Financial wellness is an important part of your employees’ well-being — and the success of your business. So give them a no-cost benefit that can help them reach their financial goals, minimize stress, and improve their productivity. It’s a win-win.

Help Your Employees on the Path to Financial Wellness

When your employees are financially well, they know that minor emergencies or expenses won’t cause financial hardship. A better understanding of their budgeting options can help them build better financial habits, and keep making progress.

Employees who are stressed about their finances are less productive and in worse financial shape than other employees.1

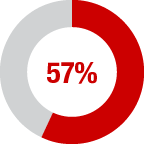

More than half of surveyed employees are financially stressed.

Employees Who Learn to Better Manage Their Money

Have less stress about their everyday finances

Are happier and more productive at work

Know they’re protected against financial risks

Are able to make more informed and confident financial decisions

Cultivate healthier financial habits

Workplace Well-Being Is More than Health and Retirement Benefits

More than half of surveyed employees are financially stressed, and 44% of those employees admit that stress is a distraction at work.1

Key@Work makes doing the right thing easy.

We’ll provide educational sessions — right at the workplace. Choose from a wide range of financial topics for these sessions, and we’ll set up a time that’s convenient for your business.

Your employees will have access to:

- Information on how to earn higher interest rates for checking and savings, more cashback, loan discounts, and more — it all starts with a KeyBank checking account. Learn more about relationship benefits.

- One-on-one and group meetings with Key bankers to provide an in-depth Key Financial Wellness Review.®

- Advice to help them get started on the path to financial wellness with alerts and insights to stay on track

We know it’s an ongoing journey, and we’ll be with them every step of the way.

Contact Key@Work

Find out more about how Key@Work can help your business and your employees thrive.

All credit products are subject to credit approval.