Middle market business leaders brace for economic downturn in first half of 2023

*The Q1 Middle Market Sentiment survey was fielded and this report was developed before the Silicon Valley Bank and Signature Bank closings during the week of March 6, 2023.

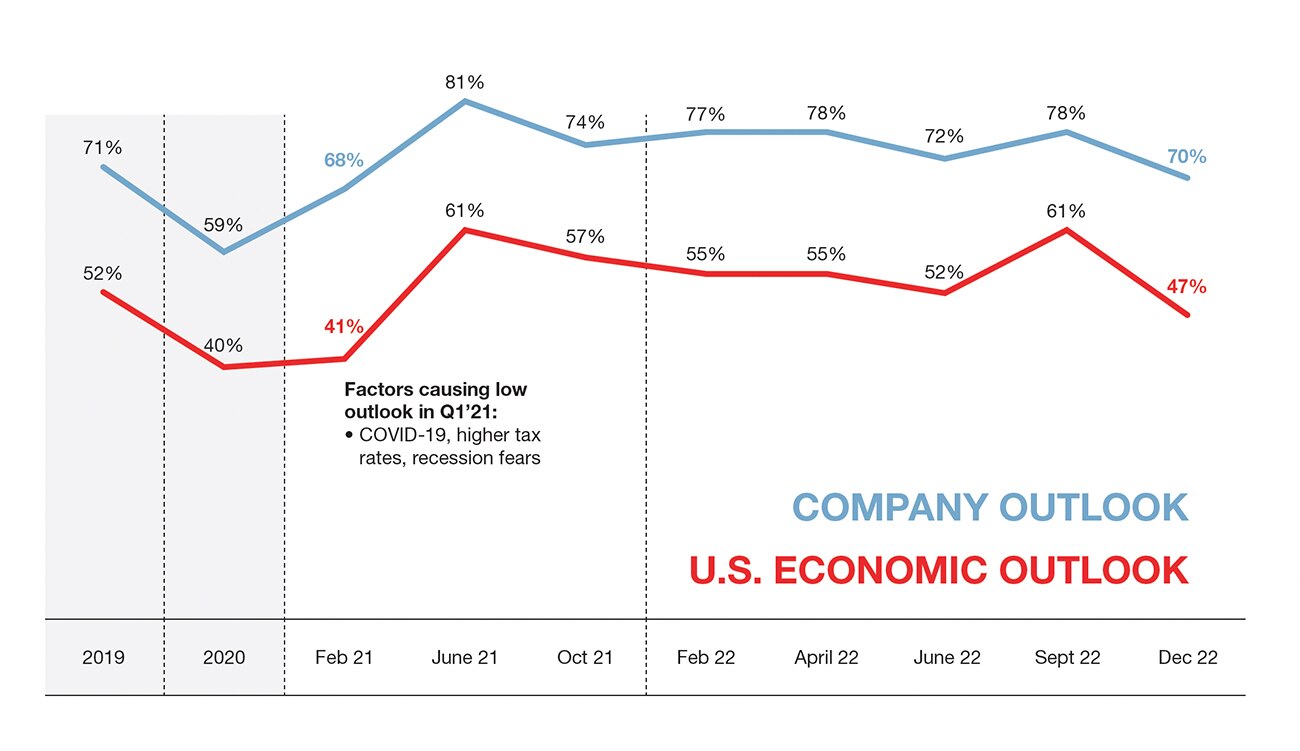

In September of 2022, middle market business leaders expressed optimism despite ongoing economic uncertainty: 78% reported that the outlook for their businesses was either very good or excellent. But by the end of the year, that optimism was waning. In KeyBank’s December survey of 400 owners and executives of businesses with $10 million to $2 billion in revenues, respondents revealed greater apprehension about the outlook for their companies over the next 12 months and expressed the lowest outlook for the broader U.S. economy since the first quarter of 2021. With inflation, supply chain disruptions, higher energy costs and other factors exerting pressure on middle market businesses, many are preparing for significant challenges in 2023.

Outlook tumbles for individual companies and broader U.S. economy

Seventy percent of middle market business leaders said the outlook for their companies over the next 12 months is very good or excellent — a decline of eight percentage points since September. Confidence in the overall U.S. economy dropped even more sharply, from 61% characterizing the outlook as excellent or very good in September to only 47% at year-end.

COMPANY OUTLOOK

2019 – 71%

2020 – 59%

FEB 21 – 68%

JUNE 21 – 81%

OCT 21 – 74%

FEB 22 – 77%

APRIL 22 – 78%

JUNE 22 – 72%

SEPT 22 -78%

DEC 22 – 70%

U.S. ECONOMIC OUTLOOK

2019 – 52%

2020 – 40%

FEB 21 – 41%

JUNE 21 – 61%

OCT 21 – 57%

FEB 22 - 55%

APRIL 22 – 55%

JUNE 22 – 52%

SEPT 22 – 61%

DEC 22 – 47%

Factors causing low outlook in Q1’21:

- COVID-19, higher tax rates, recession fears

Between the third and fourth quarters of 2022, company outlook decreased most sharply among middle market business owners and executives in the construction (87% to 78%) and manufacturing (79% to 73%) industries. Geographically, the West region experienced a 17-point drop in positive company outlook, from 83% to 66%. And in terms of company size, optimism is waning the most at companies with revenues between $10 and $250 million: Just over two-thirds (68%) of these business leaders report an excellent or very good outlook for their company’s next 12 months, down from 76% in September. The factors contributing to this shift toward a more pessimistic outlook will not come as a surprise: Inflation, high energy costs and supply chain disruptions were the three most commonly cited issues having a negative impact on the middle market.

Middle market business owners also expressed less confidence in the current state of the broader U.S. economy. Fewer than half characterize their U.S. economic outlook as excellent or very good — a general sentiment on par with the beginning of 2021, when companies were dealing with COVID-19, concerns about tax rates and fears around a potential recession. The retail, transportation and construction industries reported the largest downward shifts in economic outlook, with transportation feeling the least optimistic: Only 33% have a very good or excellent outlook. Smaller businesses and those in the Northeast and West regions also reported diminishing confidence in the U.S. economy. In the West, 78% of businesses had a positive outlook in September, and as of December, only 43% did — a staggering 35-point drop.

“Increased pessimism in the West may be coming from pockets of the tech industry that are going through a reset. But outside of tech, macroeconomic factors like strong population growth and low unemployment rates are raising the tides for some local economies.”

– Drew Yergensen, Utah market president,

KeyBank commercial banking leader

While their outlook has dimmed both at the macroeconomic level and for their enterprises, middle market business leaders continue to be more optimistic about their own companies than the overall U.S. economy. And among the 70% of middle market businesses where company outlook is still definitively positive, almost all (94%) are anticipating moderate to significant revenue increases in the next 12 months.

More than two-thirds of business leaders anticipate negative impact from impending economic downturn

In keeping with their lowered expectations for their own companies and the U.S. economy, most middle market business owners (80%) are anticipating an economic downturn in 2023. Fifty-one percent of those surveyed expect a downturn to hit within the first half of the year and 29% anticipate it during the third or fourth quarter.

“U.S. consumers are still spending, but we’re seeing orders softening in the automotive, tech and distribution sectors. Most CEOs don’t lay people off when the order book is strong. But when orders soften, that’s when you start to see layoffs and hiring freezes.”

– Dave Mannarino, Michigan market president,

KeyBank commercial banking leader

Of those middle market business owners and executives who believe a 2023 downturn is coming, 68% expect it to have a negative impact on their business. And while expectations around timing are consistent across companies, business leaders who expect a downturn and have a neutral or negative company outlook are more likely to anticipate negative effects from a downturn than those with a more positive outlook: 89% of those with a lower outlook expect to be affected negatively, compared to 59% of those with a very good or excellent company outlook.

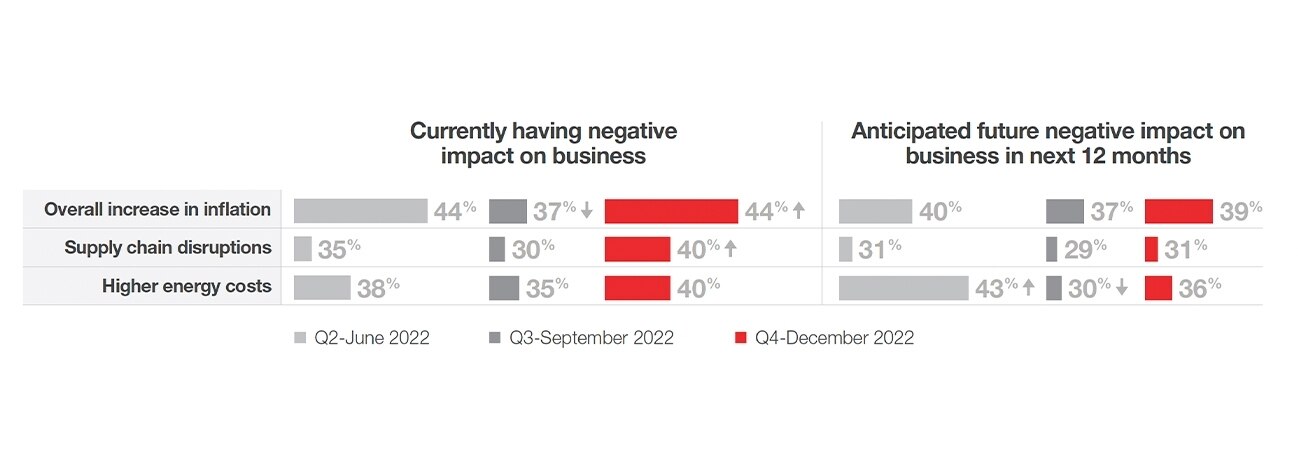

Inflation remains top of mind

When it comes to middle market business leaders’ biggest concerns, inflation continues to outrank energy prices and supply chain disruptions. The percentages of survey respondents who indicated that each of these three factors is currently having a negative impact on their businesses were as high or higher in December than at any other point in 2022, and at least a third anticipate negative impacts on their businesses as a result.

CURRENTLY HAVING NEGATIVE IMPACT ON BUSINESS

Overall Increase in inflation

Q2 JUNE 2022 – 44%

Q3 SEPTEMBER 2022 – 37%

Q4 DECEMBER 2022 – 44%

Supply chain disruptions

Q2 JUNE 2022 – 35%

Q3 SEPTEMBER 2022 – 30%

Q4 DECEMBER 2022 – 40%

Higher energy costs

Q2 JUNE 2022 – 38%

Q3 SEPTEMBER 2022 – 35%

Q4 DECEMBER 2022 – 40%

ANTICIPATED FUTURE NEGATIVE IMPACT ON BUSINESS IN NEXT 12 MONTHS

Overall Increase in inflation

Q2 JUNE 2022 – 40%

Q3 SEPTEMBER 2022 – 37%

Q4 DECEMBER 2022 – 39%

Supply chain disruptions

Q2 JUNE 2022 – 31%

Q3 SEPTEMBER 2022 – 29%

Q4 DECEMBER 2022 – 31%

Higher energy costs

Q2 JUNE 2022 – 43%

Q3 SEPTEMBER 2022 – 30%

Q4 DECEMBER 2022 – 36%

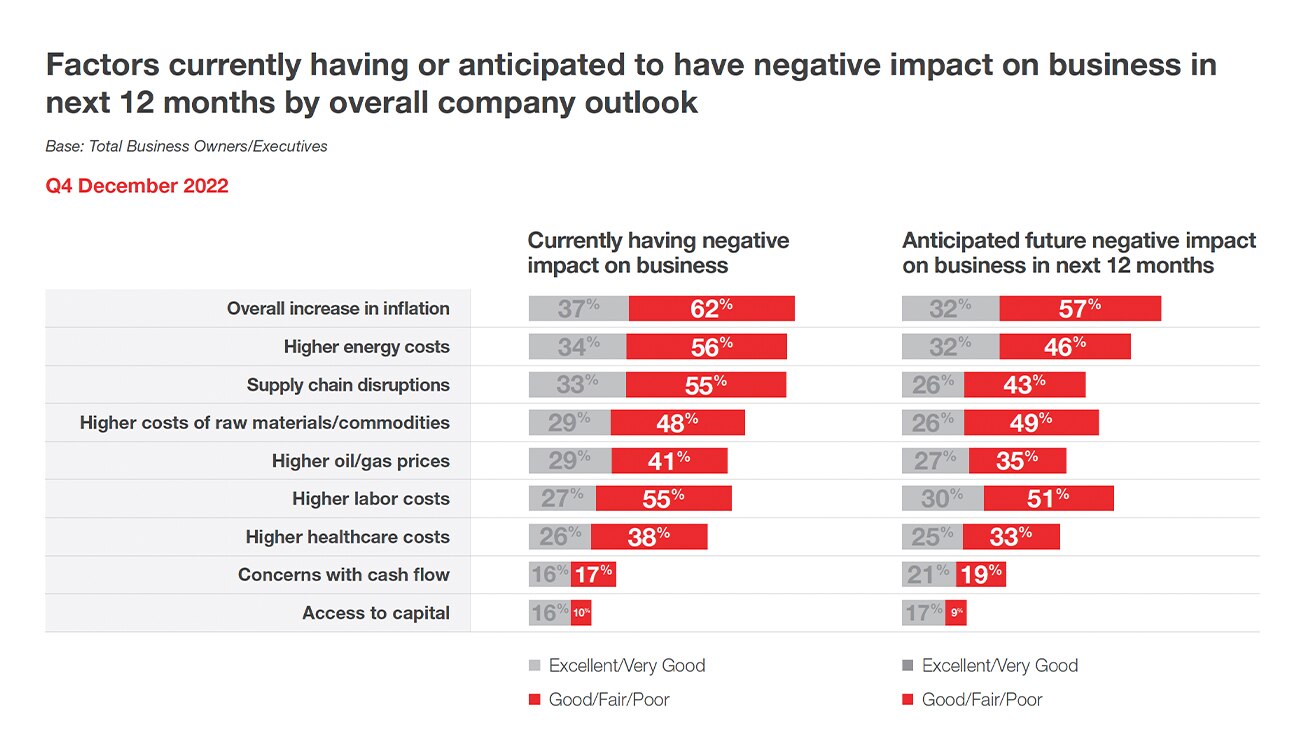

Concerns around healthcare costs and cash flow are also trending upward, reaching all-time highs at the end of 2022. Thirty percent of middle market business owners and executives named the rising cost of healthcare as a current concern, and 21% expect cash flow concerns to have a negative impact on their business over the next 12 months. This uptick in concerns around future cash flow was more pronounced among businesses with a positive company outlook, increasing eight percentage points between September and December. Among business leaders with a more neutral or negative company outlook, concerns about energy costs and operational limitations caused by labor shortages increased the most sharply (15 and 17 percentage points, respectively).

FACTORS CURRENTLY HAVING OR ANTICIPATED TO HAVE NEGATIVE IMPACT ON BUSINESS IN NEXT 12 MONTHS BY OVERALL COMPANY OUTLOOK

CURRENTLY HAVING A NEGATIVE IMPACT ON BUSINESS

Overall increase in inflation

Excellent/Very Good 37%

Good/Fair/Poor – 62%

Higher energy costs

Excellent/Very Good – 34%

Good/Fair/Poor – 56%

Supply chain disruptions

Excellent/Very Good – 33%

Good/Fair/Poor – 55%

Higher costs of raw materials/commodities

Excellent/Very Good -29%

Good/Fair/Poor – 48%

Higher oil/gas prices

Excellent/Very Good – 29%

Good/Fair/Poor – 41%

Higher labor costs

Excellent/Very Good – 27%

Good/Fair/Poor – 55%

Higher healthcare costs

Excellent/Very Good – 26%

Good/Fair/Poor – 38%

Concerns with cash flow

Excellent/Very Good – 16%

Good/Fair/Poor – 17%

Access to capital

Excellent/Very Good – 16%

Good/Fair/Poor – 10%

ANTICIPATED FUTURE NEGATIVE IMPACT ON BUSINESS IN NEXT 12 MONTHS

Overall increase in inflation

Excellent/Very Good – 32%

Good/Fair/Poor – 57%

Higher energy costs

Excellent/Very Good – 32%

Good/Fair/Poor – 46%

Supply chain disruptions

Excellent/Very Good – 26%

Good/Fair/Poor – 43%

Higher costs of raw materials/commodities

Excellent/Very Good – 26%

Good/Fair/Poor – 49%

Higher oil/gas prices

Excellent/Very Good – 27%

Good/Fair/Poor – 35%

Higher labor costs

Excellent/Very Good – 30%

Good/Fair/Poor – 51%

Higher healthcare costs

Excellent/Very Good – 25%

Good/Fair/Poor – 33%

Concerns with cash flow

Excellent/Very Good – 21%

Good/Fair/Poor – 19%

Access to capital

Excellent/Very Good – 17%

Good/Fair/Poor – 9%

Heading into 2023, middle market businesses are taking a variety of measures to mitigate these anticipated negative effects. To combat increases in inflation, which ranked highest among all factors anticipated to pose challenges over the coming year, companies are planning to improve processes and create more operational efficiencies (38%); increase sales and marketing efforts to generate more customers and revenue (35%); pass increased costs to customers through higher prices (33%); identify alternative suppliers/sources of raw materials/commodities (32%); and implement changes to supply chain information/management systems (28%).

“Inflation seems like it cannot be tamed at this point. Even as the Fed has increased rates, inflation is stubbornly high.”

– Dave Mannarino, Michigan market president,

KeyBank commercial banking leader

While inflation creates a good deal of concern, many businesses are also seeing some positive effects, such as increased customer demand and the ability to raise prices. Among the 32% of middle market business owners and executives who indicate that the positive impact of inflation has outweighed the negative, those in the construction industry were especially likely to cite increased value of investments and holdings (72%) and increased customer spending (64%) as beneficial to their organizations. However, the percentage of survey respondents who report that the negative impacts of inflation outweigh positive effects increased from 28% in September to 34% in December.

“Inflation, especially of raw material inputs and labor costs, is on a lot of people’s minds. Companies are minding their costs, but also passing their increased costs on to their customers. For the most part, companies that are raising prices are having success in getting those increases to stick.”

– Jim Barger, New England KeyBank commercial banking executive

The financial implications of higher energy costs are also on the minds of middle market business leaders. Of the 50% who reported that their business is currently impacted by higher energy/oil/gas costs, 65% have seen a reduction in profit margins as a result, and 40% report decreased revenues. Moreover, most of these business owners and executives are not anticipating near-term relief: 60% expect that higher oil and gas prices will negatively impact their bottom line within the next three months. In response, they plan on improving processes and creating more operational efficiencies (41%), increasing energy efficiency efforts (41%), increasing digital and automation capabilities (39%) and passing increased costs on to customers (38%) over the next six months.

Supply chain concerns are once again on the rise among middle market business leaders. Since September, the number of survey respondents who report that supply chain disruptions are currently having a negative impact on their business has increased 10 percentage points, from 30% to 40% — an all-time high. In 2023, these companies plan to counteract supply chain challenges primarily by identifying alternative suppliers (44%), passing increased costs on to customers (42%), carrying excess inventories as a buffer (37%) and implementing changes to supply chain information/management systems (37%). The survey also revealed an increase in middle market business leaders planning to reduce their company’s workforce in response to supply chain events: An all-time high of 21% indicated that they plan to take this step — even as many businesses struggle to keep enough qualified workers on staff.

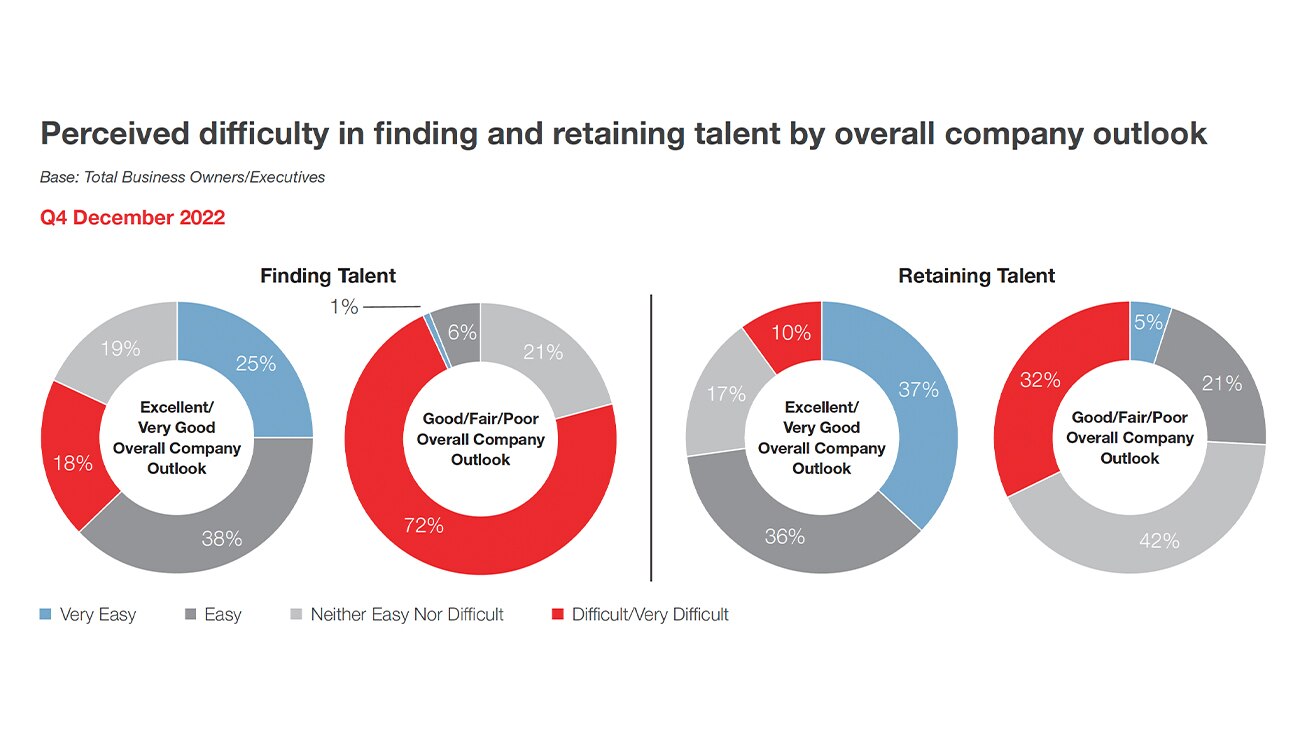

Pessimism around hiring and retaining talent grows, especially in healthcare

The challenge of maintaining a qualified workforce is intensifying in the middle market. Key’s December survey found that business leaders and executives are more pessimistic about finding and retaining qualified talent than at any point throughout 2022. This trend is especially pronounced among companies in the healthcare industry: For example, less than half (48%) expect that it will be easy or very easy to retain employees over the next six months, compared to 59% of companies overall.

“Both large healthcare systems and smaller regional hospitals are really struggling to hire the people they need. They’ve had to pay more, and their labor costs are going way up.”

– Jim Barger, New England KeyBank commercial banking executive

Not surprisingly, business leaders with a neutral or negative company outlook are significantly more concerned about finding and retaining qualified workforces than those with a positive outlook:

PERCEIVED DIFFICULTY IN FINDING AND RETAINING TALENT BY OVERALL COMPANY OUTLOOK

Q4 DECEMBER 2022

FINDING TALENT

EXCELLENT/VERY GOOD OVERALL COMPANY OUTLOOK

VERY EASY – 25%

EASY – 38%

NEITHER EASY NOR DIFFICULT – 19%

DIFFICULT/VERY DIFFICULT – 18%

GOOD/FAIR/POOR/OVERALL COMPANY OUTLOOK

VERY EASY – 1%

EASY – 6%

NEITHER EASY NOR DIFFICULT – 21%

DIFFICULT/VERY DIFFICULT – 72%

RETAINING TALENT

EXCELLENT/VERY GOOD OVERALL COMPANY OUTLOOK

VERY EASY – 37%

EASY – 36%

NEITHER EASY NOR DIFFICULT – 17%

DIFFICULT/VERY DIFFICULT – 10%

GOOD/FAIR/POOR/OVERALL COMPANY OUTLOOK

VERY EASY – 5%

EASY – 21%

NEITHER EASY NOR DIFFICULT – 42%

DIFFICULT/VERY DIFFICULT – 32%

On the flip side, publicly owned companies, construction firms and those with a positive outlook on the U.S. economy report above-average levels of optimism around finding qualified talent. And while business leaders with a positive company outlook are less confident about attracting and retaining talent than they were in September, 63% still anticipate it will be relatively easy to fill their job openings and 73% don’t expect difficulty in retaining employees over the first half of 2023.

Business leaders who anticipate staffing challenges in 2023 are taking measures to attract and retain the workers they need. When it comes to finding new talent, the top three practices these companies plan to implement or enhance are competitive wages and salaries (52%), flexible hours and schedules (47%) and paid time off (45%). Offering more competitive wages and salaries is also the top tactic companies plan to use to retain talent (49%), followed by enhancing health and wellness benefits (47%) and flexible hours and schedules (45%). Manufacturing companies skew higher than average on plans to offer flexible hours and PTO to help retain talent.

For middle market businesses, a “return to the unprecedented”

Persistent inflation and the resulting increase in interest rates, supply chain disruptions, elevated energy costs and labor shortages have all contributed to a decline in optimism among middle market business leaders. While most are still confident about their companies’ prospects in the year ahead, they are also clear-eyed about the challenges they will need to navigate to keep their businesses operating smoothly.

“We used the word ‘unprecedented’ a lot during the pandemic, but the reality is, we’re in unprecedented times again. During this period of higher inflation, higher interest rates and a murkier economic outlook, make sure you have a strong relationship with your bank and that you’re positioned to work through challenges together as partners.”

– Drew Yergensen, Utah market president,

KeyBank commercial banking leader

KeyBank middle market experts can help your business navigate periods of uncertainty and provide strategic solutions to any issue your business faces, including efficiently managing and maximizing cash flow. To learn more about KeyBank’s middle market capabilities, contact a KeyBank Relationship Manager.