How KeyBank Alerts Can Help Protect Your Funds

In today’s digital age, online banking has become an integral part of our lives, offering convenience and accessibility like never before. However, this convenience also comes with the risk of potential fraud and unauthorized transactions on our bank accounts. That’s where KeyBank alerts offer an added layer of defense against fraudulent activities.

Here, we’ll explore how KeyBank alerts work and why they’re an essential tool to help protect your accounts.

What are KeyBank alerts?

KeyBank alerts work around the clock to help ensure the safety and security of your funds. Alerts help monitor your accounts for activity that meets your predetermined criteria — and then report suspicious transactions the moment they arise. They allow you to enjoy the convenience of digital banking with added peace of mind.

You have a wide range of alerts available at no charge to you.

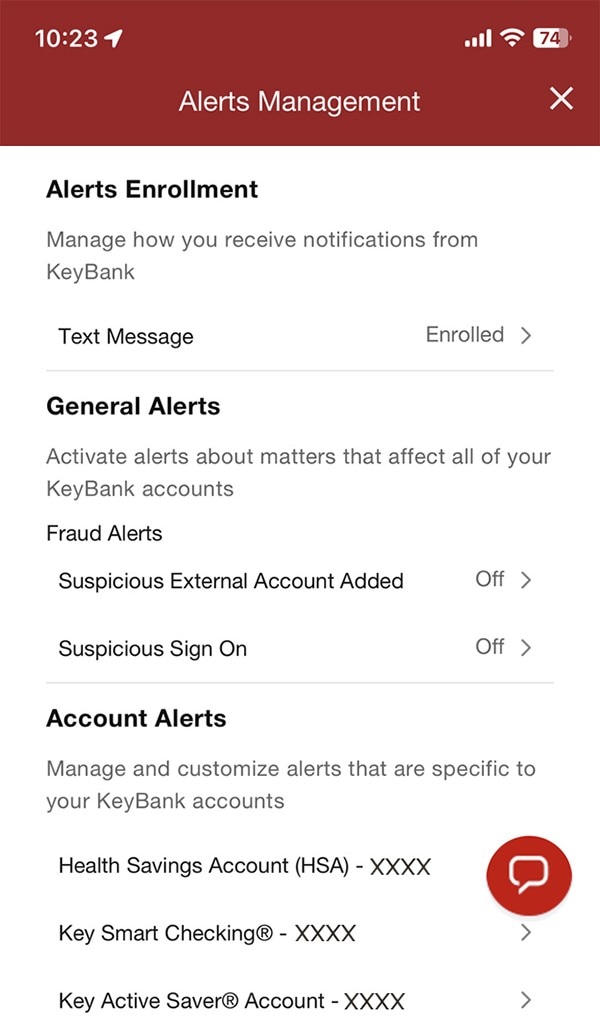

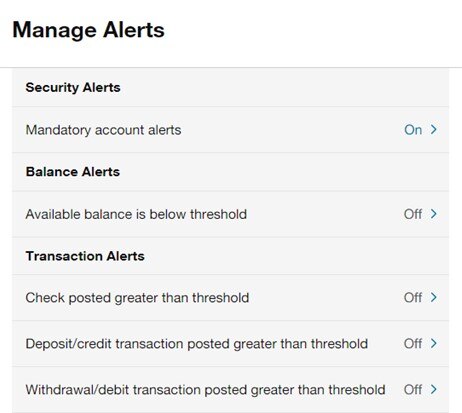

As a Key client, you can select from a variety of complementary alerts and customize the delivery to meet your needs. For example, you may choose alerts to notify you:

You can also opt to receive your alerts by email, text, or mobile app messages — or choose all three for maximum coverage!

You can also opt to receive your alerts by email, text, or mobile app messages — or choose all three for maximum coverage!

How do KeyBank alerts help protect against fraud?

KeyBank alerts can notify you immediately of sizeable transactions or suspicious activity on your account. This enables you to respond promptly and take the appropriate steps if a fraudulent transaction is discovered, and potentially prevent further fraud.

Some alerts can even help you identify the potential for fraud and stop it before fraudulent transactions are made. For example, receiving real-time notice of an unauthorized change to your username or password allows you to report the issue and secure your account before the fraudster can make purchases or withdrawals.

How to sign up for KeyBank alerts.

KeyBank alerts are incredibly easy to use — and even easier to set up:

From there, you can choose which alerts you want to enable and how you want to receive them. With just a few clicks, you’ll enact a whole new layer of fraud protection for your accounts.

What to do if you receive a concerning KeyBank alert.

KeyBank alerts are an easy, efficient way to monitor your accounts, and concerning alerts are your cue to take swift action.

But exactly what action should you take? Be assured, our knowledgeable KeyBank security team is here to help you.

Let’s fight fraud. Together.

KeyBank alerts are an easy, added layer of protection for our digital lives. And staying informed about emerging fraud trends is another important tactic for safeguarding your finances. Learn more about our commitment to fraud prevention and cybersecurity at key.com/consumersecurity.