Inflation still a top concern for middle market businesses, alongside labor and healthcare costs

At the end of 2023, middle market business leaders’ confidence in their companies’ prospects remained unshakeable, and their outlook on the overall U.S. economy improved slightly. Yet most still expect to see an economic downturn in 2024, and a quarter of those surveyed in November and December said they believed the economy was already in one. KeyBank’s latest Middle Market Sentiment survey asked 400 owners and executives of businesses with $10 million to $2 billion in annual revenue about their outlook for the year, the challenges currently affecting their businesses, and their growth plans for 2024.

Company outlook for 2024 remains steadfastly positive — much higher than for the U.S. economy

In looking at the overall U.S. economy, the number of middle market business leaders who characterized their outlook as excellent or very good increased 2 percentage points to 49% at the end of 2023. Respondents in the South and West regions were more optimistic, with 55% and 56% reporting a positive outlook, respectively. Among business leaders of the largest companies in the sample, with $500 million to $2 billion in revenue, 62% expressed positive sentiments about the U.S. economy. A higher-than-average proportion of respondents at publicly owned companies reported a positive outlook for the overall economy and their businesses (62% and 85%, respectively).

The consumer continues to be really strong. By most forecasts and estimates, holiday spending either met or exceeded expectations. The business community’s biggest fears about an economic pullback have not come to pass, and I think the worst is behind us.

Ryan P. Hartzell, Director

Consumer & Retail Investment Banking

KeyBanc Capital Markets

Measuring the prospects for their own businesses, nearly three-quarters (73%) of business owners and executives reported an excellent or very good company outlook for 2024. This level of confidence remained steady throughout 2023. Business leaders in the South (79%) and West (77%) regions were the most optimistic, and positive sentiment in the Midwest jumped 6 percentage points between Q3 and Q4. Eighty-four percent of survey respondents in the construction industry reported an excellent or very good company outlook for 2024.

Executives in manufacturing and retail reported contrasting trends in their perceptions of the economy and their own businesses. The number of business leaders at manufacturing firms with an excellent or very good outlook for the U.S. economy increased 5 percentage points between September and the end of 2023, from 46% to 51%. But the number who cited a positive outlook for their own businesses decreased by 9 percentage points to 67%. In retail, the opposite trend emerged: Fewer retail business owners and executives expressed positive sentiment about the overall U.S. economy at the end of the year (51%, compared to 57% in September), but slightly more were optimistic about their own businesses than in September (71% versus 69%).

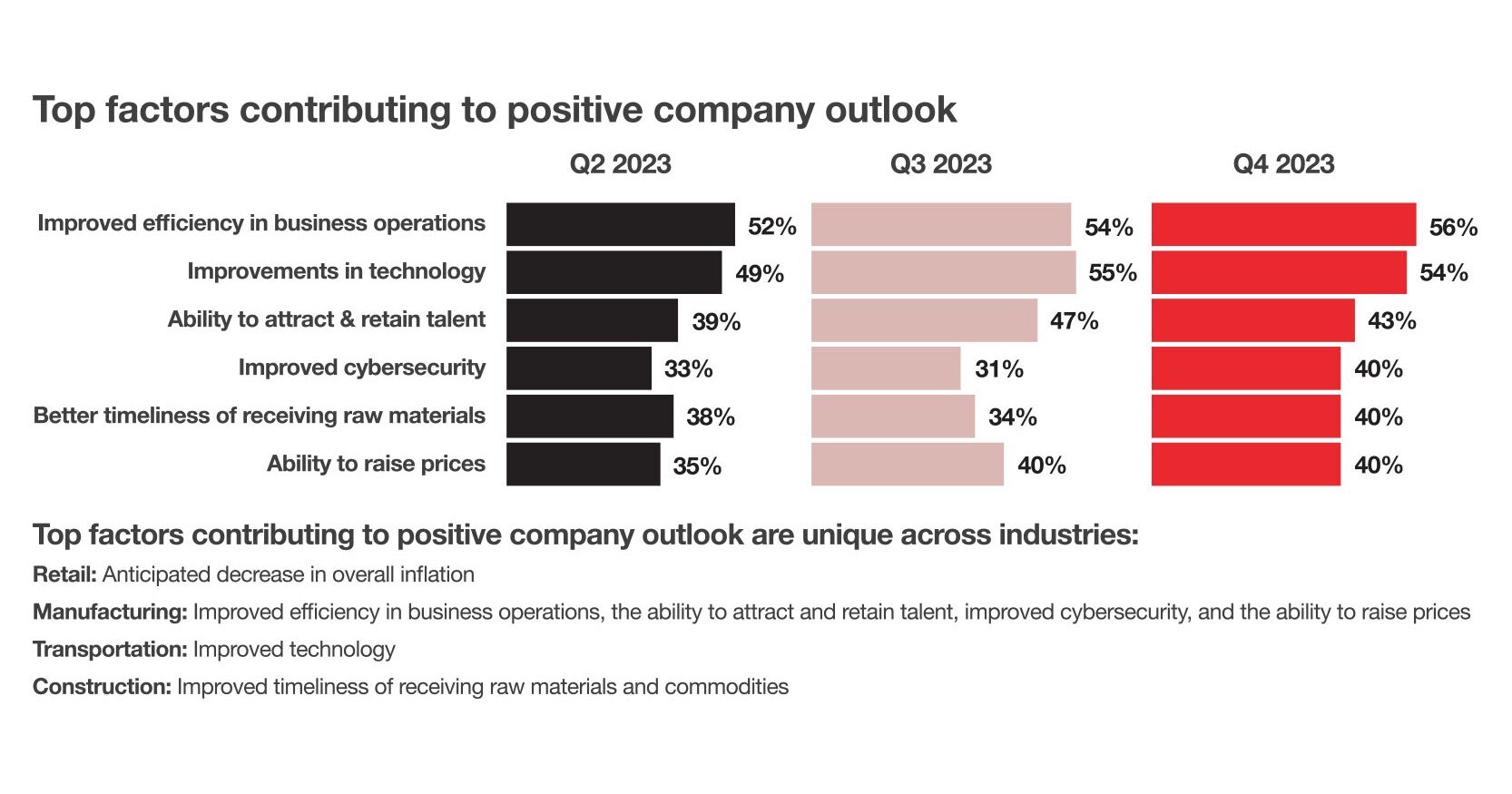

Among business leaders with a positive company outlook, the top two contributing factors were improvements to operational efficiency and technology, both cited by more than half of respondents. Forty-three percent reported that their ability to attract and retain talent was a positive factor, and the number of respondents who cited improvements to cybersecurity increased 9 percentage points to 40%.

GRAPH 1 – TOP FACTORS CONTRIBUTING TO POSITIVE COMPANY OUTLOOK

Q2 2023

- Improved efficiency in business operations – 52%

- Improvements in technology – 49%

- Ability to attract & retain talent – 39%

- Improved cybersecurity – 33%

- Better timeliness of receiving raw materials – 38%

- Ability to raise prices – 35%

Q3 2023

- Improved efficiency in business operations – 54%

- Improvements in technology – 55%

- Ability to attract & retain talent – 47%

- Improved cybersecurity – 31%

- Better timeliness of receiving raw materials – 34%

- Ability to raise prices – 40%

Q4 2023

- Improved efficiency in business operations – 56%

- Improvements in technology – 54%

- Ability to attract & retain talent – 43%

- Improved cybersecurity – 40%

- Better timeliness of receiving raw materials – 40%

- Ability to raise prices – 40%

Top factors contributing to positive company outlook are unique across industries:

Retail: anticipated decrease in overall inflation

Manufacturing: improved efficiency in business operations, the ability to attract and retain talent, improved cybersecurity, and the ability to raise prices

Transportation: improved technology

Construction: improved timeliness of receiving raw materials and commodities

Antivirus and anti-malware protection rank as top cybersecurity tools

When it comes to cybersecurity, the majority of middle market business leaders aren’t worried. Eighty-two percent said their IT networks are secure, compared to only 18% who consider them either somewhat or very vulnerable. Business owners and executives in the retail industry are more apt to be concerned, with only 66% indicating their networks are secure.

Middle market businesses executives who are confident in the security of their networks are more likely than those at vulnerable businesses to use antivirus and anti-malware protection on all business computers. In addition, more secure businesses than vulnerable ones have implemented measures to prevent network connections to unauthorized devices (32% versus 27%). However, more respondents who perceive their organizations’ IT networks as vulnerable require dual authorization for outgoing payments (33% versus 26% of vulnerable businesses).

GRAPH 2 – TOP TOOLS USED FOR CYBERSECURITY EFFORTS

- Antivirus protection on all business computers – 50%

- Anti-malware protection on all business computers – 48%

- Requiring strong passwords – 48%

- Multi-factor authentication – 43%

- VPN required to access company resources – 37%

- Password expiration policies – 35%

Network security can be a huge issue. We see fraud happening almost on a weekly basis, and it has been an eye-opener for a lot of businesses. The protection banks can provide customers via systems like positive pay or other security solutions to help keep processes secure is critical.

Mike McKay

Agribusiness National Sales Manager

Commercial Banking Leader, KeyBank

Is an economic downturn looming, or did it already happen?

Despite their generally positive outlook about their own companies’ prospects, most middle market business leaders see an economic downturn on the horizon — and during the fourth quarter of 2023, the number who believed the economy was already in a downturn increased from 17% to 24%.

How do these business owners and executives define a downturn? When asked which metrics they most associate with the phrase “economic downturn,” the top two responses were high interest rates (cited by 45%) and high rates of inflation (41%). Fewer respondents said they define a downturn based on factors related to their own business performance, such as poor or low business profit growth (24%) or poor or low business revenue growth (22%).

Given their focus on interest rates and inflation, it makes sense that nearly a quarter (24%) of middle market business leaders surveyed in late 2023 believed the U.S. was already in an economic downturn. Looking ahead, another 60% expect the next downturn to occur before 2025. Of those anticipating a downturn, 64% anticipate it will have a negative impact on their businesses, down slightly from 69% in September. But business leaders with a positive 2024 company outlook were much less worried at the end of 2023 than in the prior quarter: Just over half (51%) anticipate that the next economic downturn will negatively affect their businesses, an 11-percentage-point drop since September.

Predictions about when a downturn will hit vary by region. More than a third of respondents in the Midwest (39%) expect a downturn to occur within the first half of 2024, compared to 31% of respondents overall, and 37% of those in the Northeast anticipate a downturn in the second half of 2024 (compared to 29% overall). Finally, 26% of middle market leaders in the West surveyed do not expect a downturn to happen before 2025, compared to 16% overall.

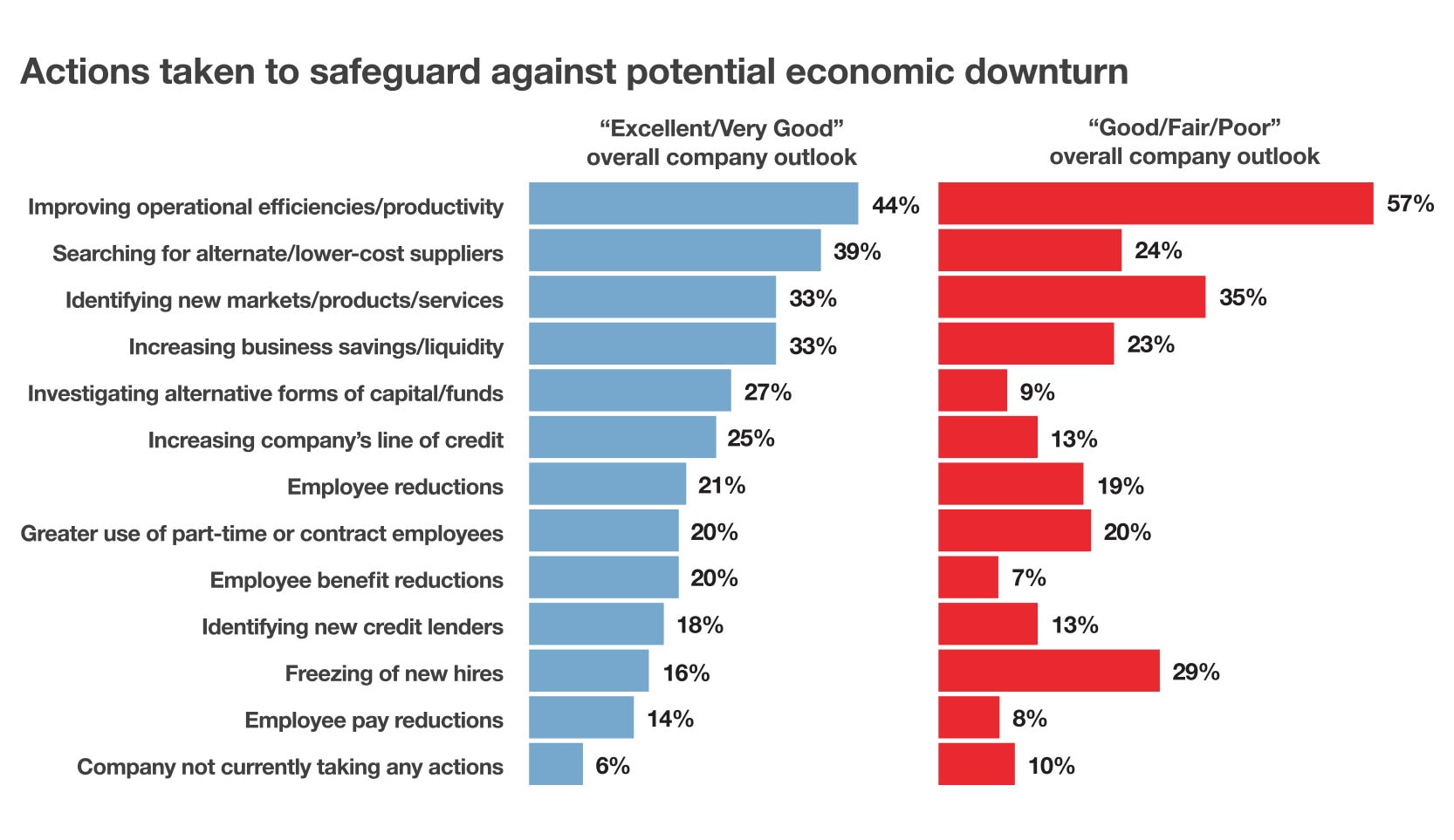

Leaders are taking steps to prepare. In response to a potential economic downturn, nearly half of middle market business leaders — including 57% of those with a less positive company outlook for 2024 — have prioritized improving operational efficiencies and productivity. Almost a third (29%) of respondents with a less positive company outlook also reported enacting hiring freezes to safeguard against an economic downturn, compared to only 19% overall. Meanwhile, 39% of companies with a positive 2024 outlook reported searching for alternate or low-cost suppliers, an increase of 10 percentage points over the previous quarter. Notably, companies with a more positive outlook are also more likely to be taking steps to shore up their capital positions, including increasing business savings and liquidity (33%), investigating alternative forms of capital and funds (27%), and increasing their lines of credit (25%).

GRAPH 3 – ACTIONS TAKEN TO SAFEGUARD AGAINST POTENTIAL ECONOMIC DOWNTURN

“Excellent/Very Good” overall company outlook

- Improving operational efficiencies/productivity – 44%

- Searching for alternate/lower-cost suppliers – 39%

- Identifying new markets/products/services – 33%

- Increasing business savings/liquidity – 33%

- Investigating alternative forms of capital/funds – 27%

- Increasing company’s line of credit – 25%

- Employee reductions – 21%

- Greater use of part-time or contract employees – 20%

- Employee benefit reductions – 20%

- Identifying new credit lenders – 18%

- Freezing of new hires – 16%

- Employee pay reductions – 14%

- Company not currently taking any actions – 6%

“Good/Fair/Poor” overall company outlook

- Improving operational efficiencies/productivity – 57%

- Searching for alternate/lower-cost suppliers – 24%

- Identifying new markets/products/services – 35%

- Increasing business savings/liquidity – 23%

- Investigating alternative forms of capital/funds – 9%

- Increasing company’s line of credit – 13%

- Employee reductions – 19%

- Greater use of part-time or contract employees – 20%

- Employee benefit reductions – 7%

- Identifying new credit lenders – 13%

- Freezing of new hires – 29%

- Employee pay reductions – 8%

- Company not currently taking any actions – 10%

Other headwinds on the horizon for 2024

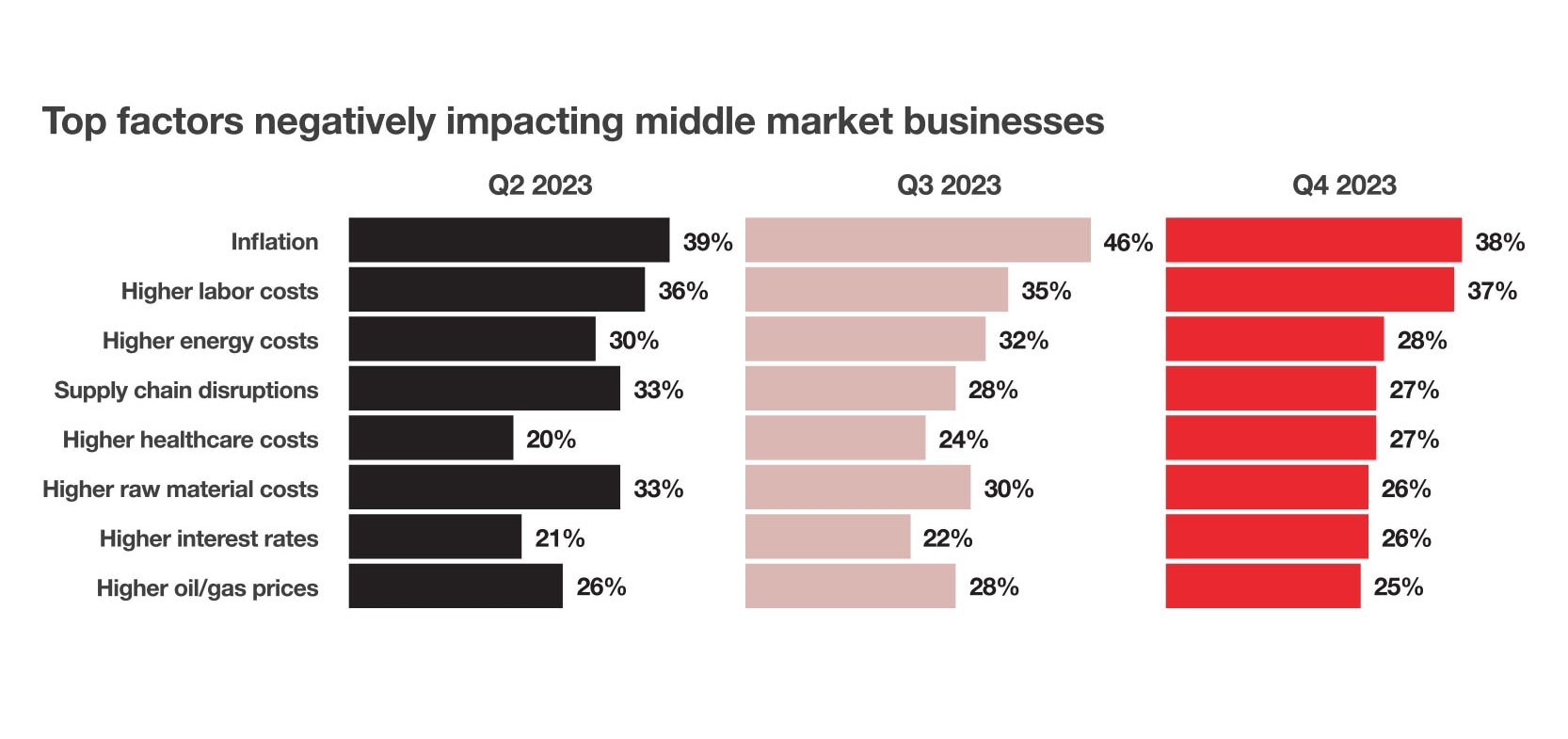

In the third quarter of 2023, almost half (46%) of middle market business leaders reported that inflation was having a negative impact on their businesses, making it the top concern among survey respondents. At year end, inflation was still the No. 1 factor negatively affecting middle market businesses, but the number of respondents who cited it as a concern fell to 38%, followed closely by higher labor costs (37%). This trend aligns with economic data reports: Inflation rose 2.6% in December from a year earlier as measured by the Personal Consumption Expenditures Price Index, a marked decline from the 5.4% increase at the end of 2022. The six-month annualized inflation rate decreased from 4% in the first half of 2023 to less than 1.9% during the second half of the year. Businesses are clearly still experiencing the effects of inflation, but some may be starting to feel relief as it eases.

For a while, everyone understood that inflation was rampant, and businesses could pass along price increases to customers. As inflation cools, businesses need to focus on efficiency to preserve their margins.

Daniel R. Dower

Northwest Ohio Market President

Commercial Banking Leader, KeyBank

In response to inflation, 38% of business leaders plan to increase their sales and marketing efforts to generate more revenue during the first half of the year. Just less than one-third (31%) of respondents plan to increase automation to improve productivity. However, that percentage climbed to 39% among business leaders who have a less optimistic company outlook for 2024. An increasing number of respondents said their companies plan to increase R&D efforts (24%) and carry excess inventory (23%) due to inflation.

Fewer executives are concerned than they were in the previous quarter about the future effects of higher oil and gas prices and their ability to attract and retain talent. Meanwhile, concerns about the costs of labor, healthcare, and rising interest rates are emerging as watchpoints for 2024.

GRAPH 4 – TOP FACTORS NEGATIVELY IMPACTING MIDDLE MARKET BUSINESSES

Q2 2023

- Inflation – 39%

- Higher labor costs – 36%

- Higher energy costs – 30%

- Supply chain disruptions – 33%

- Higher healthcare costs – 20%

- Higher raw material costs – 33%

- Higher interest rates – 21%

- Higher oil/gas prices – 26%

Q3 2023

- Inflation – 46%

- Higher labor costs – 35%

- Higher energy costs – 32%

- Supply chain disruptions – 28%

- Higher healthcare costs – 24%

- Higher raw material costs – 30%

- Higher interest rates – 22%

- Higher oil/gas prices – 28%

Q4 2023

- Inflation – 38%

- Higher labor costs – 37%

- Higher energy costs – 28%

- Supply chain disruptions – 27%

- Higher healthcare costs – 27%

- Higher raw material costs – 26%

- Higher interest rates – 26%

- Higher oil/gas prices – 25%

Higher interest rates are also on the minds of middle market business owners and executives, with the number who said these rates were having a negative impact on their bottom lines increasing from 22% in Q3 2023 to 26% in Q4. In addition, 11% anticipated that access to capital and credit will have a negative impact on their business operations within the next 12 months. Among those, more than three-quarters (78%) expect to see those negative impacts within the next six months — a 7-percentage-point increase over the previous quarter. Business leaders who reported these concerns are looking for alternative sources of capital and credit via private equity firms (47%), private debt lenders (42%), and new commercial lending relationships (41%). The business leaders anticipating issues with cash flow in 2024 are concerned about finding financing or credit options, as well as their ability to finance growth.

Among the businesses we talk to, a primary concern is how quickly rates will come down. I think we’ll see some pent-up demand for access to capital because of their desire to fuel growth. But they want to do so at rates that they can stomach.

Erica Choi

Albany, New York, Commercial Sales Leader

KeyBank

Concerns about the increasing cost of healthcare are also on the rise among middle market business owners and executives. Among the 22% of survey respondents who expected higher healthcare costs to have a negative impact on their bottom lines in the next 12 months, the vast majority (84%) expect to see those negative effects within three to six months, a 19-percentage-point increase from the prior quarter. At the same time, healthcare benefits ranked as the top benefit desired by hourly employees applying for a new role (cited by 62% of middle market business leaders). Despite the importance of these benefits to workers, the number of middle market business leaders who said they were considering implementing or enhancing healthcare benefits to attract talent dropped from 53% in Q3 of 2023 to 44% in the fourth quarter.

Half the middle market plans to add employees in first half of 2024

U.S. employers added 216,000 jobs in December 2023. This figure exceeded expectations, and coupled with the 3.7% unemployment rate, ended the year on a high note for the labor market. Business owners and executives in the middle market also reported positive developments around attracting and retaining talent. Since September, their ability to retain talent remained stable, while ease of finding talent improved significantly. More than half of those surveyed at the end of 2023 (52%) said it was easy or very easy to find talent, compared to 41% in the prior quarter. This may be a particularly welcome development for middle market businesses looking to bring on new employees during the first half of 2024.

When asked how they plan to invest in or expand the scope of their operations in the next six months, nearly half of middle market leaders (48%) said they plan to add employees. Hiring new talent exceeded other avenues of growth such as adding new facilities or locations (28%) and considering an acquisition (22%) or merger (13%). Among business owners and executives who plan to expand operations by hiring in 2024 and anticipate challenges to attracting talent, the top three methods they will focus on are offering competitive wages and salaries (68%), health and wellness benefits (62%), and a company match on retirement plans (57%).

Opportunity and uncertainty await middle market business leaders in 2024

From leveraging new technology to boosting productivity and strengthening cybersecurity defenses, to adding employees to their ranks, middle market businesses are embracing a variety of new opportunities in 2024. Falling inflation and possible interest rate reductions from the Fed may ease concerns about access to capital as the year unfolds. Additionally, these businesses have become experienced at managing through uncertainty — the kinds of unknowns posed by geopolitical conflicts abroad and an election year at home. And while most middle market business owners and executives are still wary about a potential economic downturn, the majority remain confidently optimistic about their companies’ financial prospects for the year ahead.

KeyBank has the industry expertise, insights, and solutions to help your business manage for growth and identify opportunities in an uncertain economic environment. Our banking teams offer integrated solutions and strategic expertise to help your business raise capital and manage payments, liquidity, and cash flow. To learn more about KeyBank’s middle market capabilities, contact a KeyBank Relationship Manager.