Technology and AI drive positive outlooks in the middle market

Artificial intelligence (AI) and technology are powering growth and playing a major role in the flourishing of middle market businesses in 2024. The impact is clear: In our latest survey, U.S. middle market business leaders cite AI, automation, and technology implementations as top methods for expanding operations.

KeyBank’s latest Middle Market Sentiment survey asked 400 owners and executives of businesses with $10 million to $2 billion in annual revenue about their outlook for the year, the challenges currently affecting their businesses, and their growth plans for 2024. The survey takes the pulse of the vibrant and vital middle market sector — representing one-third of the U.S. economy, according to the National Center for the Middle Market.

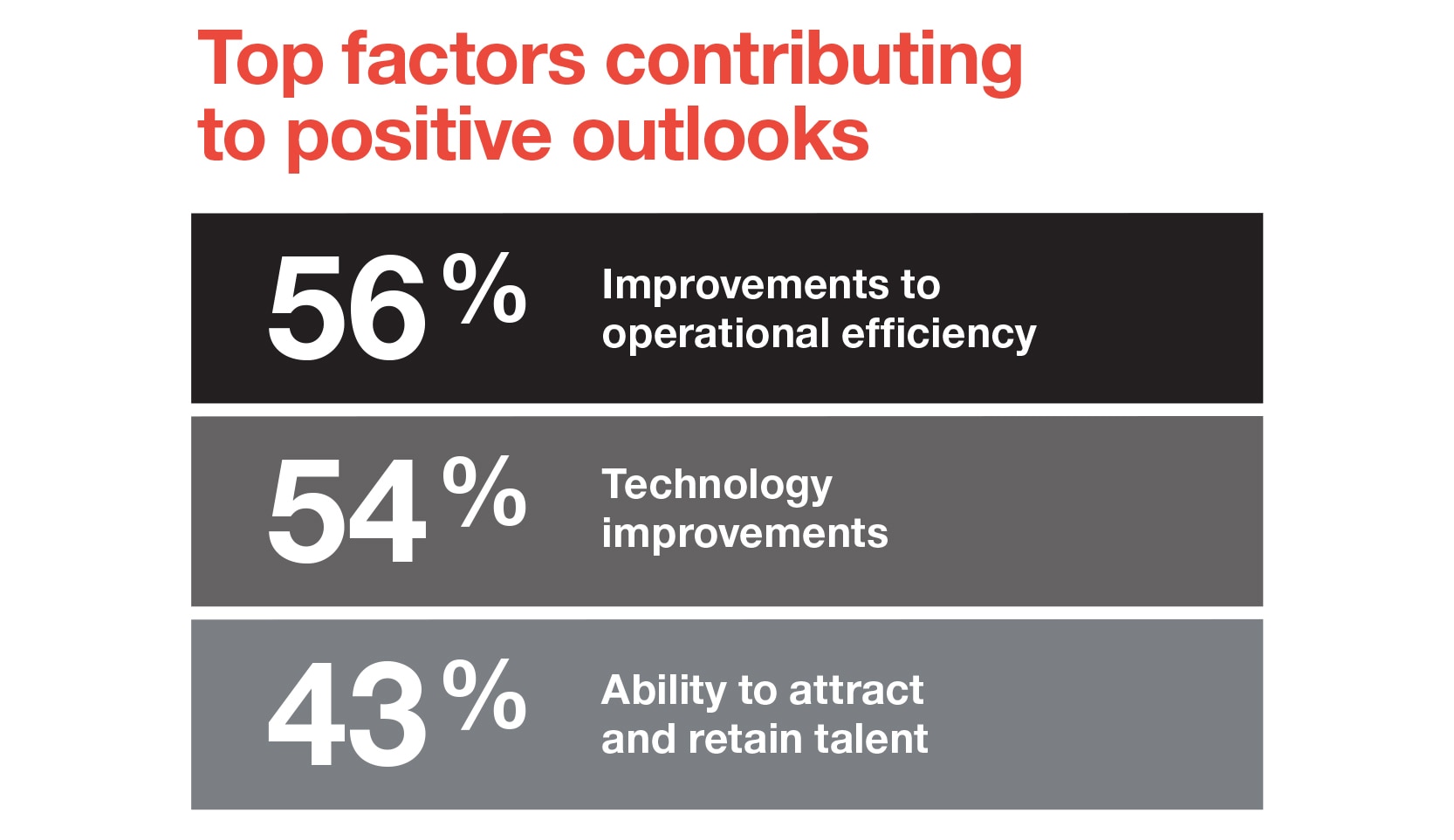

Growth is not the only issue on the minds of middle market business leaders. Of the 73% with a positive outlook for their company in 2024, more than half (56%) attribute improvements to operational efficiency as the top factor in their positive outlook, followed by technology improvements (54%).

These leaders believe in the power of Generative AI and other automation tools to act as a safeguard against a potential economic downturn by improving efficiency and productivity — even more so than finding lower-cost suppliers or introducing new products to increase revenue.

In this report, we explore how leaders are thinking about AI implementation both related to overall operational improvement and on such specific functions as financial management, sales, customer relationships, cybersecurity, forecasting, product development, risk management, and more.

GRAPH 1 – TOP FACTORS CONTRIBUTING TO POSITIVE OUTLOOKS

- 56% - Improvements to operational efficiency

- 54% - Technology improvements

- 43% - Ability to attract and retain talent

Improving operational efficiencies/productivity remains the top action for companies looking to protect themselves against a potential recession

There has been a significant uptick in those acting against a downturn by finding alternative/lower-cost suppliers for raw materials/parts, which is primarily driven by publicly owned (excluding retail) and construction companies.

GRAPH 2 – Q4-DEC 2023 ACTIONS TAKEN TO SAFEGUARD AGAINST POTENTIAL ECONOMIC DOWNTURN

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

- 48% - Improving operational efficiencies/productivity

- 35% - Searching for or determining alternate lower-cost suppliers of raw materials

- 34% - Identifying new markets/products/services to increase revenues

- 30% - Increasing business savings/liquidity

- 22% - Increasing company’s line of credit

AI and automation adoption powers business and job growth

Our survey revealed that when leaders are optimistic about their company’s future growth, they are more likely to implement AI and automation solutions.

While this shift toward technology often creates anxiety within the workforce, our data indicates that companies with a positive outlook are more likely to add employees (54%) rather than reduce them. They are also expanding their use of automation (48%) and AI (44%) to drive further growth.

Additionally, leaders who are expanding the use of technology and automation are significantly more likely to pursue additional business expansion strategies. These include implementing AI (65%), making process improvements (58%), introducing new products (55%), making significant equipment purchases (54%), and adding employees (52%).

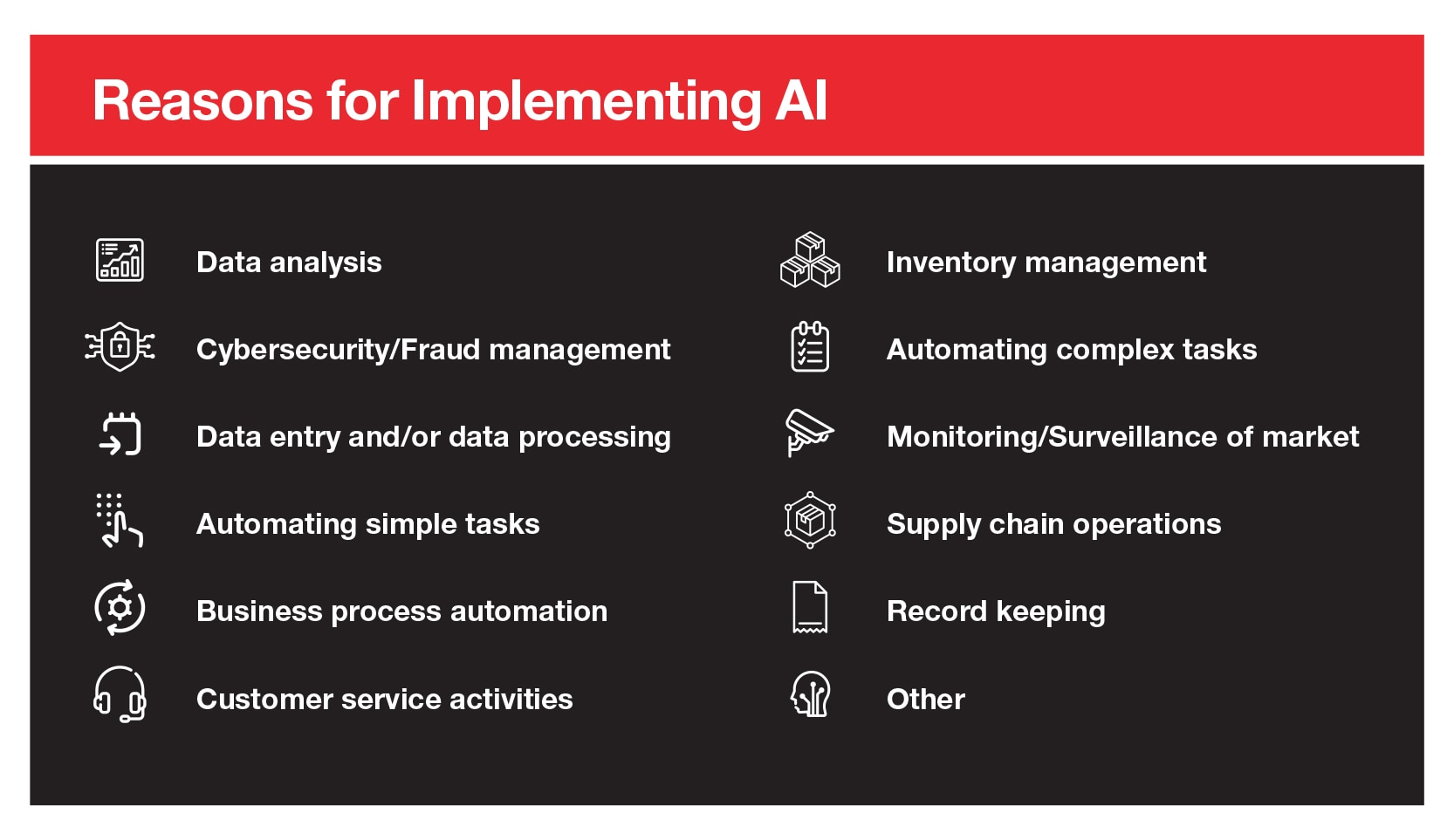

Middle market businesses are adopting AI for a wide variety of business functions

AI is sweeping across virtually every department within organizations, helping many different functional leaders rise to equally varied business challenges.

Of the middle market companies expanding the scope of their operations with AI, most hope to achieve operational efficiencies and increased productivity. Additionally, more than half of the companies embracing AI cite improved decision-making, improved forecasting and planning, enhanced customer relationships, increases in sales and revenue, and the ability to respond more rapidly to market threats and opportunities.

As for general use of AI, data analysis is most popular (67%), followed by cybersecurity and fraud management (62%). Reducing risk is the fastest-growing reason for investing in AI: 51% of middle market leaders cite reduced risk as a desired outcome, up from 39% in the third quarter of 2023.

GRAPH 4 – REASONS FOR IMPLEMENTING AI

- Data analysis

- Cybersecurity/Fraud management

- Data entry and/or data processing

- Automating simple tasks

- Business process automation

- Customer service activities

- Inventory management

- Automating complex tasks

- Monitoring/Surveillance of market

- Supply chain operations

- Record keeping

- Other

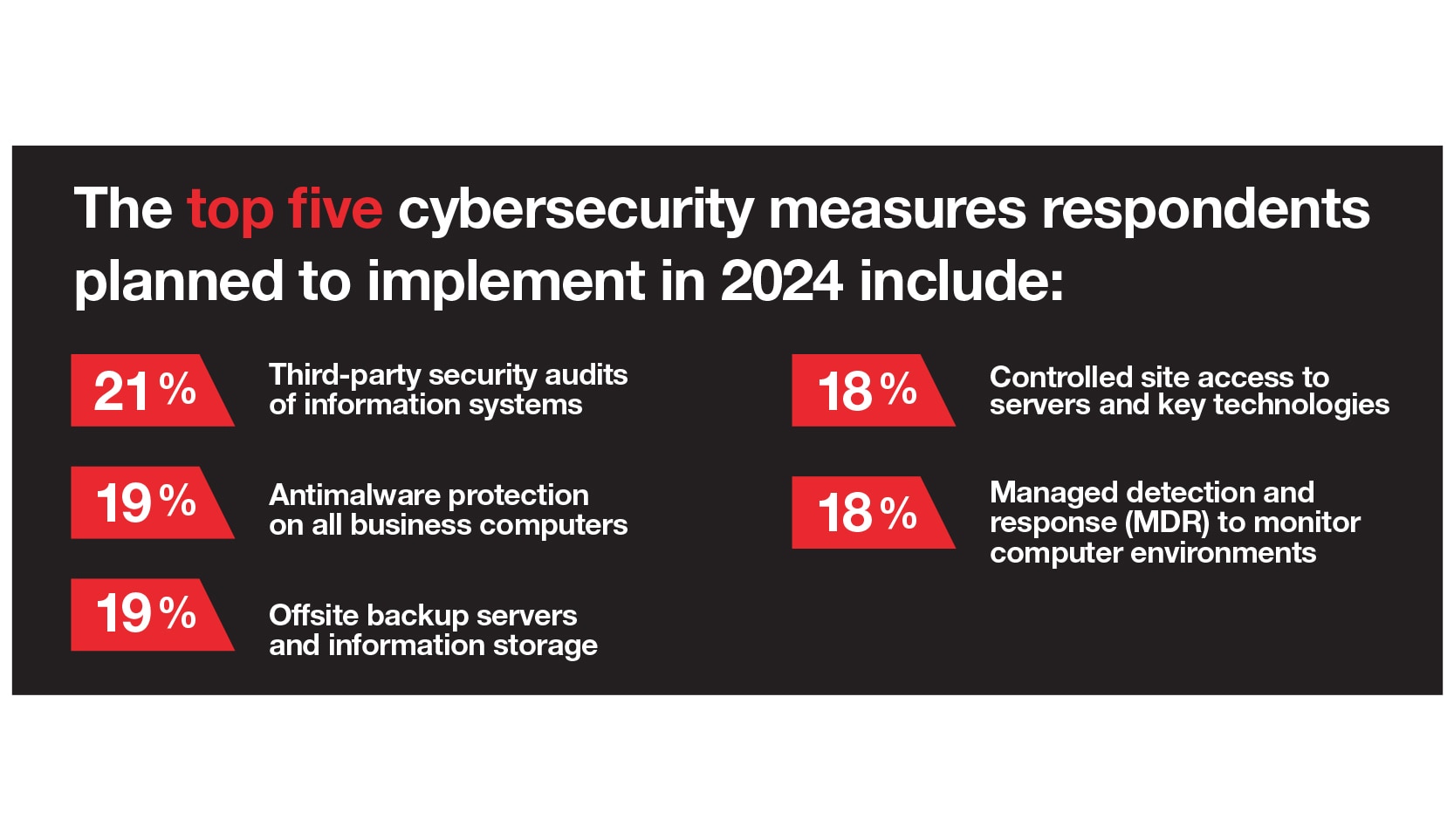

Cybersecurity is a key area of focus for middle market technology investments

Cybersecurity is a driving force for technology investment and is often paired with implementation of AI-related systems. In our survey, 62% of leaders planning to implement AI programs cited cybersecurity and fraud management as part of the scope.

The most common new cybersecurity programs of 2024 include third-party security audits of information systems (21%) and the use of antimalware protection software (19%).

GRAPH 5 – THE TOP FIVE CYBERSECURITY MEASURES RESPONDENTS PLANNED TO IMPLEMENT IN 2024 INCLUDE:

- 21% - Third-party security audits of information systems

- 19% - Antimalware protection on all business computers

- 19% - Offsite backup servers and information storage

- 18% - Controlled site access to servers and key technologies

- 18% - Managed detection and response (MDR) to monitor computer environments

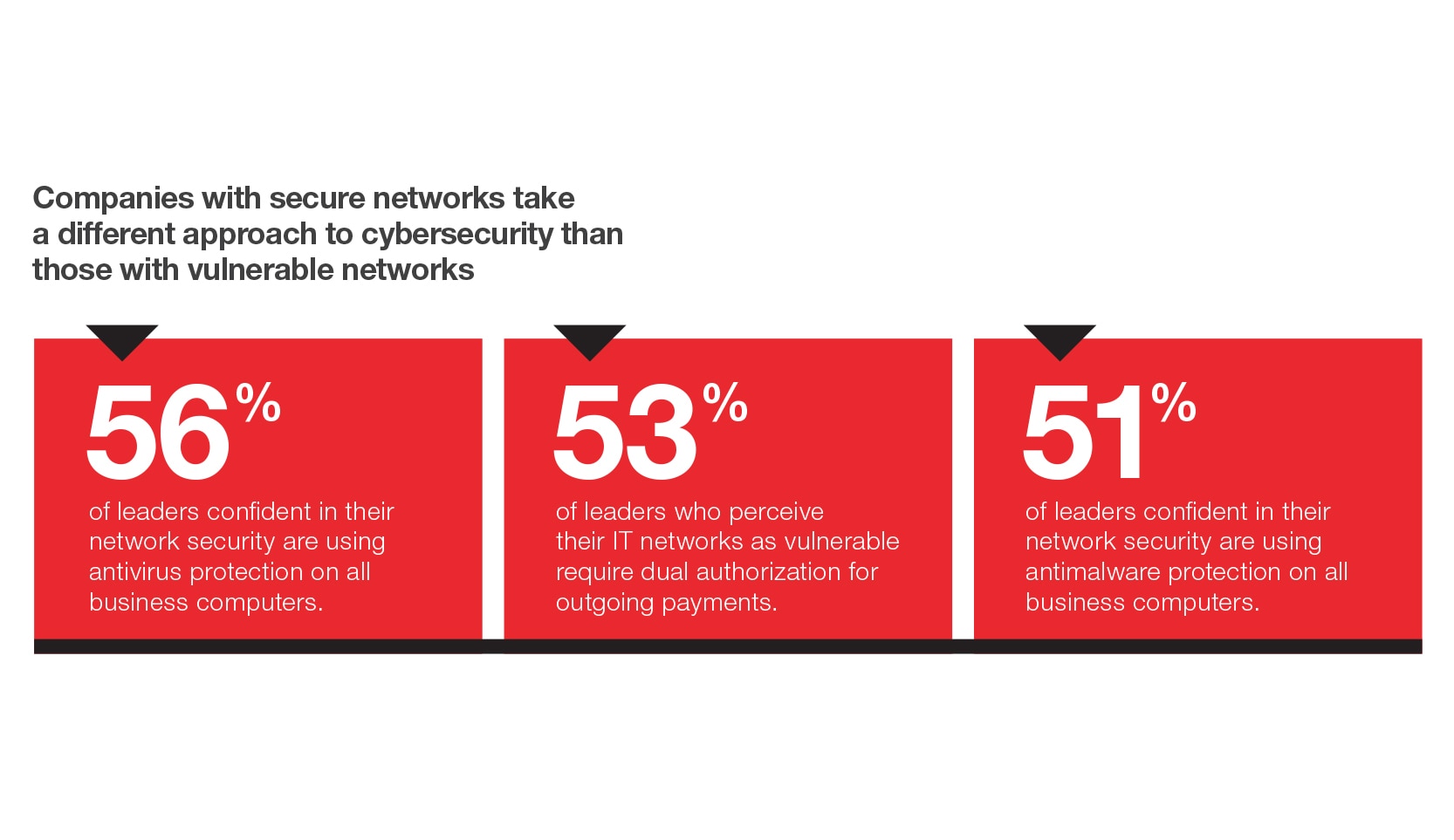

Security and peace of mind are the real measure of return on technology investment. The vast majority — 82% — of those surveyed consider their networks secure. Among those confident in their networks, more than half have invested in antivirus protection and antimalware software. A third of them also require dual authorization for outgoing payments — a leading practice for avoiding business fraud.

GRAPH 6 – COMPANIES WITH SECURE NETWORKS TAKE A DIFFERENT APPROACH TO CYBERSECURITY THAN THOSE WITH VULNERABLE NETWORKS

- 56% of leaders confident in their network security are using antivirus protection on all business computers.

- 53% of leaders who perceive their IT networks as vulnerable require dual authorization for outgoing payments.

- 51% of leaders confident in their network security are using antimalware protection on all business computers.

Conclusion

Middle market leaders are reporting increasing levels of adoption of AI, cybersecurity, and other advanced technologies compared to mid-2023. Citing critical business drivers such as sales, productivity, network security, and supply chain effectiveness, it seems no business function is being left untouched by new technologies in 2024.

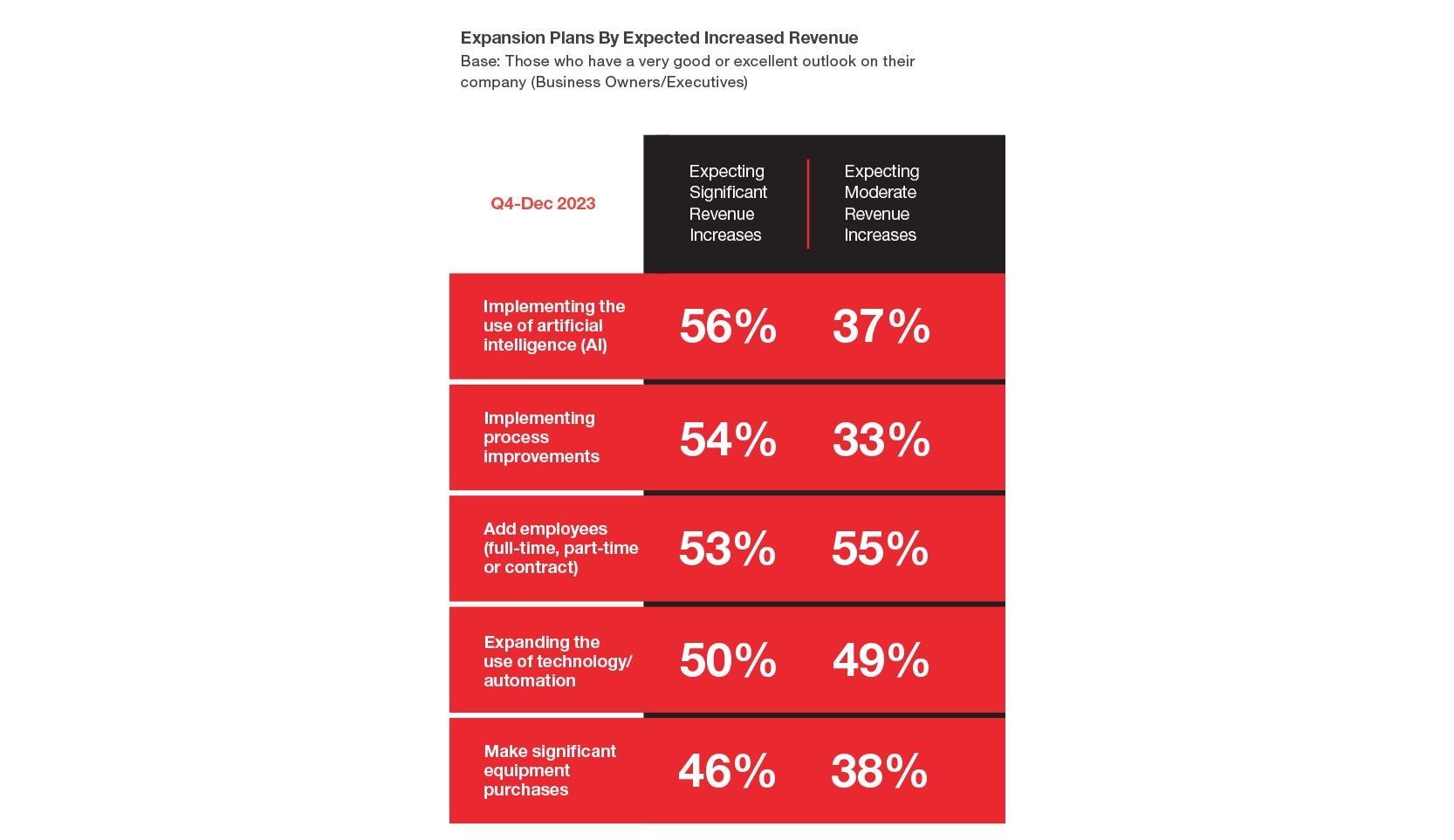

In fact, the more positive the outlook of a leader, the more likely they are to execute AI or cybersecurity implementations this year. Of the executives expecting their company to enjoy significant revenue increases, more than half (56%) plan to implement the use of AI, compared to only 37% of those executives expecting moderate revenue increases.

GRAPH 7 – EXPANSION PLANS BY EXPECTED INCREASED REVENUE

BASE: THOSE HAVE A VERY GOOD OR EXCELLENT OUTLOOK ON THEIR COMPANY (BUSINESS OWNERS/EXECUTIVES)

Q4-DEC 2023

- Implementing the use of artificial intelligence (AI)

- Expecting Significant Revenue Increases 56%

- Expecting Moderate Revenue Increases 37%

- Implementing process improvements

- Expecting Significant Revenue Increases 54%

- Expecting Moderate Revenue Increases 33%

- Add employees (full-time, part-time or contract)

- Expecting Significant Revenue Increases 53%

- Expecting Moderate Revenue Increases 55%

- Expanding the use of technology/automation

- Expecting Significant Revenue Increases 50%

- Expecting Moderate Revenue Increases 49%

- Make significant equipment purchases

- Expecting Significant Revenue Increases 46%

- Expecting Moderate Revenue Increases 38%

This data, especially, shows a clear connection between the use of AI and advanced technology on more than just sentiment and general outlook, but expected growth and financial success for middle market companies.