2019 Financial Confidence Survey Report

Women business leaders are optimistic and hopeful for the future

Key Takeaways

- 71% of women business owners are highly optimistic that they will achieve their business goals in the next 12 months.

- 9 out of 10 women plan to grow or expand their business within the next two years.

Introduction

Building on the optimism shown in the results of our 2018 Financial Confidence Survey, women business owners and executives remain positive. While their concerns may have changed, their focus and confidence are strong.

But what else is on the minds of women business leaders? To find out, Key4Women® conducted the 2019 Financial Confidence Survey, which polled women who either share or have primary responsibility for making high-level financial or other strategic decisions for their companies. We asked them about their business outlook over the next year, their plans for growth and expansion, and the barriers to success they’re facing and how they mitigate them. Their responses provide us good news but also make it clear there’s progress to make in terms of gender bias and barriers.

The Future Still Looks Bright

Despite recent headlines and the risk of an economic downturn, women leaders remain positive. Remarkably, 71% of women polled said they are highly optimistic they will achieve their business goals within the next 12 months.

This number is a slight increase from last year’s results – 66%. So, what is behind this sentiment? Highly optimistic business owners largely credit their positive outlook to three factors: the ability to hire good workers, new or different internal processes, and access to credit.

Women-Owned Businesses Are on the Grow

With optimism comes plans for growth. Accordingly, 90% of women business owners plan to expand or grow their business in the next two years. Our findings further indicate that 60% will focus on their current business, and 63% will grow or expand their business in the next year.

While plans for growth are strong, they are more so among women whose businesses have annual revenues of $5 million or more. Of this group, a notable 93% say they plan to expand, while 71% will grow or expand within the next year.

The Search for Funding

Whether it’s for the start-up or growth phase, most businesses need to borrow money. For women seeking capital, who have considered all available options and weighed the pros and cons of each, personal funding, business loans, and credit cards are their top sources. In fact, 44% of respondents have used personal funding to raise their start-up capital.

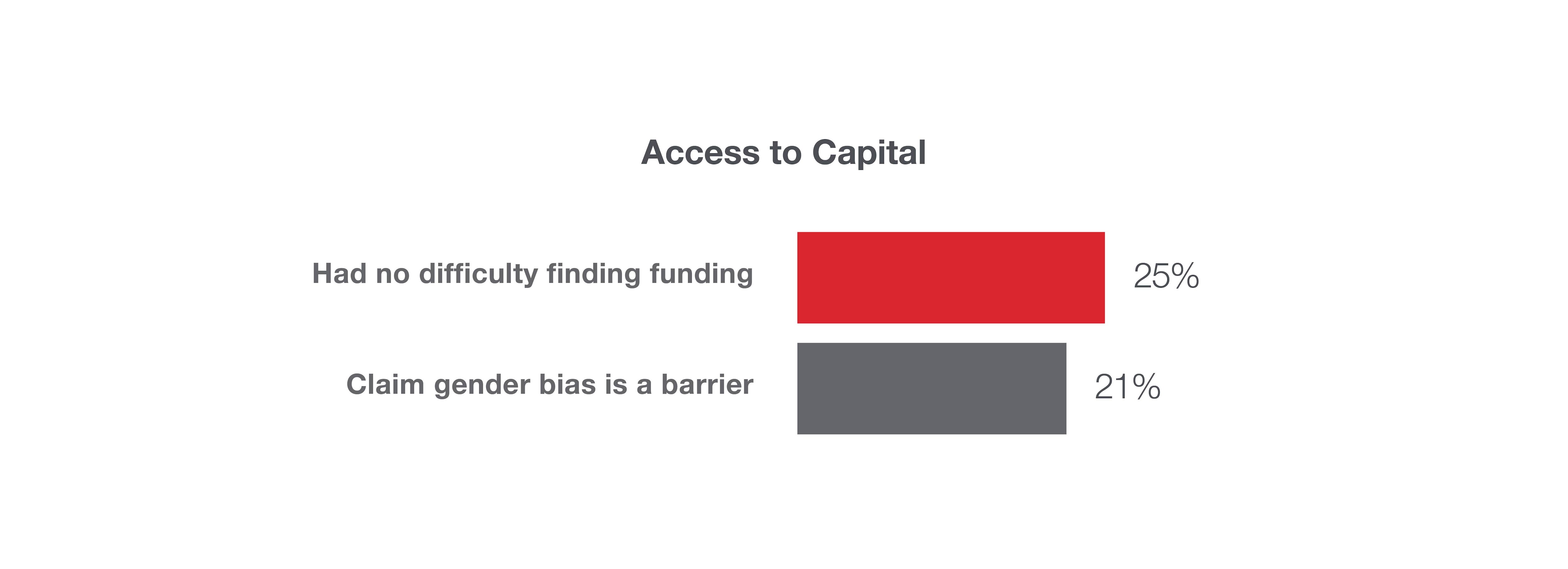

For some women, access to capital continues to be a hurdle. While 25% of respondents did not find it difficult to find funding, 21% claim gender bias makes it difficult to do so.

44%

of women business owners have used personal funding to raise their start-up capital.

Access to capital

25% - had no difficulty finding funding

21% - claim gender bias is a barrier

Confidence in the Workplace

From handling business finances to managing conflict and negotiating, there are many skills business leaders and executives must have to lead their business successfully. But how confident are women in their abilities in these areas? As it turns out, very. Confidence levels remain mostly unchanged from 2018, with 8 in 10 women expressing high levels of confidence in their abilities.

A Look to the Future

For years, many professional women have been striving to be professional superwomen – thriving in their careers, making a difference in the community, and keeping the household running on schedule. This begs the question, at a time when women are accomplishing so much, how confident do they feel about their financial future? Overall confidence remains strong among respondents, as 57% are very confident in their personal financial future, and 54% are highly confident they could maintain their lifestyle after selling their business.

Notably, women who own businesses are significantly more confident than those who do not. Among business owners, 65% are confident in their personal financial future, while 61% are confident they could maintain their lifestyle after selling their business.

Hope Amidst Barriers

While progress has been made, there’s still work to do to close the gender gap. Despite the gender-based barriers that still exist, women leaders remain hopeful and are not hesitant to act against them. Slightly more than half of the respondents (58%) feel they have experienced barriers to success due to their gender. And two-thirds of respondents have taken action against those barriers, including working harder (57%), joining local business organizations (49%), and calling out the bias (41%). Of the actions taken, networking with other women in business tops the list at 66%.

Furthermore, women who own businesses are more likely to act against gender-based barriers, with 77% of respondents indicating they’ve done so.

58%

of women have experienced barriers to success due to their gender.

Change on the Horizon

The findings of our survey are strong indicators that women business owners and executives are confident in their roles and optimistic about the future. As they look ahead, they do so with hope.

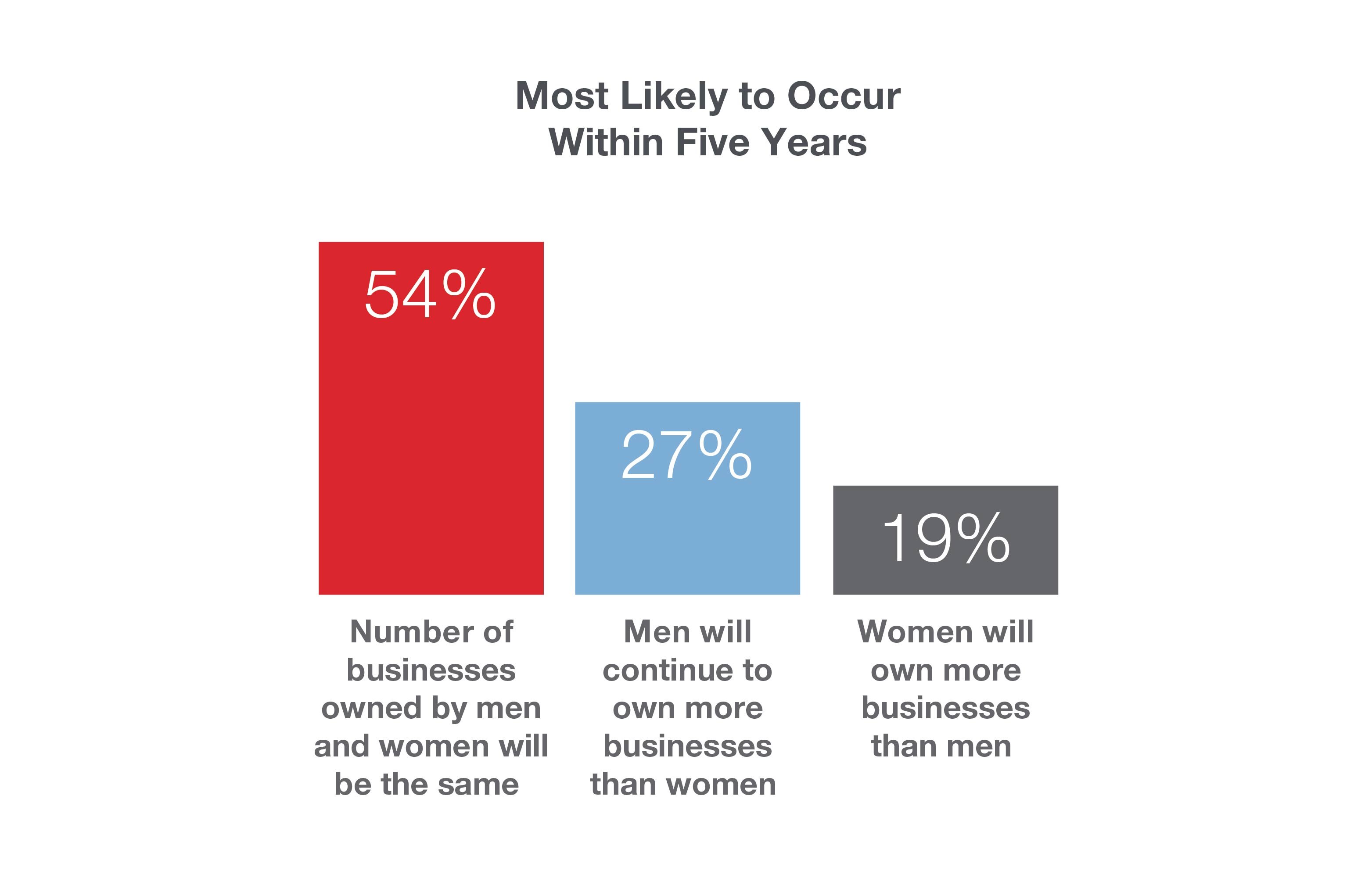

When asked what most likely will occur in the next five years, the majority of women who responded – 54% – believe the number of businesses owned by women and men will be similar. Interestingly, 27% think men will continue to own more businesses than women, while 19% think women will own more businesses than men.

Most likely to occur within five years

54% - Number of businesses owned by men and women will be similar

27% - Men will continue to own more businesses than women

19% - Women will own more businesses than men

It’s clear that optimism is the mood of the year. We’ll keep our finger on the pulse while remaining steadfast in our mission to support the advancement of women in business through advocacy, connections, and empowerment.

Key4Women: Empowering Women in Business

Established in 2005, Key4Women provides a network and platform for women in business to:

- Make meaningful connections.

- Get involved with our local networking events.

- Tap into capital to build and grow their businesses.

- Get customized financial services and advice from a local Key4Women certified advisor, including integrated wealth management.

- Access intellectual resources and articles on a variety of topics.

- Connect with us on LinkedIn, Twitter, and Facebook.

For more information on the benefits of Key4Women® and to join, visit Key.com/women.

The Support You Need

For more Key4Women resources to help you reach your goals, visit key.com/women, or email us to learn more.