Sweeps Overview Tour

Investment Sweep Reporting

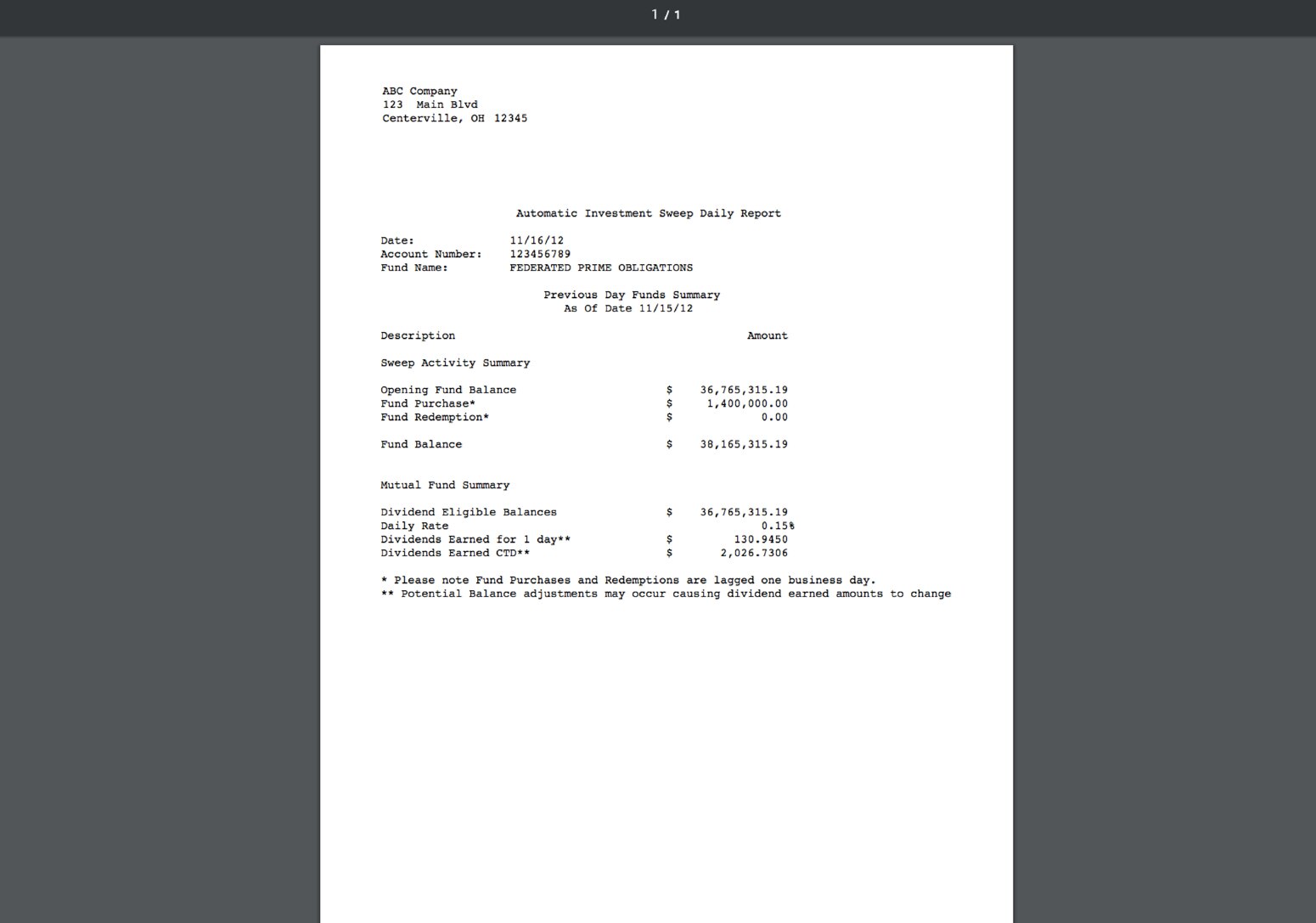

View daily investment reports or confirmations.

Non-deposit products: ARE NOT FDIC INSURED • ARE NOT DEPOSITS • MAY LOSE VALUE

An investment in money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Without limiting the foregoing, shares of a Federated Money Market Fund are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by KeyBank or any affiliates or subsidiaries of KeyBank, and are subject to investment risk, including possible loss of the principal amount invested. Shares of the Federated Money Market Funds are not insured or guaranteed by the U.S. Government, any state government or any U.S. or state government or government-sponsored agency. Although the money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

Your account (the “Account”) may be invested in mutual funds (such as the Federated Money Market Fund) for which neither KeyBank National Association nor any of its affiliates or subsidiaries (“Key”) serves as an investment adviser, fund manager, or distributor (“Non-Proprietary Mutual Funds”). Key may receive compensation from the Non-Proprietary Mutual Funds and/or the Non-Proprietary Mutual Fund companies for providing services in connection with investments by its customers. For example, Key has entered into arrangements with the Non-Proprietary Mutual Fund companies under which the Non-Proprietary Mutual Funds and/or the Non-Proprietary Mutual Fund companies will compensate Key for the Non-Proprietary mutual fund services.

These fees for services shall be in addition to, and will not reduce, Key’s compensation for other services to your account. Such fees for services will not be paid directly by your account, but will be paid to Key by the Non-Proprietary Mutual Funds company (i.e., Federated Investors, Inc. or its affiliates) or the Non-Proprietary Mutual Fund (i.e., the Federated Money Market Fund) itself. The compensation to be paid by Federated (or its affiliates) as such fees for services can be up to 0.10% (10 basis points) annually. The compensation paid by the Federated Money Market Fund out of fund assets can vary, is disclosed in the prospectus for the Federated Money Market Fund, and can be up to 0.25% (25 basis points) annually of the total amount of the account assets invested in the Federated Money Market Fund.

Federated Securities Corp. is the distributor of the Federated money market funds.

Credit Sweep Reporting

View daily investment reports or confirmations.

Investments are: Not FDIC insured; Are not deposits; May lose value.

An investment in money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Without limiting the foregoing, shares of a Federated Money Market Fund are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by KeyBank or any affiliates or subsidiaries of KeyBank, and are subject to investment risk, including possible loss of the principal amount invested. Shares of the Federated Money Market Funds are not insured or guaranteed by the U.S. Government, any state government or any U.S. or state government or government-sponsored agency. Although the money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

Your account (the “Account”) may be invested in mutual funds (such as the Federated Money Market Fund) for which neither KeyBank National Association nor any of its affiliates or subsidiaries (“Key”) serves as an investment adviser, fund manager, or distributor (“Non-Proprietary Mutual Funds”). Key may receive compensation from the Non-Proprietary Mutual Funds and/or the Non-Proprietary Mutual Fund companies for providing services in connection with investments by its customers. For example, Key has entered into arrangements with the Non-Proprietary Mutual Fund companies under which the Non-Proprietary Mutual Funds and/or the Non-Proprietary Mutual Fund companies will compensate Key for the Non-Proprietary mutual fund services.

These fees for services shall be in addition to, and will not reduce, Key’s compensation for other services to your account. Such fees for services will not be paid directly by your account, but will be paid to Key by the Non-Proprietary Mutual Funds company (i.e., Federated Investors, Inc. or its affiliates) or the Non-Proprietary Mutual Fund (i.e., the Federated Money Market Fund) itself. The compensation to be paid by Federated (or its affiliates) as such fees for services can be up to 0.10% (10 basis points) annually. The compensation paid by the Federated Money Market Fund out of fund assets can vary, is disclosed in the prospectus for the Federated Money Market Fund, and can be up to 0.25% (25 basis points) annually of the total amount of the account assets invested in the Federated Money Market Fund.

Federated Securities Corp. is the distributor of the Federated money market funds.