Sweeps Complete User Guide

Complete User Guide Sections

Non-deposit products: ARE NOT FDIC INSURED • ARE NOT DEPOSITS • MAY LOSE VALUE

Automated Sweeps are useful for automating and optimizing daily cash positioning and overnight investing and/or borrowing. Sweeps automatically transfer funds between a deposit account and an investment or a commercial line of credit.

Sweep processing runs once daily, after all other transactions have posted. Sweep transfers are driven by a preset target balance for the deposit account. If the available balance is above the target balance, a sweep transfer automatically debits the account and funds an investment or pays down a loan. Conversely, if the available balance in the deposit account is below the target balance, a sweep transfer automatically liquidates some of the investment* or draws on the loan to credit the account and restore the target balance.

As a result, the target balance is automatically maintained in the deposit account and excess cash is put to work elsewhere. This can provide for increased earnings and/or reduced interest expense as well as overdraft avoidance*. Because the process runs at the end of day, it is more efficient than what can be accomplished by manual cash positioning and investing / borrowing at some point in the middle of the day.

There are two basic types of investment sweeps, overnight investments and open-term investments.

- Overnight investment sweeps automatically invest excess balances and return all principle and earnings the next business day. KeyBank offers one overnight investment sweep:

- Automated Repurchase Agreement Sweep – Repo Sweeps invest in securities that are direct obligations of the U.S. Government, or those that are fully guaranteed as to principal and interest by the U.S. Government. Investments are collateralized at 100% of market value. Minimum investment: $25,000. Investment increment: $2,500. Earnings are classified as investment income.

*Repo Sweep only serves to invest excess funds; it does not fund the deposit account to cure deficits.

- Automated Repurchase Agreement Sweep – Repo Sweeps invest in securities that are direct obligations of the U.S. Government, or those that are fully guaranteed as to principal and interest by the U.S. Government. Investments are collateralized at 100% of market value. Minimum investment: $25,000. Investment increment: $2,500. Earnings are classified as investment income.

- Open-term investment sweeps do not necessarily return invested funds to the deposit account each day. Invested funds remain invested until they are needed to restore the target balance in the deposit account. KeyBank offers two open-term investment sweeps:

- Automatic Investment Sweep — Automatic Investment Sweep invests in government money market mutual funds managed by Federated® Investors. Investments are made on a next-day basis. Investment increment: $2,500. Earnings are classified as investment income.

- Deposit Sweep (Commercial / Public ) — Deposit Sweep invests in an interest bearing KeyBank deposit accounts that is only accessible through the sweep mechanism. Earnings are classified as interest.

- Credit Sweep – Credit Sweep links a deposit account to a commercial line of credit. Excess cash automatically sweeps to pay down the loan balance (until it reaches $0). Deficits in the deposit account are automatically cured by sweeps that draw on the loan (up to the credit limit).

Employees of KeyBank NA do not provide investment advice. Clients are responsible for determining the appropriateness of any deposit or investment. Mutual fund investments are not FDIC insured, not guaranteed, may lose value. Mutual fund prospectuses and other information are available at www.FederatedInvestors.com.

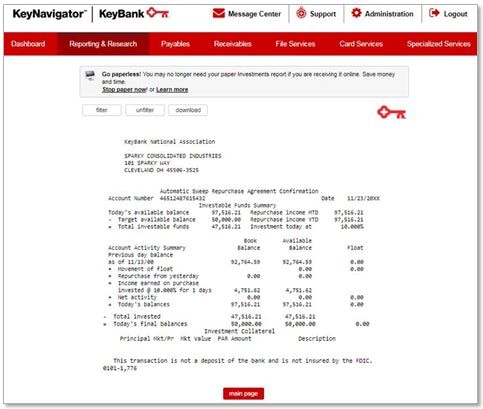

- Automated Repurchase Agreement Sweep provides a Daily Sweep Confirmation that displays the deposit account ledger and available balances, net transaction activity, the sweep target available balance, the sweep investment amount, the underlying investment security and daily, monthly and yearly income earned.

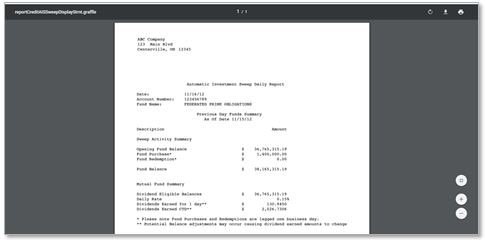

- Automatic Investment Sweep provides a Daily Investment Sweep Report that displays the money market mutual fund name, investment account opening balance, amount invested (purchased) or amount sold (redeemed), investment account closing balance, dividend rate and daily earnings amount. A monthly statement for the investment account is provided.

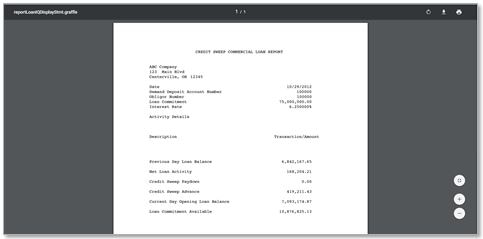

- Credit Sweep provides a Daily Credit Sweep Report that displays the previous day loan balance before sweeping, the amount of any sweep paydown / advance transfer, and the previous day closing loan balance. For some loans (on Loan IQ system), the following are also displayed: loan commitment amount, interest rate, net loan activity and available credit.

- Deposit Sweep provides a monthly statement for the investment account.

For all sweep types, sweep debits and credits to the deposit account are displayed on the optional Previous Day Report of all transaction activity.

5.1 Investment Sweep Reporting

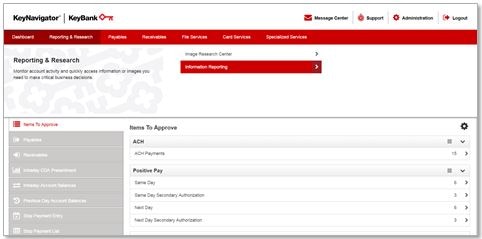

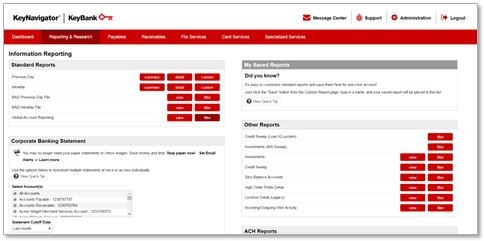

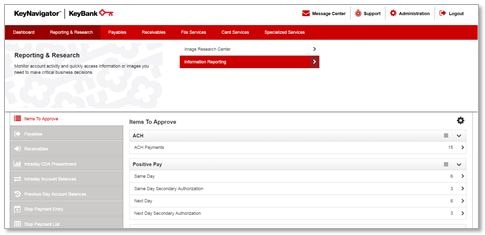

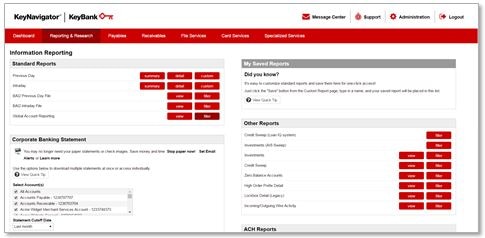

- To view daily investment reports or confirmations, go to the Reporting & Research area and select Information Reporting.

- For the Automatic Investment Sweep, click Filter next to Investments (AIS Sweep) to choose a specific account(s) or date(s) before viewing a daily Investment Sweep Report.

For the Automated Repurchase Agreement Sweep, click View next to Investments to display the latest Repurchase Sweep Confirmation, or click Filter to choose a specific account(s) or date(s) before viewing a daily Repurchase Sweep Confirmation.

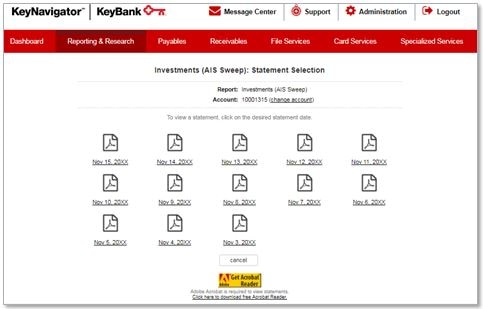

- Investments (AIS Sweep) Report Filter - Select an account and date(s), then click View.

- Investments (AIS Sweep) Report List - Automatic Investment Sweep Reports are displayed in descending date order. Select one to view it in PDF format.

- Investments (AIS Sweep) Daily Report - Automatic Investment Sweep Daily Reports display the money market mutual fund name, investment account opening balance, amount invested (purchased) or amount sold (redeemed), investment account closing balance, dividend rate and daily earnings.

- Repurchased Sweep Confirmation - Daily Repurchased Sweep Confirmations display ledger and available balances, net transaction activity, the sweep target available balance, the sweep investment amount, the underlying security and daily, monthly and yearly income earned.

Click Filter if you would like to retrieve a Repurchased Sweep Confirmation(s) for another account(s) and/or date(s), or click Unfilter to display the latest Repurchased Sweep Confirmation(s).

Click Download to export the Confirmation(s) displayed as a text file.

5.2 Credit Sweep Reporting

- To view daily Credit Sweep reports, go to the Reporting & Research area and select Information Reporting.

- Credit Sweep - click View to display the latest Credit Sweep Report, or click Filter to choose a specific account(s) or date(s) before viewing a daily Credit Sweep Report.

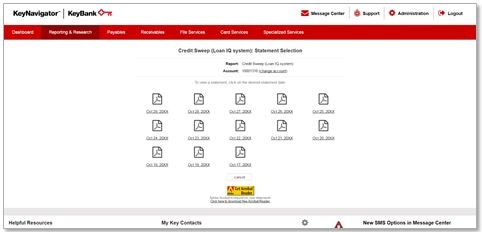

Credit Sweep on the Loan IQ system - click Filter to choose a specific account(s) or date(s) before viewing a daily Credit Sweep Report.

- Daily Credit Sweep Reports display the previous day loan balance before sweeping, the amount of sweep paydown or sweep advance transfers, and the previous day closing loan balance.

Click Filter if you would like to retrieve a Credit Sweep Report(s) for another account(s) and/or date(s) or click Unfilter to display the latest Credit Sweep Report(s).

Click Download to export the Credit Sweep Report(s) displayed as a text file.

- Credit Sweep (Loan IQ) Filter - Select an account and date(s), then click View.

- Credit Sweep (Loan IQ) Report List - Credit Sweep Reports are displayed in descending date order. Select one to view it in PDF format.

- Credit Sweep (Loan IQ) Reports display loan commitment amount, interest rate, previous day opening loan balance, net loan activity, the amount of sweep paydown or sweep advance transfers, the previous day closing loan balance and available credit.

The target balance that controls whether a sweep transfer occurs is adjustable. The default target balance is $25,000 in available funds. Clients may opt for a higher target balance. Typically this is done in order to generate more earnings credits with which to offset bank fees. Contact your KeyBank Payment Advisor if you would like to change the target balance for your sweep.