number in the report header on each page identifies the section you are viewing.

- Report Number: (For bank use)

- Bank ID: (For bank use)

- Report Title: Name of report, time period covered, client name and address

- Run Date: Date the report was produced

- Eff. Date: Date the report is “as of” (effective date)

- Master DDA Number: Key Accounts Manager master account number

- Client Number: Bank assigned number to identify the set of sub-accounts associated (a.k.a “group number”). Multiple groups may be associated with the same master account.

- Division Number: Optional number you assign of up to six (6) digits for the purpose of segregating sub-accounts within a group to produce subtotals on the report. For closed sub-accounts, the division number is “CLOSED.” If you have not assigned values to open accounts, the division number will be “000000.”

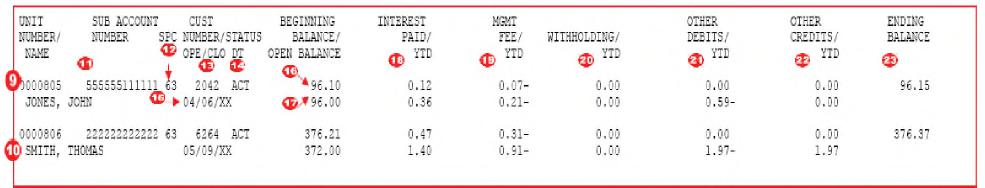

In Sections I and III, the first line displays monthly values and the second line displays year to date values. The Division Number in the report header on each page identifies the section you are viewing. Accounts in Sections I-IV are sorted by the (optional) unit number field.

NOTE: If for some reason an account does not reconcile from beginning balance to ending balance, it will be denoted by two asterisks (**). Contact Key Accounts Manager Support if you need more information.

Sections I and III

Sections II, IV, and V

9. Unit Number: Optional value you assign to identify sub accounts of up to seven (7) alphanumeric characters. If you do not assign a value, the unit number will be “0000000.” Sub-accounts are sorted by unit number.

10. Name: Name of the sub-account funds owner

11. Sub-Account Number: The account number of the sub account

12. SPC: (For bank use)

13. Cust Number: Last four (4) digits of the sub-account funds owners’ Social Security Number or “0000” if certified by W-8BEN

14. Status: Sub-Account status “ACT” – open sub account; “INA” – closed sub-account. Closed sub-accounts are reported for one (1) year from the date of closure.

15. Open/Clo Dt: Date the sub-account was opened or closed

16. Beginning Balance: Prior month ending balance or “0.00” for newly opened accounts

17. Open Balance: The amount of the first item (i.e. check) deposited to the sub-account. If multiple items are deposited, only the first item will be displayed.

18. Interest Paid: Amount of interest credited to the sub-account

19. Management Fee: (not available) 20. Withholding: Bank will withhold some interest for tax purposes if sub-account funds owner is subject to withholding as indicated on W-9 or W-8BEN.

21. Other Debits: All debit transactions except Management Fee and Withholding

22. Other Credits: All credit transactions except Interest Paid

23. Ending Balance: Beginning Balance + Other Credits + Interest Paid – Withholding – Management Fee – Other Debits

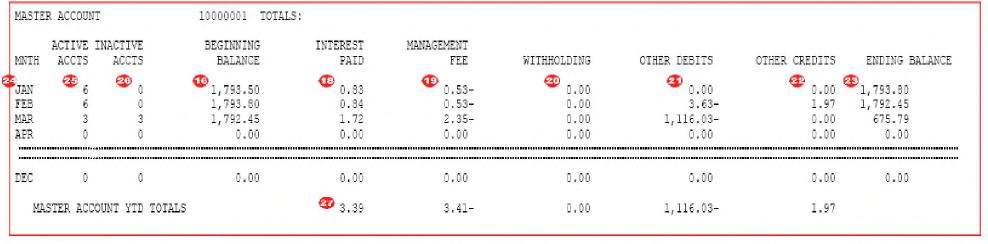

24. Month: Month

25. Active Accounts: Count of open sub-accounts

26. Inactive Accounts: Count of closed sub-accounts. Closed sub-accounts are reported for one (1) year from the date of closure.

27. Division / Master Account Totals: Year to Date totals

3.3 Understanding Life-Care and Non-Profit Reports

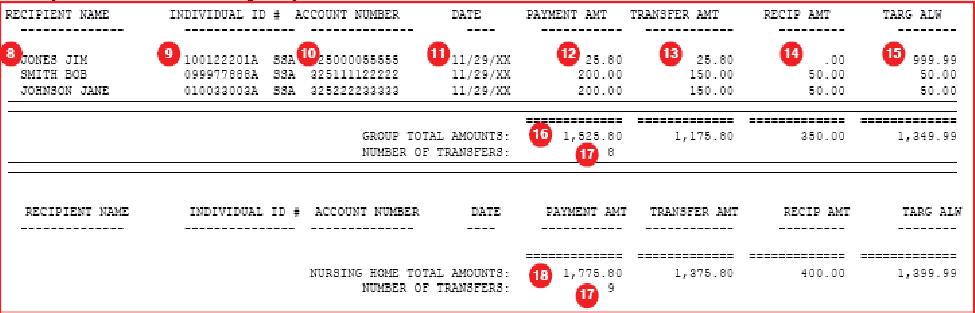

The Daily and Monthly Life-Care Activity reports display all transactions in sub-accounts, including incoming deposits and amounts automatically transferred to the master account, residual funds (allowances), and the maximum amount that can remain in the sub-accounts. Activity for each of your locations appears together, with totals for all locations displayed at the end of the report.

The Life-Care/Non-Profit Standing Transfer Activity report is generated twice a month when Social Security payments are received in the sub-accounts (generally on the 4th and 15th days of the month). Deposits are grouped together and totaled by location.

Header

- Report Number: (For bank use)

- Report Title: Name of the report

- Run Date: Date the report was produced

- Bank Name: (For bank use)

- Group Number: Bank assigned number to identify the set of sub-accounts associated

- Name: Client or Facility Name

- Account: Master account number

Activity

8. Recipient Name: Sub-Account funds holder (beneficiary)

9. Individual ID #: SSA/SSI claim number

10. Account Number: Sub-Account number

11. Date: Effective date of the transfer

12. Payment Amt.: Amount of payment received

13. Transfer Amt.: Amount that was automatically transferred by the Bank to the master account

14. Recip Amt.: Amount of funds remaining in the sub-account to be used as a personal allowance by the funds owner. This amount is determined by the facility and Social Security Administration.

15. Targ Alw: Maximum balance that may remain in the sub-account

16. Group Total Amounts: Summary amounts for the group.

17. Number of Transfers: Summary count for the group / facility

18. Nursing Home Total Amounts: Summary amounts for the facility (all groups)

Standard Transfer Activity

19. Participant Name: Sub-Account funds owner

20. Effective Date: Effective date of received payment and automatic transfer to the master account.

21. From Account: Sub-Account number

22. To Account: Master account number or alternate account number (if requested)

23. Group Total: Summaries for the group

24. Nursing Home Total: Summaries for the facility (all groups)

Funds can be transferred online via the Key Accounts Manager section between two master accounts and between master and sub-accounts. Transfers between sub-accounts are not allowed. Transfers between Key Accounts Manager accounts are book transfers and are available immediately in the receiving account.

Funds can be transferred online in the Key Navigator Specialized Services section, between the Key Accounts Manager master and non-Key Accounts Manager accounts.

Same-day transfers must be completed by 7:00 p.m. local time.

NOTE: Local time is defined according to where the account is held.

Transfers completed after 7:00 p.m. will be effective the following business day.