Optimistic middle market leaders are setting their sights on growth

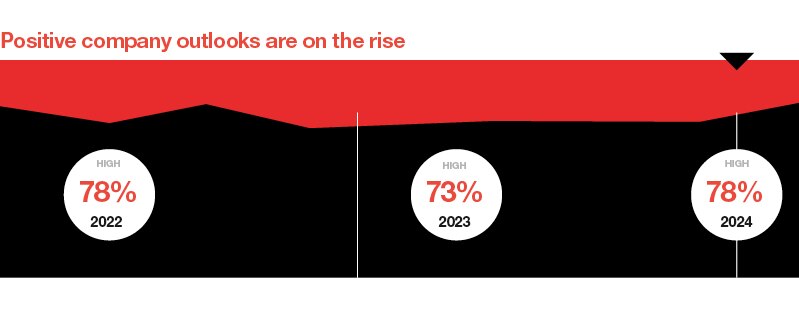

Despite market performance, optimism has increased for middle market business leaders looking to the second half of 2024. According to KeyBank’s latest Middle Market Sentiment survey of 700 owners and executives of businesses with $10 million to $1 billion in annual revenue, respondents are displaying a renewed confidence in their companies’ financial performance — with optimism jumping to its highest level in years. In the survey, 78% of middle market leaders characterized the outlook for their companies over the next 12 months as excellent or very good.

As middle market companies continue to remain resilient, they also have their sights set on growth: 52% of survey respondents with a positive economic outlook expect to be involved in M&A activity on the buy side in 2024, while 87% of leaders with concerns about accessing capital and credit plan to use alternative sources (like private equity and private debt lending, for example) within the next three years to support a transaction. The number of leaders planning to use artificial intelligence (AI) to expand the scope of their operations is also on the rise since late last year. Before the end of 2024, more than half of the business owners and executives surveyed plan to expand company operations by implementing AI, while 46% plan to add employees, and 44% plan to introduce new products.

GRAPH 1 – POSITIVE COMPANY OUTLOOKS ARE ON THE RISE

HIGH – 78% - 2022

HIGH – 73% - 2023

HIGH – 78% - 2024

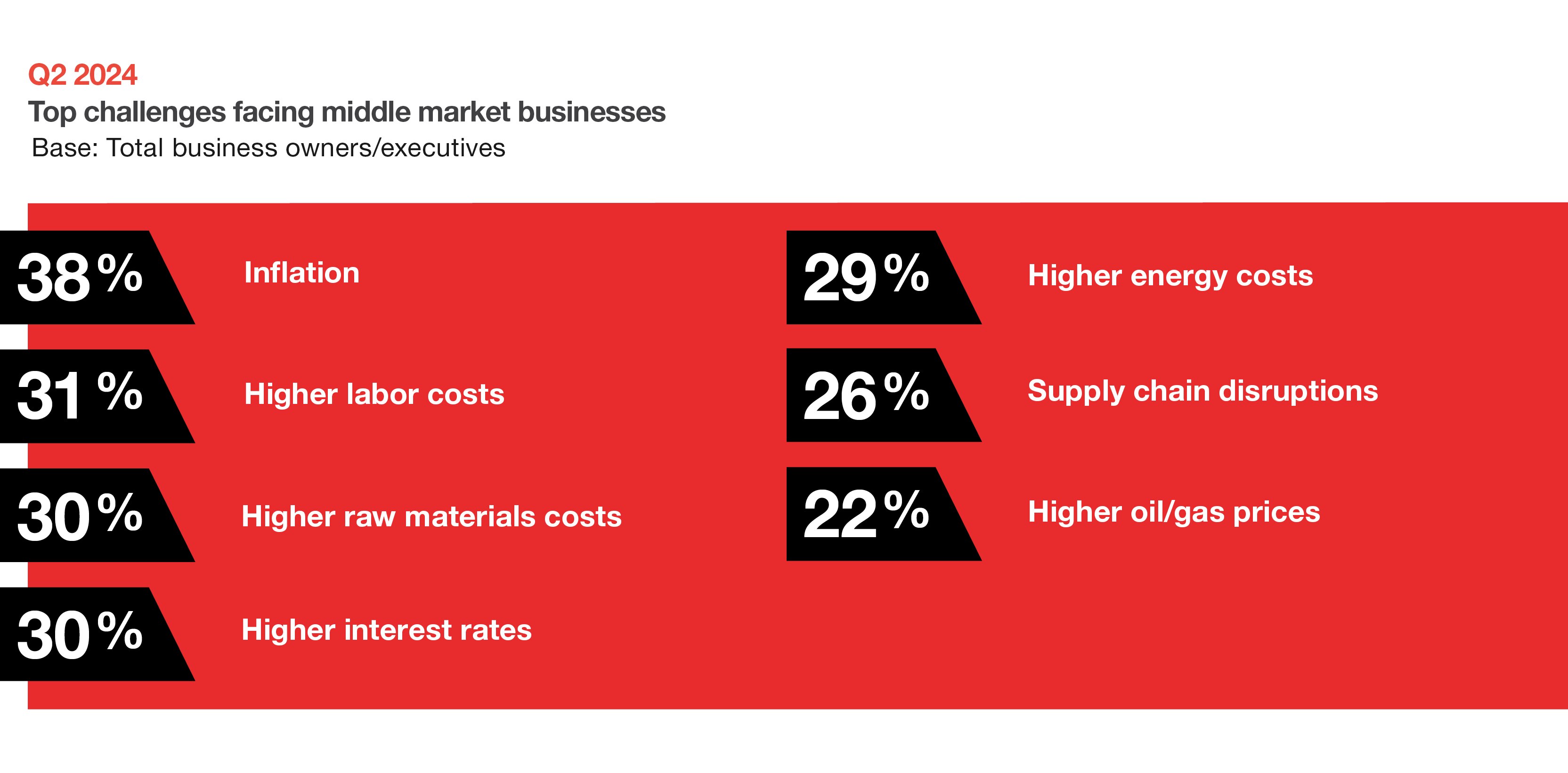

Despite the overall positive sentiment among business leaders, there are still concerns around inflation, interest rates, and the cost of labor, energy, and materials. In response, they are looking for ways to ramp up operational and energy efficiencies, increase their sales and marketing efforts to boost revenue, and deploy automation to drive productivity.

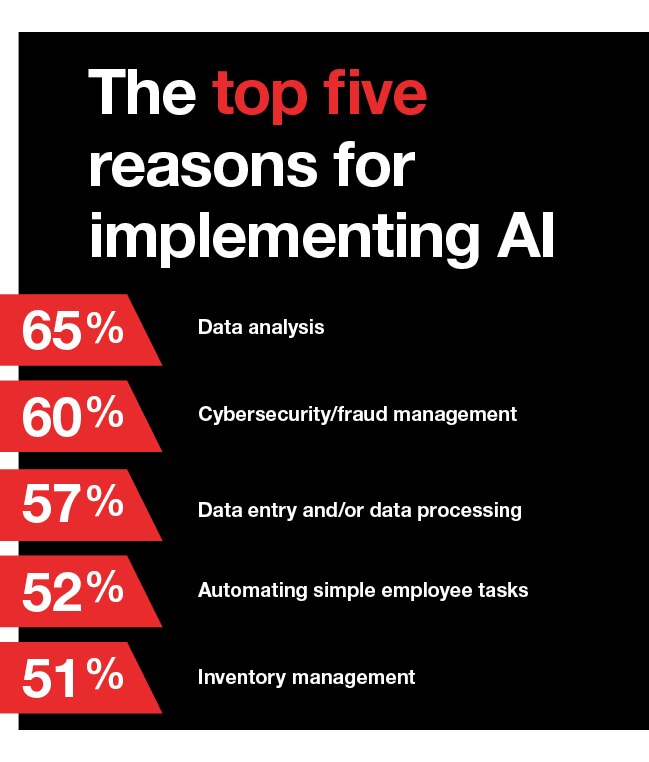

Cybersecurity continues to be front and center for business leaders, with one-third of businesses experiencing a cybersecurity or financial fraud issue in the past 12 months. This might point to why 60% of companies plan to implement AI for cybersecurity and fraud management purposes.

GRAPH 2 – Q2 2024 – TOP CHALLENGES FACING MIDDLE MARKET BUSINESSES IN 2024

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

38% - INFLATION

31% - HIGHER LABOR COSTS

30% - HIGHER RAW MATERIALS COST

30% - HIGHER INTEREST RATES

29% - HIGHER ENERGY COSTS

26% - SUPPLY CHAIN DISRUPTIONS

22% - HIGHER OIL/GAS PRICES

Company outlook rises while overall economic outlook holds steady

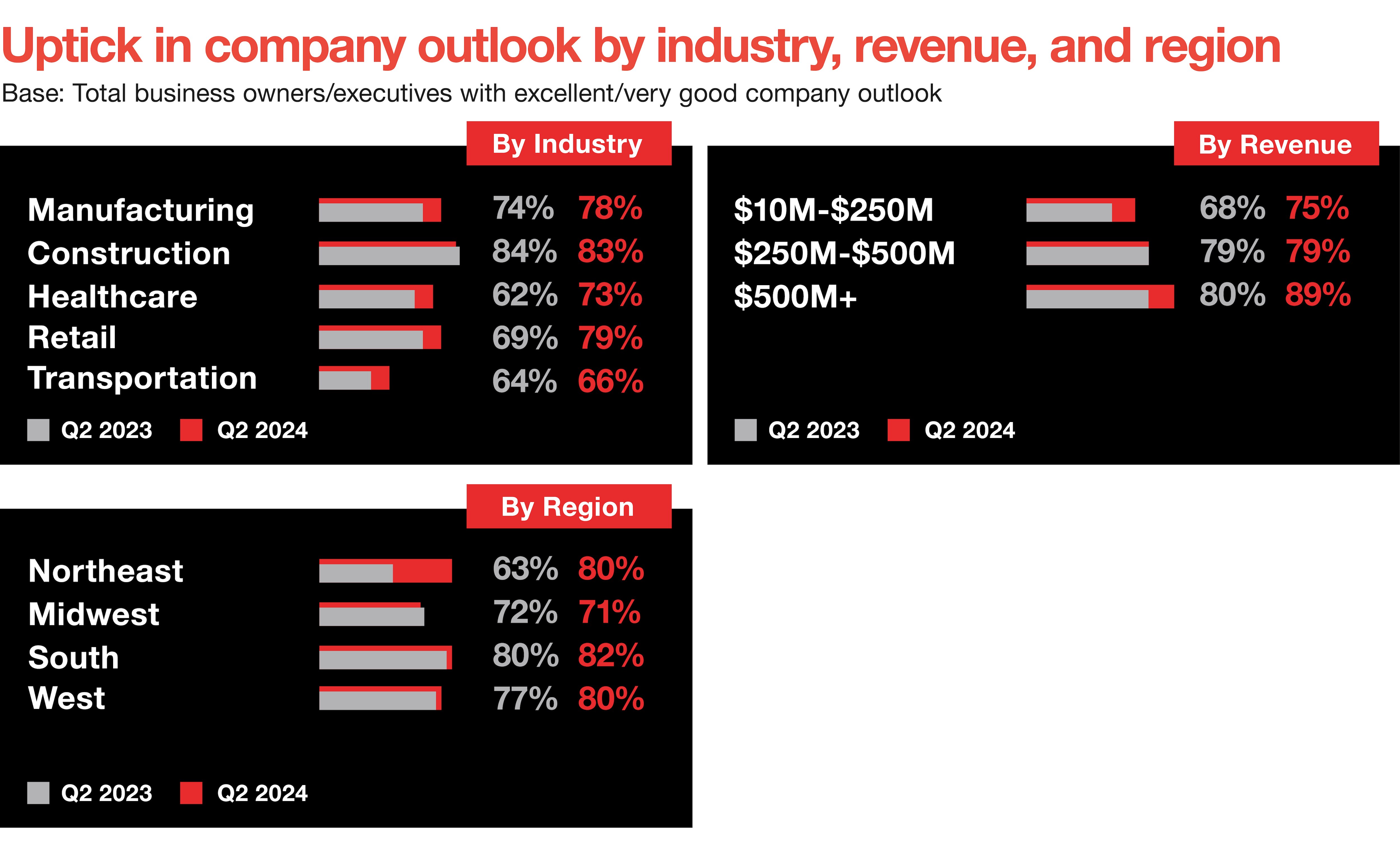

Middle market business leaders feel more optimistic about their companies’ outlooks than they did a year ago. Nearly 80% of middle market business leaders surveyed characterized the outlook for their companies’ financial performance over the next 12 months as excellent or very good — an increase of 5 percentage points from a year ago. The uptick in positive sentiment was steeper among leaders of companies in the healthcare and retail industries, those in the highest revenue groups, and businesses based in the Northeast.

GRAPH 3 – UPTICK IN COMPANY OUTLOOK BY INDUSTRY, REVENUE, AND REGION

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES WITH EXCELLENET/VERY GOOD COMPANY OUTLOOK

BY INDUSTRY

MANUFACTURING

Q2 2023 – 74%

Q2 2024 – 78/%

CONSTRUCTION

Q2 2023 – 84%

Q2 2024 – 83%

HEALTHCARE

Q2 2023 – 62%

Q2 2024 – 73%

RETAIL

Q2 2023 – 69%

Q2 2024 – 79%

TRANSPORTATION

Q2 2023 – 64%

Q2 2024 – 66%

BY REVENUE

$10M-$250M

Q2 2023 – 68%

Q2 2024 – 75%

$250M-$500M

Q2 2023 – 79%

Q2 2024 – 79%

$500M +

Q2 2023 – 80%

Q2 2024 – 89%

BY REGION

NORTHEAST

Q2 2023 – 63%

Q2 2024 – 80%

MIDWEST

Q2 2023 – 72%

Q2 2024 – 71%

SOUTH

Q2 2023 – 80%

Q2 2024 – 82%

WEST

Q2 2023 – 77%

Q2 2024 – 80%

Dig deeper with localized insights from our regional experts

Our regional reports go beyond the national perspective, offering in-depth data and insights into business sentiment, economic outlook, and growth factors unique to the Midwest, Northeast, and West regions. Authored by our local experts, each report highlights the key issues middle market businesses face in your area, providing valuable context to inform your business decisions. Select your region of the U.S. and unpack insights tailored to you.

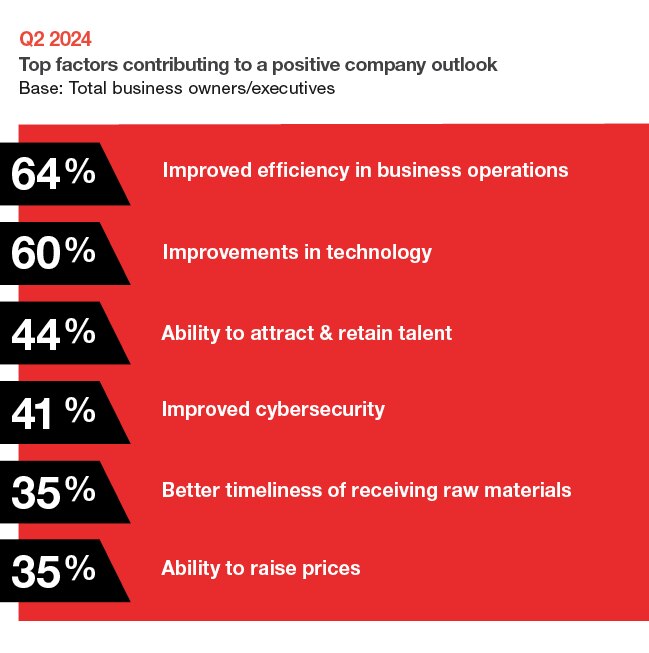

Leaders attribute these upticks primarily to continued efficiencies in their business operations and technology advancements. Improved efficiency in business operations remained the top factor contributing to a positive company outlook, cited by 64% of respondents compared to 56% at the end of 2023 and 52% in Q2 2023. Improvements to technology was cited by 60% as a top factor, climbing from 54% at the end of 2023 and 49% in Q2 2023. The ability to attract and/or retain talent was also crucial, with 44% reporting that it was a contributing factor to their positive company outlook.

GRAPH 4 – Q2 2024 – TOP FACTORS CONTRIBUTING TO A POSITIVE COMPANY OUTLOOK

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

64% - IMPROVED EFFICIENCY IN BUSINESS OPERATIONS

60% - IMPROVEMENTS IN TECHNOLOGY

44% - ABILITY TO ATTRACT & RETAIN TALENT

41% - IMPROVED CYBERSECURITY

35% - BETTER TIMELINESS OF RECEIVING RAW MATERIALS

35% - ABILITY TO RAISE PRICES

Meanwhile, middle market business leaders’ overall outlook on the economy held steady. The number of respondents who described their outlook on the U.S. economy over the next 12 months as excellent or very good increased 1 percentage point to 50%. Many leaders who were especially optimistic about their corporate outlooks also shared optimism about the economy, including companies in the retail industry, those in the highest and lowest revenue groups, and businesses based in the Northeast.

Optimistic business leaders express appetite for M&A activity

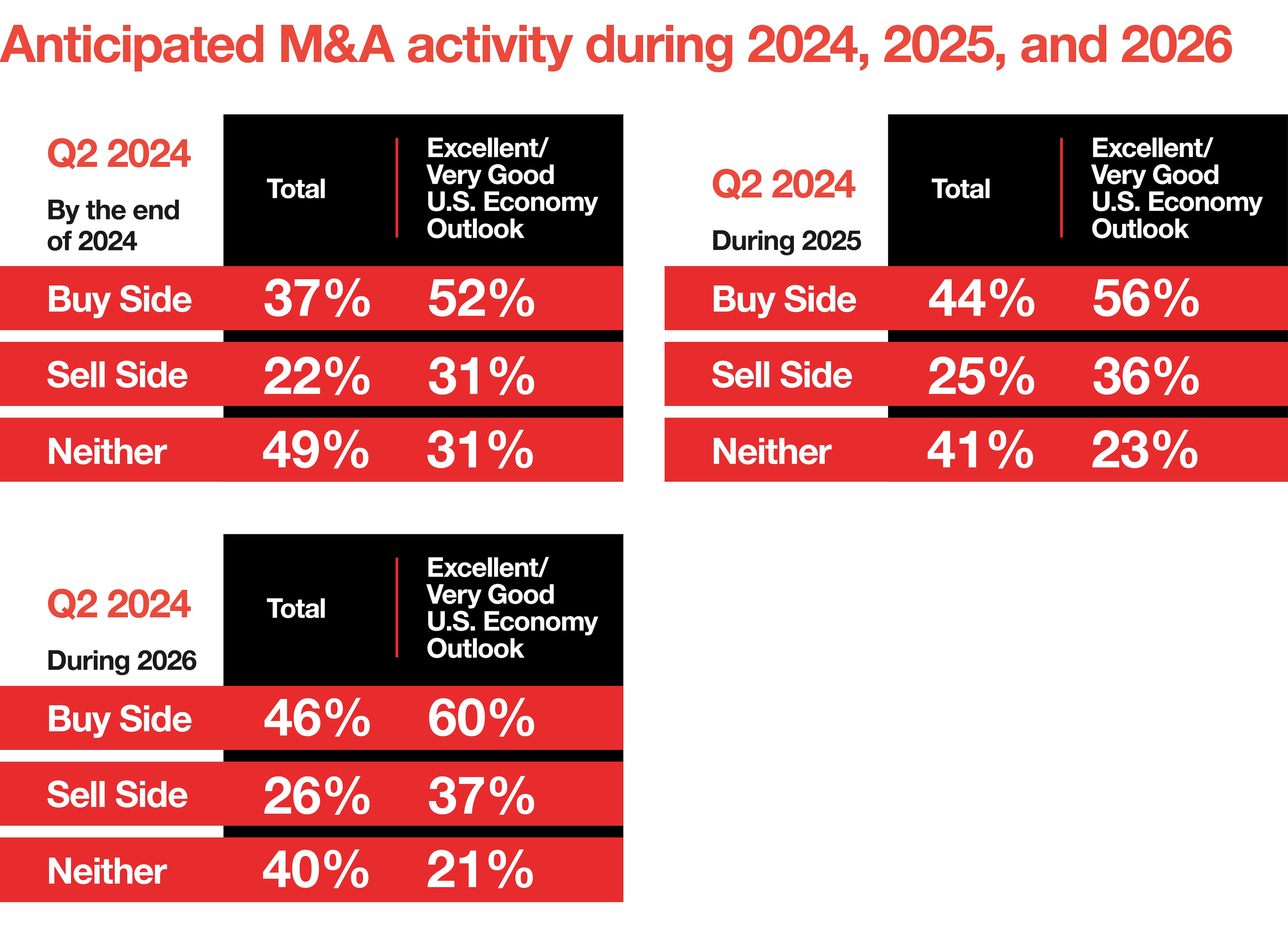

M&A is on the minds of middle market leaders. More than half (52%) of survey respondents with a positive economic outlook expect to be involved in M&A activity on the buy side by the end of 2024.

When looking a few years into the future, optimistic leaders are even more interested in M&A, as 56% of leaders expect buy-side activity in 2025, and 60% in 2026. Optimistic leaders also anticipate sell-side M&A activity to increase from 31% by the end of 2024 to 36% in 2025 and 37% in 2026.

GRAPH 5 – ANTICIPATED M&A ACTIVITY DURING 2024, 2025, 2026

Q2 2024

BY THE END OF 2024

BUY SIDE

TOTAL – 37%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 52%

SELL SIDE

TOTAL – 22%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 31%

NEITHER

TOTAL – 49%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 31%

DURING 2025

BUY SIDE

TOTAL – 44%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 56%

SELL SIDE

TOTAL – 25%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 36%

NEITHER

TOTAL – 41%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 23%

DURING 2026

BUY SIDE

TOTAL – 46%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 60%

SELL SIDE

TOTAL – 26%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 37%

NEITHER

TOTAL – 40%

EXCELLENT/VERY GOOD U.S. ECONOMY OUTLOOK – 21%

Leaders at public companies appear more likely to be involved in buy-side activity than leaders at smaller firms. Middle market companies between $250 million and $500 million in revenue are more likely to seek sell-side opportunities.

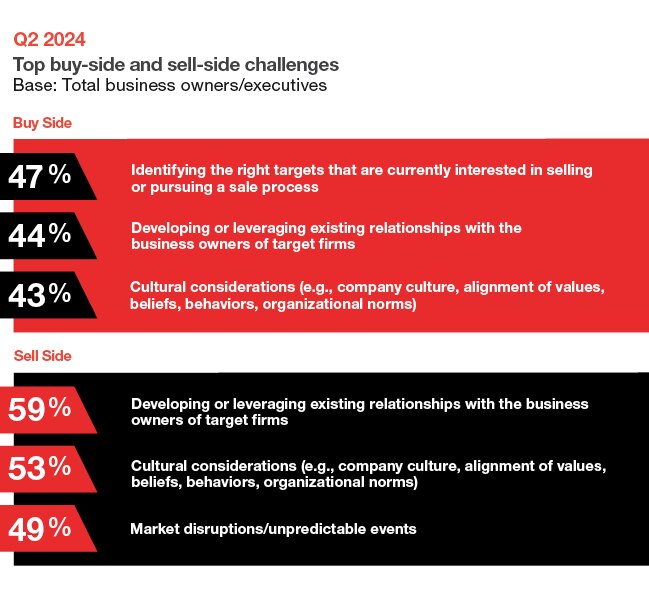

Identifying the right targets was the top challenge identified on the buy side. On both the buy and sell sides of potential transactions, middle market leaders cited developing relationships with owners and executives of target firms and cultural considerations (including alignment of values, beliefs, behaviors, and organizational norms) as top-of-mind challenges.

GRAPH 6 – Q2 2024 – TOP BUY-SIDE AND SELL-SIDE CHALLENGES

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

BUY SIDE

47% - IDENTIFYING THE RIGHT TARGETS THAT ARE CURRENTLY INTERESTED IN SELLING OR PURSUING A SALE PROCESS

44% - DEVELOPING OR LEVERAGING EXISTING RELATIONSHIPS WITH THE BUSINESS OWNERS OF TARGET FIRMS

43% - CULTURAL CONSIDERATIONS (E.G. COMPANY CULTURE, ALIGNMENT OF VALUES, BELIEFS, BEHAVIORS, ORGANIZATIONAL NORMS)

SELL SIDE

59% - DEVELOPING OR LEVERAGING EXISTING RELATIONSHIPS WITH THE BUSINESS OWNERS OF TARGET FIRMS

53% - CULTURAL CONSIDERATIONS (E.G. COMPANY CULTURE, ALIGNMENT OF VALUES, BELIEFS, BEHAVIORS, ORGANIZATIONAL NORMS)

49% - MARKET DISRUPTIONS/UNPREDICTABLE EVENTS

Middle market businesses are rapidly expanding, with many turning to M&A to accelerate growth in a dynamic environment. Achieving an optimal outcome requires a deep knowledge of industry and market subtleties and a planned approach to optimize target identification, transaction execution, business integration, and synergy capture.

Randy Paine, President, KeyBanc Capital Markets & Key Institutional Bank

Private equity represents alternative capital source, growth engine

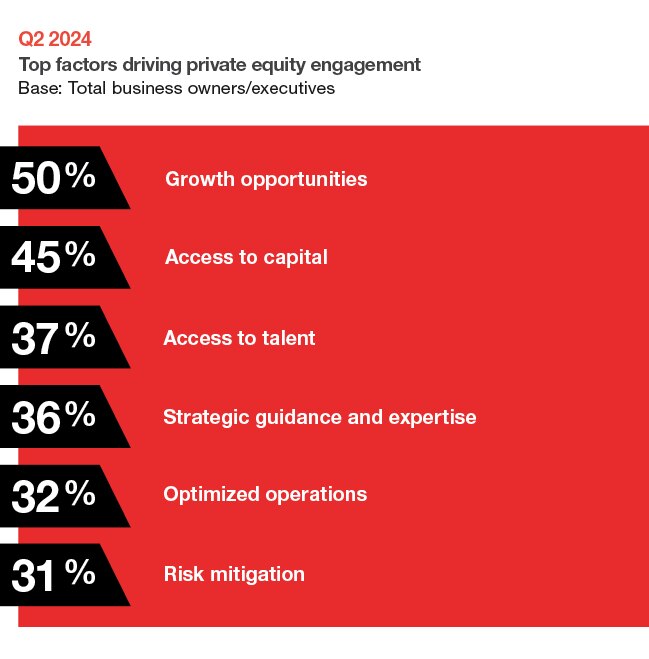

The latest survey revealed a strong connection between private equity and middle market corporate growth.

More than half of middle market business leaders with a positive outlook on the U.S. economy reported that their organizations were fully or partially owned by private equity firms. Similarly, 41% of those with positive company outlooks reported having some private equity ownership.

When asked which factors had influenced or would influence their decision to engage with a private equity firm, 50% cited growth opportunities, followed by access to capital (45%) and access to talent (37%).

GRAPH 7- Q2 2024 – TOP FACTORS DRIVING PRIVATE EQUITY ENGAGEMENT

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

50% - GROWTH OPPORTUNITIES

45% - ACCESS TO CAPTIAL

37% - ACCESS TO TALENT

36% - STRATEGIC GUIDANCE AND EXPERTISE

32% - OPTIMIZED OPERATIONS

31% - RISK MITIGATION

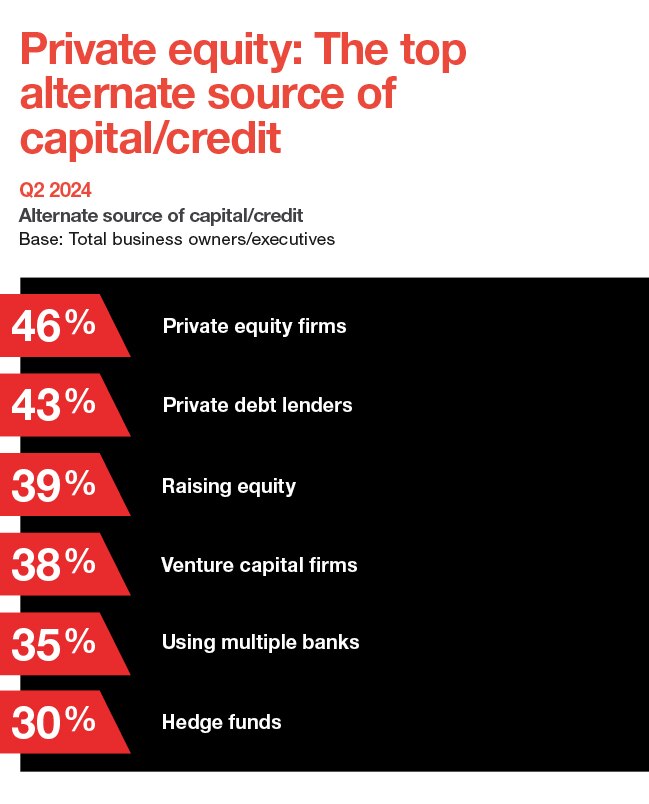

For leaders concerned with access to capital and credit, a large majority (87%) plan to use alternative sources within the next three years. Of those alternative sources, private equity firms were the top alternate source of capital/credit cited by respondents.

GRAPH 8 – PRIVATE EQUITY: THE TOP ALTERNATE SOURCE OF CAPITAL / CREDIT

Q2 2024 – ALTERNATE SOURCE OF CAPITAL / CREDIT

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

46% - PRIVATE EQUITY FIRMS

43% - PRIVATE DEBT LENDERS

39% - RAISING EQUITY

38% - VENTURE CAPITAL FIRMS

35% - USING MULTIPLE BANKS

30% - HEDGE FUNDS

Access to capital and credit is a continuing concern for middle market companies, and as inflation and elevated interest rates continue to pose challenges, it is no surprise that business leaders are looking for alternative sources. Banks are an attractive option for acquisition financing, with plenty of capacity to lend — often at a better price and with more flexible terms than alternative financing methods that lack the relationship approach banks provide.

Doug Ingram, Head of Syndicated & Leveraged Finance, KeyBanc Capital Markets

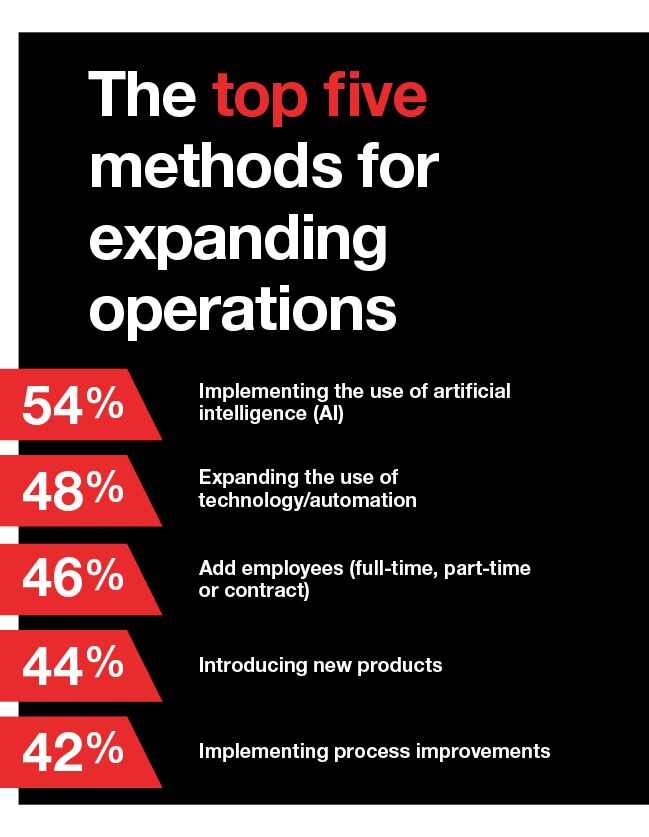

AI adoption tops list of methods for expanding operations

Many middle market businesses have set their sights on growth in the second half of 2024. These ambitious leaders are looking to expand their use of technology and automation, add employees, introduce new products, and more. Companies with higher annual revenue are more likely to report investing in several methods of expansion.

Once again, AI topped the list of methods companies are using to expand the scope of their operations. In mid-2024, more than half of those surveyed (54%) reported plans to implement artificial intelligence, an increase of 10 percentage points since the fourth quarter of 2023.

GRAPH 9 – THE TOP FIVE METHODS FOR EXPANDING OPERATIONS

54% - IMPLEMENTING THE USE OF ARTIFICIAL INTELLIGENCE (AI)

48% - EXPANDING THE USE OF TECHNOLOGY/AUTOMATION

46% - ADD EMPLOYEES (FULL-TIME, PART-TIME OR CONTRACT)

44% - INTRODUCING NEW PRODUCTS

42% - IMPLEMENTING PROCESS IMPROVEMENTS

The three top reasons for implementing AI were data analysis, cybersecurity/fraud management, and data entry and/or data processing.

GRAPH 10 – THE TOP FIVE REASONS FOR IMPLEMENTING AI

65% - DATA ANALYSIS

60% - CYBERSECURITY/FRAUD MANAGEMENT

57% - DATA ENTRY AND/OR DATA PROCESSING

52% - AUTOMATING SIMPLE EMPLOYEE TASKS

51% - INVENTORY MANAGEMENT

Middle market expansion plans reflect a continued resiliency of this sector, demonstrating an ability to adapt to the changing landscape, explore new opportunities, and invest in their future. Whether it’s adding new product lines, expanding markets, scaling their operations, or implementing new technology and automation, these businesses are setting the stage for a robust and sustainable future.

Ken Gavrity, President, KeyBank Commercial

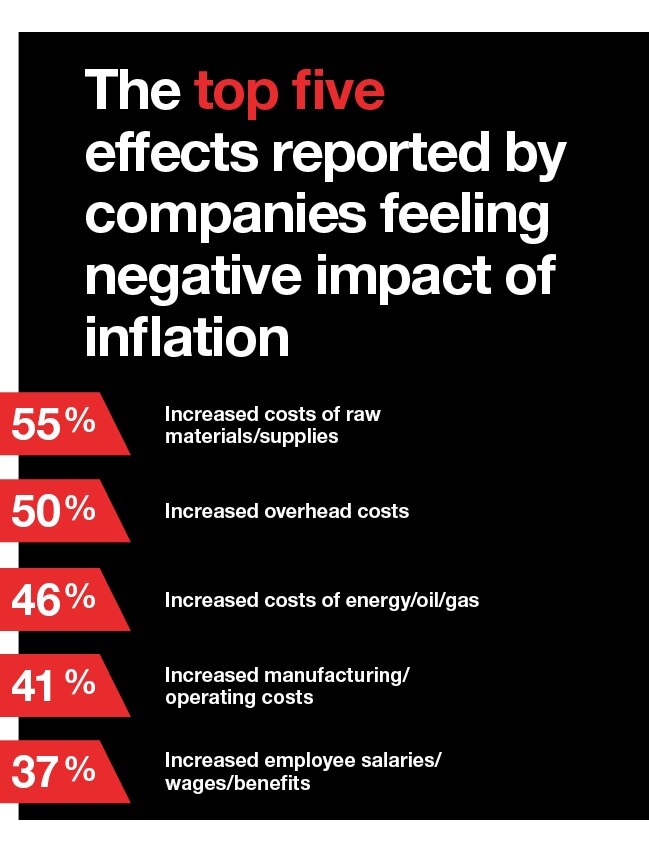

Inflation remained a concern, but some leaders report silver linings

Not surprisingly, inflation remained a top concern in the middle market at mid-year. More than one-third of survey respondents (38%) reported that overall increases in inflation are negatively impacting business operations. Inflation-induced impacts continue to include increased costs of raw materials/supplies, increased overhead costs, and increased costs of energy/oil/gas, among others.

GRAPH 11 – THE TOP FIVE EFFECTS REPORTED BY COMPANIES FEELING NEGATIVE IMPACT OF INFLATION

55% - INCREASED COSTS OF RAW MATERIALS/SUPPLIES

50% - INCREASED OVERHEAD COSTS

46% - INCREASED COST OF ENERGY/OIL/GAS

41% - INCREASED MANUFACTURING/OPERATING COSTS

37% - INCREASED EMPLOYEE SALARIES/WAVES/BENEFITS

The effects of rising energy, oil, and gas costs continue to take a toll on companies looking to combat inflation. Almost a third (29%) of leaders reported negative effects on business operations due to higher energy costs. The number of those respondents who have experienced shrinking profit margins as a result of higher energy costs increased by 9 percentage points during the first half of 2024.

An increasing number of leaders (42%) are also seeing decreased revenue due to higher energy costs, compared to the end of 2023 (36%) and Q2 2023 (37%). To combat rising energy costs, affected business leaders plan to increase energy efficiency efforts and improve processes/create operational efficiencies.

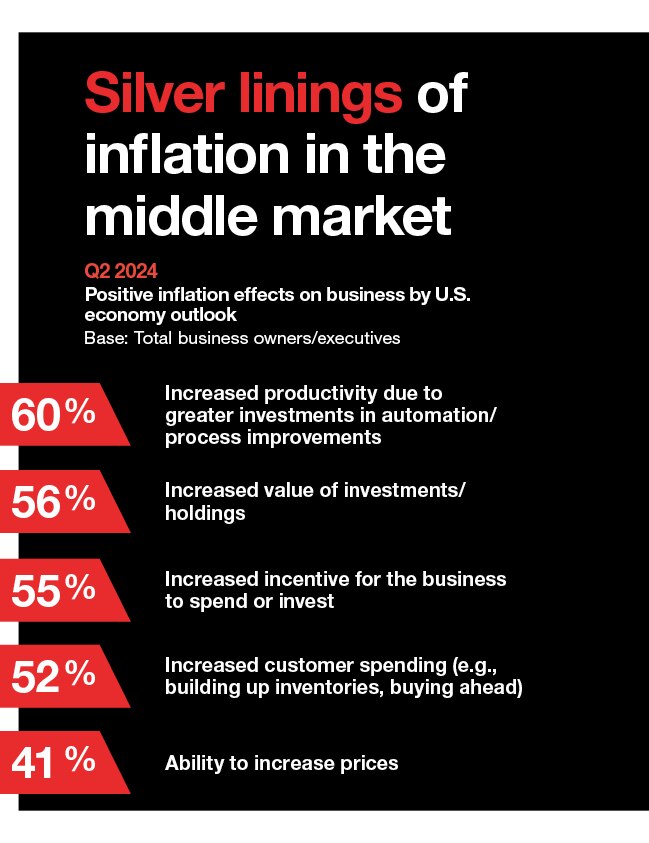

It is not all bad news: Some middle market business leaders reported positive outcomes from inflation. Among those with a positive economic outlook who reported at least some positive impact from inflation, increased productivity was the top benefit. The number of these companies citing the ability to increase prices as a positive outcome of inflation also increased by 12 percentage points to 41% since Q4 of 2023.

GRAPH 12 – SILVER LININGS OF INFLATION IN THE MIDDLE MARKET

Q2 2024 – POSITIVE INFLATION EFFECTS ON BUSINESS BY U.S. ECONOMY OUTLOOK

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

60% - INCREASED PRODUCTIVITY DUE TO GREATER INVESTMENTS IN AUTOMATION/PROCESS IMPROVEMENTS

56% - INCREASED VALUE OF INVESTMENTS/HOLDINGS

55% - INCREASED INCENTIVE FOR THE BUSINESS TO SPEND OR INVEST

52% - INCREASED CUSTOMER SPENDING (E.G., BUILDING UP INVENTORIES, BUYING AHEAD)

41% - ABILITY TO INCREASE PRICES

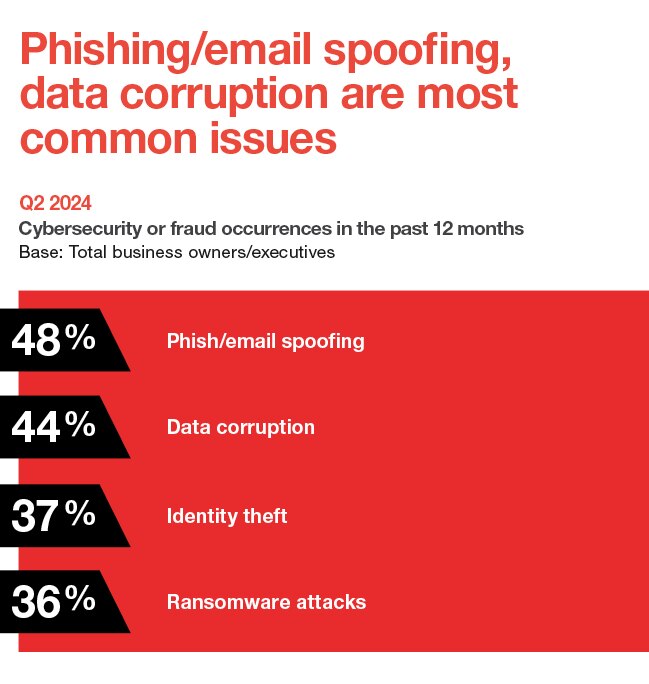

Phishing, data corruption, and check fraud are pervasive threats

In 2023, the FBI reported a staggering $12.5 billion in losses due to cybercrimes, representing a 22% increase from 2022. According to our survey, within the past 12 months, an alarming 1 in 3 middle market businesses surveyed had experienced a fraud or cybersecurity issue. The most common issues were phishing/email spoofing and data corruption, but respondents also reported identity theft, ransomware attacks, and financial statement fraud.

GRAPH 13 – PHISHING/EMAIL SPOOFING, DATA CORRUPTION ARE MOST COMMON ISSUES

Q2 2024 – CYBERSECURITY OR FRAUD OCCURRENCES IN THE PAST 12 MONTHS

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

48% - PHISH/EMAIL SPOOFING

44% - DATA CORRUPTION

37% - IDENTITY THEFT

36% - RANSOMWARE ATTACKS

Despite the severity of these threats, only about half of those surveyed used multifactor authentication, and only 36% had security measures in place to prevent unauthorized devices from connecting to their networks. When asked how they plan to bolster cybersecurity defenses in the coming year, 21% of middle market business leaders plan on implementing controlled access to servers and key technologies, followed by using anti-malware protection on all business computers (19%), and requiring dual authorization for outgoing payments (19%).

GRAPH 14 – THE TOP TOOLS LEADERS PALN TO USE TO COMBAT CYBERSECURITY THREATS

Q2 2024 – CYBERSECURITY TOOLS PLAN ON USING

BASE: TOTAL BUSINESS OWNERS/EXECUTIVES

21% - CONTROLLED SITE ACCESS TO SERVERS AND KEY TECHNOLOGIES

19% - ANTI-MALWARE PROTECTION ON ALL BUSINESS COMPUTERS

19% - DUAL AUTHORIZATION FOR OUTGOING PAYMENTS

18% - PASSWORD EXPIRATION POLICIES

In addition to high-tech security threats, old-fashioned paper check fraud remains a cause of financial losses among middle market businesses. Fraudsters are becoming more organized and sophisticated — and businesses need to protect themselves accordingly.

I’ve seen fraud losses of hundreds of thousands of dollars on a single check. Fraud is widespread because when it works, unfortunately, it can result in very large losses for the victims. It is so important for businesses to take advantage of products to protect themselves.

Matt Swope, Senior Product Leader, KeyBank Payments

Conclusion

At the mid-year mark for 2024, middle market business leaders’ optimism about their companies’ financial prospects soared to its highest point since mid-2022. This optimism, reflected by nearly 80% of business leaders surveyed, continues to be driven by improvements in operational efficiency and improvements in technology.

Companies anticipating strong performance over the coming year are exploring M&A opportunities and private equity engagement with an eye toward growth. To expand their operations over the next six months, middle market business leaders plan to implement AI, expand their use of technology and automation, and add more employees.

At the same time, inflation backed by high costs remains a stubborn challenge for many middle market companies, with more than one-third reporting that increases in inflation are currently having a negative impact on their business. Cybersecurity and financial fraud also pose threats to business operations, and companies are taking measures to bolster their defenses accordingly.

It has been a tumultuous few years for businesses, and the middle market is no exception. But heading into the second half of 2024, most middle market business owners and executives are looking forward with renewed confidence and a charted path toward future growth.

KeyBank has the industry expertise, insights, and solutions to help your business manage growth and identify opportunities in an uncertain economic environment.

Our banking teams offer integrated solutions and strategic expertise to help your business raise capital and manage payments, liquidity, and cash flow. To learn more about KeyBank’s middle market capabilities, contact a KeyBank Relationship Manager.