Inflation in focus: How middle market leaders are responding

Company leaders apprehensive about inflation see silver linings

Inflation is pushing business leaders to make tough decisions about how to move forward. Rising costs and shrinking profit margins are creating uncertainty, while the need for increased productivity through technology and process improvements is more crucial than ever.

In our latest survey, inflation remains the top concern for middle market leaders across the 38% of respondents who reported a negative impact on their businesses due to inflation. The KeyBank Middle Market Sentiment Survey, which gathered insights from 700 owners and executives of businesses with $10 million to $1 billion in annual revenue, reveals key challenges and opportunities for the year ahead.

Interestingly, inflation is affecting businesses in different ways. Larger companies (with $500 million to $1 billion in annual revenue) are finding ways to turn inflation into an advantage, while smaller businesses (with $10 million to $50 million in annual revenue) are feeling the pressure more acutely.

On a positive note, many middle market leaders are investing in technology and automation to drive productivity and growth. This report dives into two contrasting strategies: businesses with a positive outlook that are leveraging technology to combat inflation and grow, versus those with a more negative outlook who are passing on higher costs to customers.

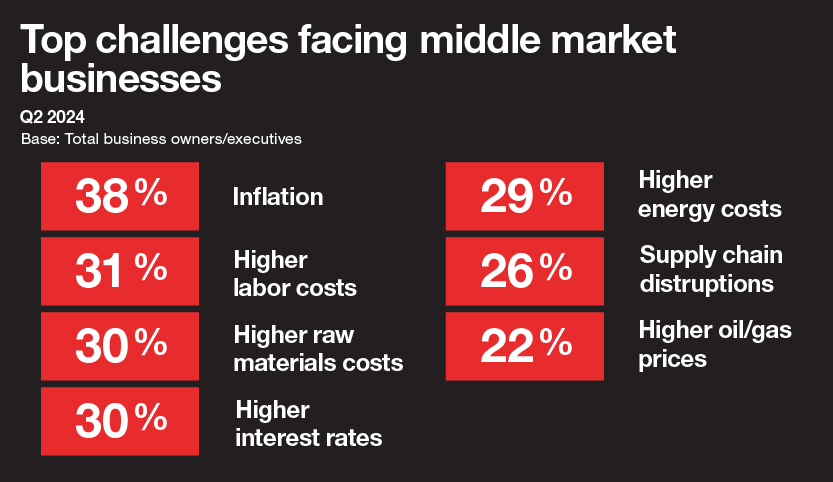

GRAPH 1 – TOP CHALLENGES FACING MIDDLE MARKET BUSINESSES

Q2 2024

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

38% - INFLATION

31% - HIGHER LABOR COSTS

30% - HIGHER RAW MATERIALS COSTS

30% - HIGHER INTEREST RATES

29% - HIGHER ENERGY COSTS

26% - SUPPLY CHAIN DISRUPTIONS

22% - HIGHER OIL/GAS PRICES

GRAPH 2 – LARGER BUSINESSES ARE EXPERIENCING POSITIVE IMPACTS, WHILE SMALLER BUSINESSES CONTINUE TO FEEL MORE NEGATIVELY ABOUT INFLATION

PERCENTAGE OF LEADERS REPORTING "POSITIVE IMPACTS OUTWEIGH NEGATIVE IMPACTS" BY COMPANY REVENUE

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

42% - $500M - $1B

18% - $10M - $50M

17% - $25M - $50M

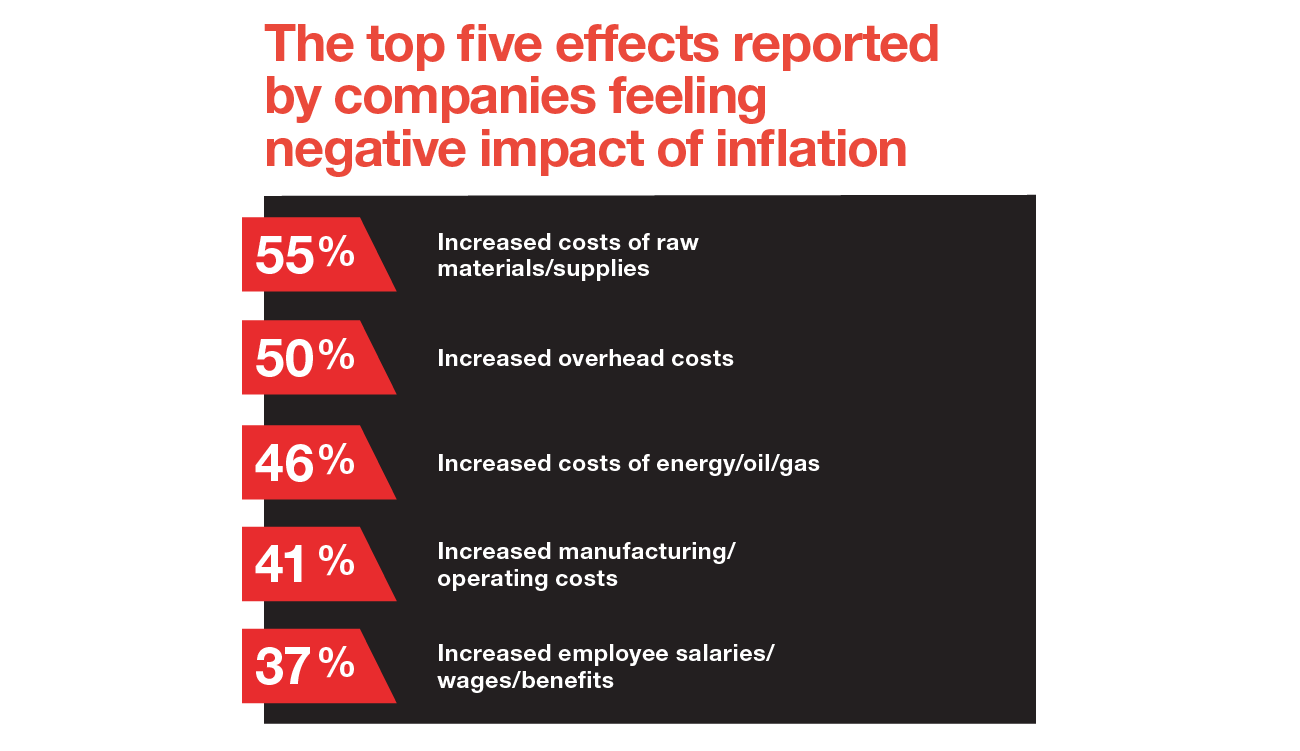

The negative effects of inflation for middle market companies

Rising costs continue to take a toll on companies looking to combat inflation. Company leaders feeling the negative impact of inflation reported as their top five concerns surges in the price of raw materials and increased costs for energy, overhead and operations, and employee salaries.

In total, 29% of leaders reported shrinking profits due to higher energy costs, with this impact increasing by 9 percentage points during the first half of 2024 compared with Q4 2023.

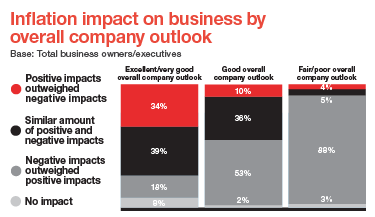

Notably, smaller businesses and those with a less optimistic outlook reported feeling the pinch of inflation more than larger businesses and those with a positive economic outlook. Nearly 90% of middle market leaders with a “fair” or “poor” outlook said the negative impacts of inflation outweigh the positive, compared to just 18% of those with an “excellent” or “very good” economic outlook.

GRAPH 3 – THE TOP FIVE EFFECTS REPORTED BY COMPANIES FEELING NEGATIVE IMPACT OF INFLATION

55% - INCREASED COSTS OF RAW MATERIALS/SUPPLIES

50% - INCREASED OVERHEAD COSTS

46% - INCREASED COSTS OF ENERGY/OIL/GAS

41% - INCREASED MANUFACTURING/OPERATING COSTS

37% - INCREASED EMPLOYEE SALARIES/WAGES/BENEFITS

GRAPH 4 – INFLATION IMPACT ON BUSINESS BY OVERALL COMPANY OUTLOOK

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

EXCELLENT/VERY GOOD COMPANY OUTLOOK

34% - POSITIVE IMPACTS OUTWEIGHED NEGATIVE IMPACTS

39% - SIMILAR AMOUNT OF POSITIVE AND NEGATIVE IMPACTS

18% - NEGATIVE IMPACTS OUTWEIGHED POSITIVE IMPACTS

8% - NO IMPACT

GOOD OVERALL COMPANY OUTLOOK

10% - POSITIVE IMPACTS OUTWEIGHED NEGATIVE IMPACTS

36% - SIMILAR AMOUNT OF POSITIVE AND NEGATIVE IMPACTS

53% - NEGATIVE IMPACTS OUTWEIGHED POSITIVE IMPACTS

2% - NO IMPACT

FAIR/POOR OVERALL COMPANY OUTLOOK

4% - POSITIVE IMPACTS OUTWEIGHED NEGATIVE IMPACTS

5% - SIMILAR AMOUNT OF POSITIVE AND NEGATIVE IMPACTS

88% - NEGATIVE IMPACTS OUTWEIGHED POSITIVE IMPACTS

3% - NO IMPACT

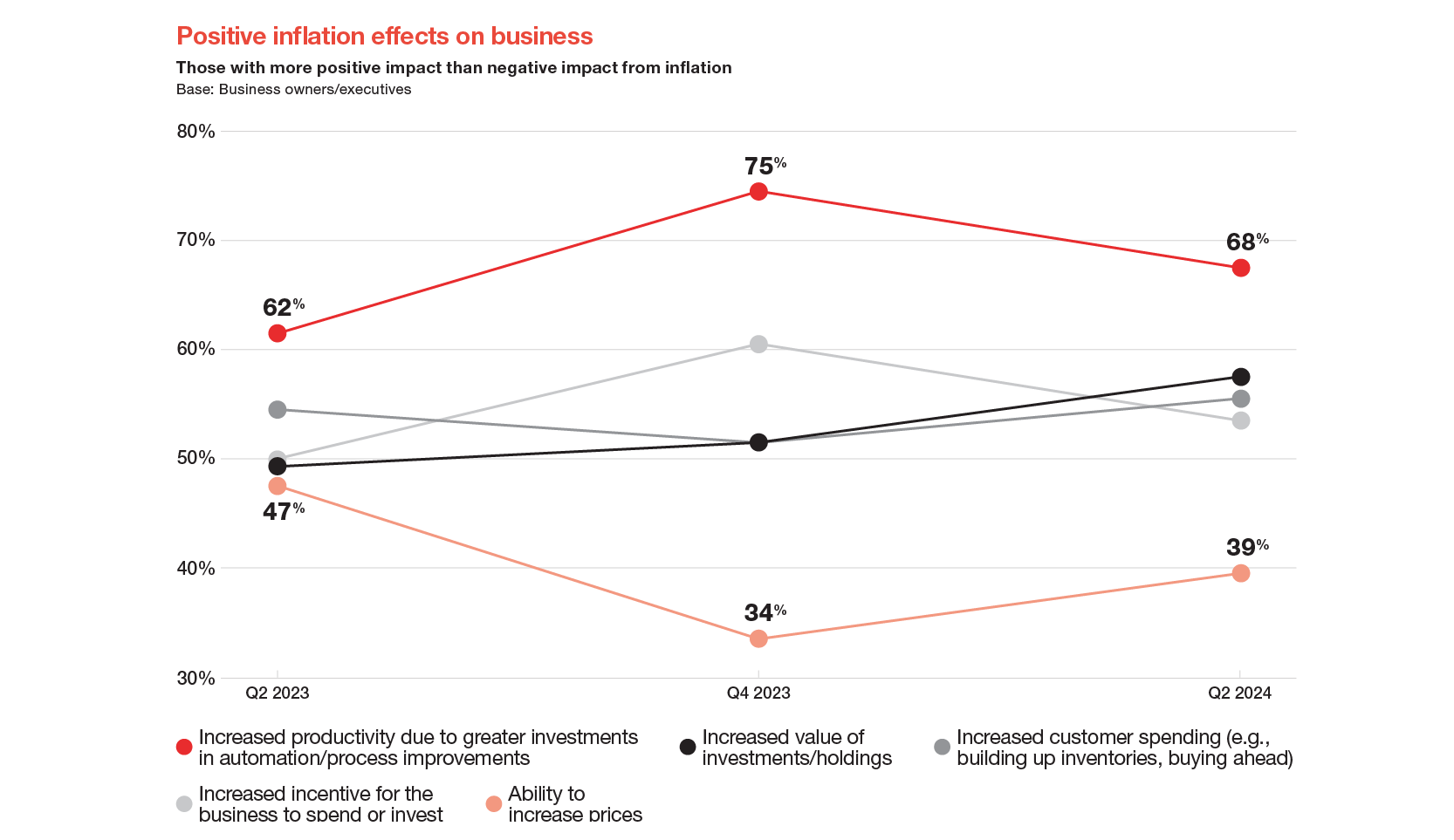

The silver lining of inflation

There is a silver lining, though. Middle market business leaders also reported positive outcomes from inflation. Survey respondents with a positive economic outlook reported increased productivity as the top benefit. Of the companies experiencing more positive than negative impacts from inflation, 68% credited productivity gains, which declined 7 percentage points after spiking in Q4 2023.

Of the business leaders who said they’re experiencing more positive than negative impacts of inflation, 39% noted the ability to raise prices as a positive effect of the current economic landscape — representing a sentiment increase from 34% in Q4 of 2023 but a decrease from 47% in Q2 of that same year.

Overall, company leaders who cited the ability to increase prices as a positive outcome of inflation rose 12 percentage points from Q4 of 2023 to 41%.

Larger companies and those with positive company outlooks are more likely to experience the most positive effects of inflation.

GRAPH 5 – POSITIVE INFLATION EFFECTS ON BUSINESS

THOSE WITH MORE POSITIVE IMPACT THAN NEGATIVE IMPACT FROM INFLATION

BASE: BUSINESS OWNERS/EXECUTIVES

INCREASED PRODUCTIVITY DUE TO GREATER INVESTMENTS IN AUTOMATION/PROCESS IMPROVEMENTS

62% - Q2 2023

75% - Q4 2023

68% - Q2 2024

INCREASED VALUE OF INVESTMENTS/HOLDINGS

49% - Q2 2023

52% - Q4 2023

58% - Q2 2024

INCREASED CUSTOMER SPENDING (E.G., BUILDING UP INVENTORIES, BUYING AHEAD)

55% - Q2 2023

52% - Q4 2023

56% - Q2 2024

INCREASED INCENTIVE FOR THE BUSINESS TO SPEND OR INVEST

50% - Q2 2023

61% - Q4 2023

54% - Q2 2024

ABILITY TO INCREASE PRICES

47% - Q2 2023

34% - Q4 2023

39% - Q2 2024

Combatting inflation effects with automation and efficiency

Middle market business leaders plan to tackle rising energy costs by improving processes and creating operational efficiencies.

Thirty-five percent of survey respondents cited “seeking to improve processes/create more operational efficiencies” and “increasing automation to improve productivity” as the top actions they plan to take in the next six months because of inflation.

Some middle market business leaders are planning to pass their increased costs on to customers. Nearly one-third of respondents in our latest survey plan on raising prices to combat inflation, down 5 percentage points from middle market leader plans in Q4 2023.

Companies with a positive outlook are more likely to invest in process improvements and automation, while those with a more negative outlook are more likely to pass on higher costs to customers.

GRAPH 6 – THE TOP FIVE ACTIONS LEADERS PLAN TO TAKE BECAUSE OF INFLATION

THOSE WITH AT LEAST SOME INFLATION IMPACT

BASE: BUSINESS OWNERS/EXECUTIVES

EXCELLENT/VERY GOOD COMPANY OUTLOOK

37% - INCREASE SALES/MARKETING EFFORTS

36% - IMPROVE PROCESSES/CREATE EFFICIENCIES

36% - INCREASE AUTOMATION TO IMPROVE PRODUCTIVITY

33% - IMPLEMENT CHANGES TO THE SUPPLY CHAIN

30% - IDENTIFY ALTERNATIVE SUPPLIERS/SOURCES

GOOD/FAIR/POOR COMPANY OUTLOOK

37% - PASS INCREASED COSTS TO CUSTOMERS THROUGH HIGHER PRICES

33% - INCREASE SALES/MARKETING EFFORTS

32% - IMPROVE PROCESSES/CREATE EFFICIENCIES

30% - INCREASE AUTOMATION TO IMPROVE PRODUCTIVITY

25% - IDENTIFY ALTERNATIVE SUPPLIERS/SOURCES

Middle market expansion plans reflect a continued resiliency of this sector, demonstrating an ability to adapt to the changing landscape, explore new opportunities, and invest in their future. Whether it’s adding new product lines, expanding markets, scaling their operations, or implementing new technology and automation, these businesses are setting the stage for a robust and sustainable future.

— Ken Gavrity, President KeyBank Commercial

Conclusion

In the face of ongoing inflation, U.S. middle market leaders are embracing technology as a critical tool to enhance efficiency and lower operating costs.

Despite economic uncertainty, many remain optimistic, seeing this period as an opportunity to invest in growth, streamline processes, and position their businesses for long-term success.

At the same time, some companies are adjusting their pricing strategies to offset rising expenses. Leaders are finding ways to navigate the increased costs of raw materials, energy, operations, and wages by passing a portion of those costs to customers.

As these strategies unfold, it’s clear that resilience, innovation, and a forward-thinking mindset will be key in shaping how middle market businesses continue to thrive in this challenging environment.

Whether you’re seeking access to capital or you’d like to invest in AI or other technologies to scale your business and/or improve processes and productivity, KeyBank’s middle market experts have a deep understanding of the unique challenges middle market business leaders face. We can provide customized insights and real-time counsel to help you increase efficiency and power growth to meet your business objectives. Contact a KeyBank relationship manager to get started.