2020 Financial Confidence Survey Report

Finding Opportunities in Adversity

2020 has been a year of unprecedented setbacks for business owners. COVID-19 forced massive shifts in the way people run and plan for the future of their businesses.

To get insights on how this affected the perspectives of businesswomen, we spoke with them about their thoughts on the future.

We asked them about their business outlook over the next year, their plans for growth, the barriers they’re facing, and new strategies they’re taking. The COVID-19 pandemic has added even more stress for women in the workplace, with 19% unable to work due to childcare issues.1 As companies adapt to work-from-home schedules and schools implement remote learning, the lines between women’s personal and professional responsibilities are more blurred than ever. As a result, we’ve seen women leaving the workforce or taking leaves of absence at much higher rates than men. This could result in a lack of women in leadership roles in the future.

Despite particularly trying conditions, women’s drive to succeed remains strong as they navigate the changing climate.

Key Takeaways

- 70% of women business owners relied on their primary bank to some degree for financial guidance and insights.

- 72% of women business owners are still moderately to highly optimistic that they will reach their business goals this year.

Plans for growth

Since women have entered the business world, they’ve faced every adversity from gender bias to wage gaps. Time and time again, women have overcome setbacks and pushed forward in the business world.

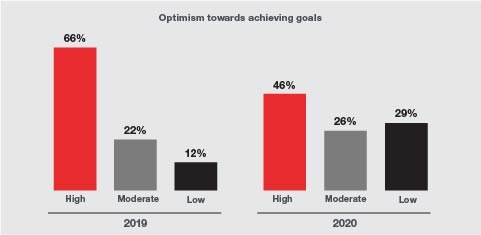

In the beginning of 2020, women’s representation in leadership roles was slowly trending upward, moving from 17% to 21% in the C-suite.2 As the year progressed, this momentum seemed to halt, with less than half of our respondents remaining optimistic about reaching their business goals over the next year. A majority of women attribute this to COVID-19 and the economy.

Though fervent optimism is trending down, about 72% of women are still moderately to highly optimistic that they will reach their business goals this year.

GRAPHIC #2 – Optimism towards achieving goals

2019

- 66% High

- 22% Moderate

- 12% Low

2020

- 46% High

- 26% Moderate

- 29% Low

Overall confidence takes hit

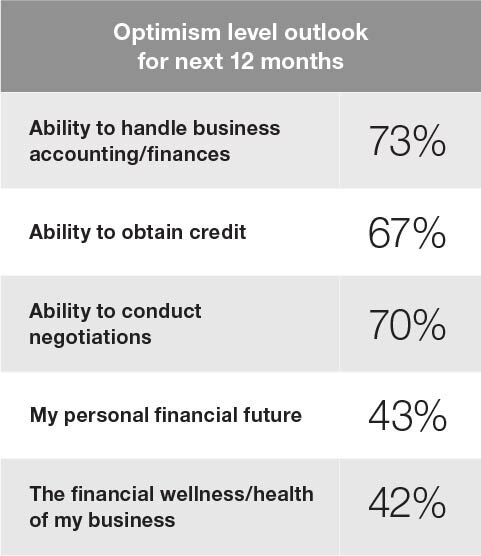

Accompanying challenges of COVID-19, women’s personal confidence has also been negatively impacted. Compared to 2019, women have significantly lower confidence in their abilities this year. Confidence in the ability to run efficient operations and manage finances is crucial to success in the business world.

In terms of specific abilities, women have more confidence in handling business accounting/ finances than obtaining credit or conducting negotiations.

Optimism level outlook for next 12 months

- 73% Ability to handle business accounting/finances

- 67% Ability to obtain credit

- 70% Ability to conduct negotiations

- 43% My personal financial future

- 42% The financial wellness/health of my business

Uncertainty in financial future

The lack of confidence has translated to their feelings toward the future of their personal and business financial wellness. While only around 40% of women reported feeling very confident in their financial future, over half reported feeling somewhat to very optimistic.

Despite being lower than previous years, overall we are still seeing that women remain resilient as they look to the future. Taking steps to get access to additional support and opportunities is a great way for women to protect the future of their businesses. Becoming a certified Women-Owned Small Business can secure insights and chances to help expand business possibilities. For businesses that are facing economic setbacks, getting the special certification, Economically Disadvantaged Woman Owned Small Business (EDWOSB) can help open doors to the future. Visit SBA.gov to learn more.

COVID-19 outcomes

The pandemic has presented new challenges and opportunities for businesses. Unfortunately, about 59% of those polled have experienced some negative impacts on their business as a result of COVID-19. Things like shutdowns, layoffs, and a reduction of buying power in their customer base have all contributed to an overall downturn.

However, about 15% of women reported slight to substantial positive impacts on their business, citing things like increased revenue, work from home productivity, and increased operational efficiencies.

59%

of those polled have experienced some negative impacts on their business as a result of COVID-19.

Financial guidance still key

About half of women in business report that their primary bank proactively reached out regarding the pandemic. Roughly 70% of women relied on their primary bank to some degree for financial guidance and insights.

Interestingly, the women we spoke to under 35 are more likely to get help from their primary bank, while women over 50 are less likely to do so. About 32% of all women in business report relying heavily on their primary bank for financial advice during the pandemic. Key4Women Certified Advisors are uniquely qualified to help women overcome challenges to reach their goals. We are always on standby to help get you where you want to be, so visit your local KeyBank branch or contact your banker to get started.

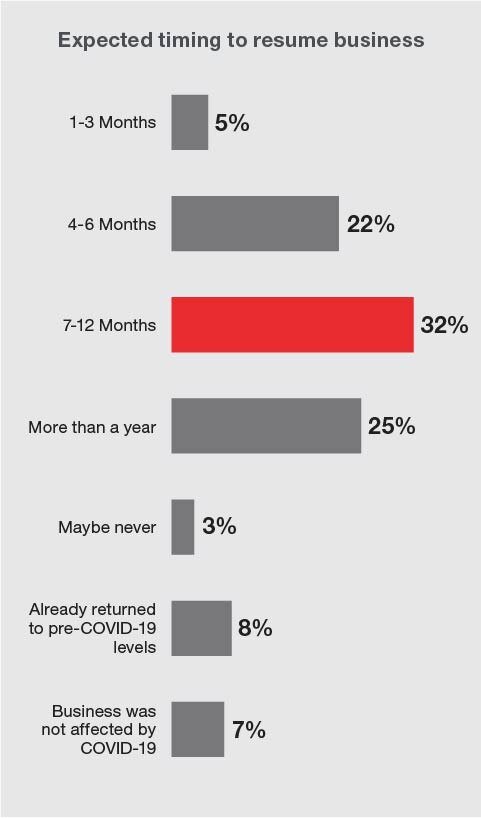

Expected timing to resume business

- 5% 1-3 months

- 22% 4-6 months

- 32% 7-12 months

- 25% More than a year

- 3% Maybe never

- 8% Already returned to pre-COVID - 19 levels

- 7% Business was not affected by COVID – 19

Recovery on the horizon

When asked when they expected their businesses to return to pre-COVID-19 performance, answers varied from 1-3 months to maybe never. The good news is many answered that they expected to resume their pre-COVID-19 operations, revenue levels, and profits within a year.

Only 3% responded that their businesses may never recover, while 8% of businesses report having already returned to pre-COVID-19 conditions.

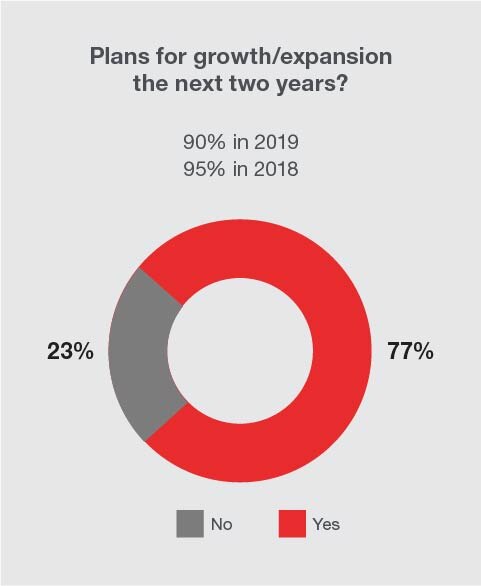

Opportunities from adversity

While we can’t underestimate the difficulties of running a business in these times, women business leaders continue to look to the future. Three-quarters are still planning on growing and expanding their business over the next two years.

While this is down from 90% in 2019, it speaks to the resilience of women in business. As women continue to face new and old challenges in the business world, we’ll continue to support women in business and do our part to accelerate their advancement.

The importance of strengthening and reaching out to your network in these times cannot be overstated. Organizations like Key4Women, National Association of Women Business Owners (NAWBO) and Women's Business Enterprise National Council (WBENC) can help connect women with other members who have resources or expertise that can help advance their business plans.

Plans for growth/expansion the next two years?

- 90% in 2019

- 95% in 2018

- 77% Yes

- 23% No

Innovation inspires growth

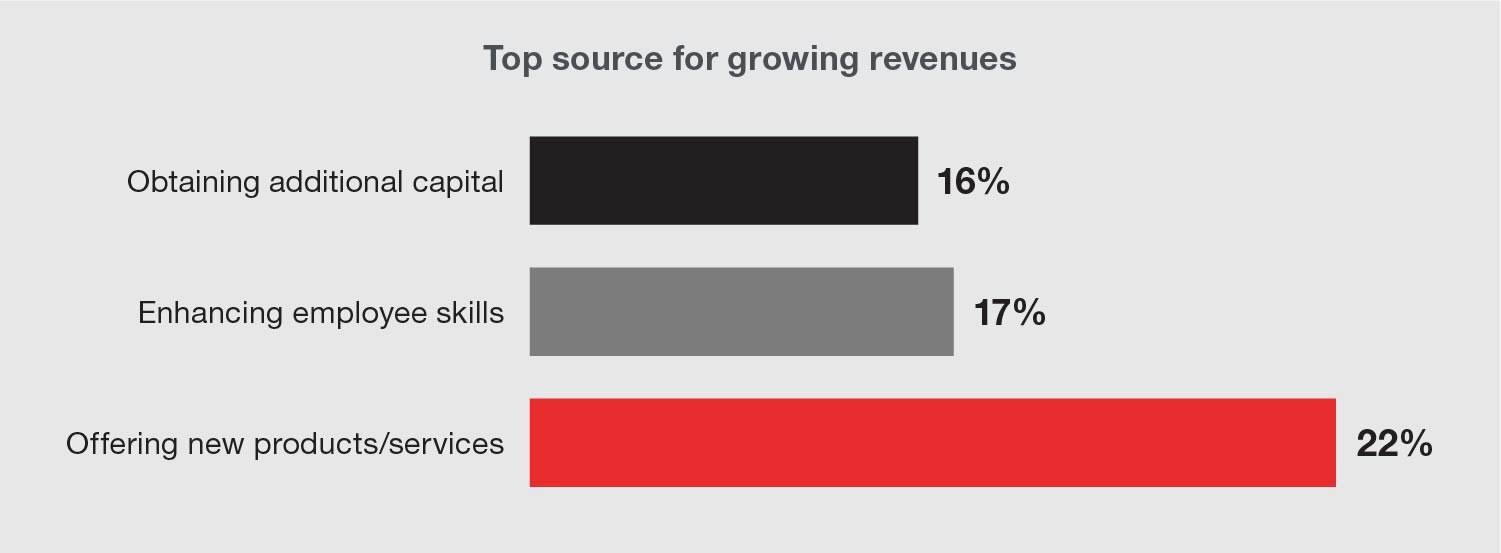

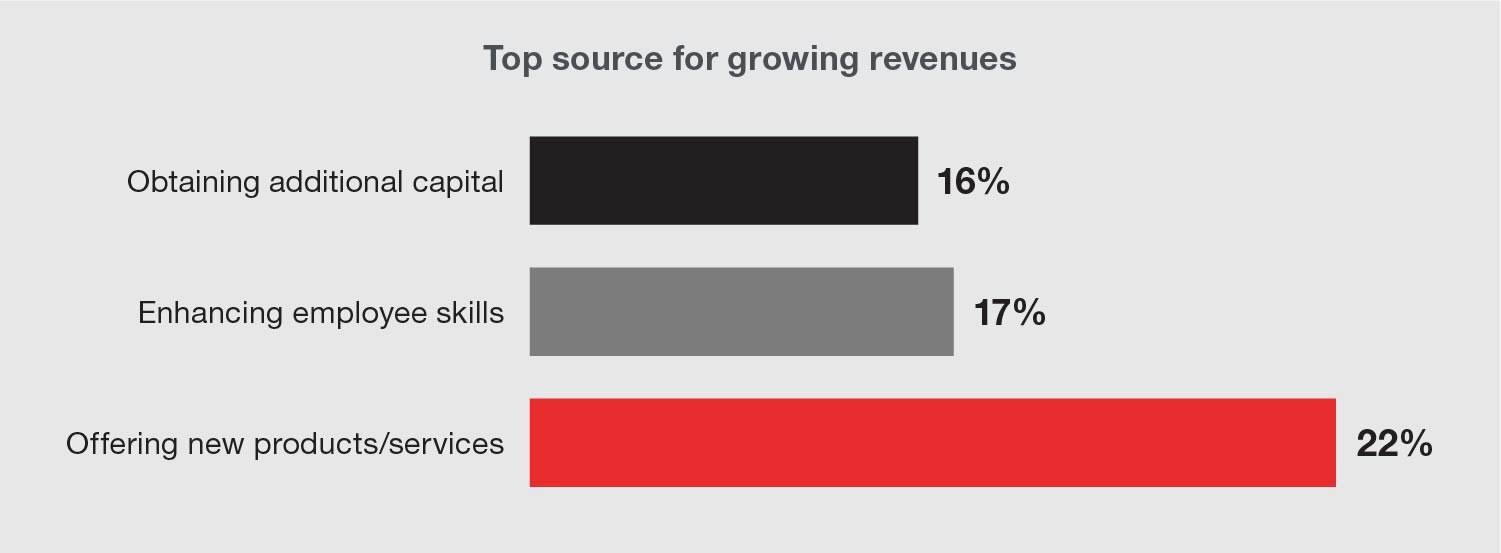

True to their strategic nature, women in business are finding new and creative ways to adapt to today’s market. When asked how they plan to rebuild or grow revenues, 22% stated by offering new products or services. Another 17% proposed enhancing employee skills, followed closely by obtaining additional capital.

While outlooks aren’t as positive as they’ve been in past years, women continue to rise to the challenge with new solutions. Pivoting business trajectories to meet customers’ new and immediate needs will help supplement depleting revenue streams and attract new customers, while positioning the business as a leader. Business owners should consider offering a new product or service, expanding employee training and education, or surveying current customers about any unmet needs.

Top source for growing revenues

- 16% Obtaining additional capital

- 17% Enhancing employee skills

- 22% Offering new products/services

Top source for growing revenues

- 16% Obtaining additional capital

- 17% Enhancing employee skills

- 22% Offering new products/services

Looking to the future

Key4Women recently completed an advice series with women leaders about how they’ve managed the challenges they’ve faced in 2020.

They talked to us about the importance of utilizing technology to maintain close contact with suppliers, employees, and customers in the age of remote work. Adaptability is another key component of business, as women find themselves adjusting payment schedules, offering new solutions, innovating new delivery methods, and implementing changes that help them better serve customers.

Along with prioritizing virtual communication, women shared that maintaining an up-to-date, relevant digital presence helps their customers stay in the loop on important business updates. Things like updating business hours, service offerings, and other company news ensures customers are always privy to the most accurate information.

Key4Women is here as a resource to help you make connections, find solutions, and achieve your goals. Contact your local Key4Women Certified Advisor to talk about your needs by scheduling an appointment at your nearby KeyBank branch or by contacting your banker directly.

So, what’s next?

- Reach out to your banker about what the right next steps are for you.

- Build your network and professional relationships to gain more insights into how your peers are handling current challenges.

- Look for collaborative opportunities with other local businesses or connections in your network.

- Partner with other businesses to offer more comprehensive solutions and create operational efficiencies.

- Join organizations that can provide you with additional resources and support.

- Take advantage of opportunities and aid from national organizations, like the SBA’s Office of Women Business Owners and NAWBO and local groups such as Chambers of Commerce.

Key4Women: Empowering women in business

Established in 2005, Key4Women provides a network and platform for women in business to:

- Make meaningful connections.

- Get involved with our local networking events.

- Tap into capital to build and grow their businesses.

- Get customized financial services and advice from a local Key4Women certified advisor, including integrated wealth management.

- Access intellectual resources and articles on a variety of topics.

- Connect with us on LinkedIn, Twitter, and Facebook.

For more information on the benefits of Key4Women® and to join, visit Key.com/women.

Meet with your banker to review your business plan and strategize for the future of your business and finances.

The Support You Need

For more Key4Women resources to help you reach your goals, visit key.com/women, or email us to learn more.

Misty L. Heggeness & Jason M. Fields. "Working Moms Bear Brunt of Home Schooling While Working During COVID-19." United States Census Bureau. August 18, 2020. https://www.census.gov/library/stories/2020/08/parents-juggle-work-and-child-care-during-pandemic.html.

McKinsey & Company and LeanIn.org. "Women in the Workplace 2020" Report.

Key.com is a federally registered service mark of KeyCorp.

KeyBank Member FDIC