Survey says - Optimism persists but turns more cautious for seniors housing and healthcare

In recent years, higher costs, rising interest rates, and labor shortages have posed tough challenges for the seniors housing sector. Despite these hurdles, two-thirds of seniors housing owners, operators, and other professionals are optimistic about the direction of the industry over the next 12 months.

Prior to the 2023 National Investment Center for Seniors Housing & Care (NIC) Fall Conference, KeyBank Real Estate Capital surveyed a group of seniors housing owners, operators, investors, investment bankers, lenders, and brokers to understand their perspectives on the current state of their businesses and the industry at large. Respondents were most active in memory care, assisted living, and independent living facilities.

KEY LEARNINGS

- While 60% expect deal volume to increase over the next year, almost a third expect declines.

- Acquisition, renovation, and expansion dominate growth opportunities.

- Staffing and rising interest rates are tied for the biggest challenge facing seniors housing businesses over the next 12 months.

- Refinancing emerges as a top challenge for more than half of respondents.

Optimism persists, but turns more cautious

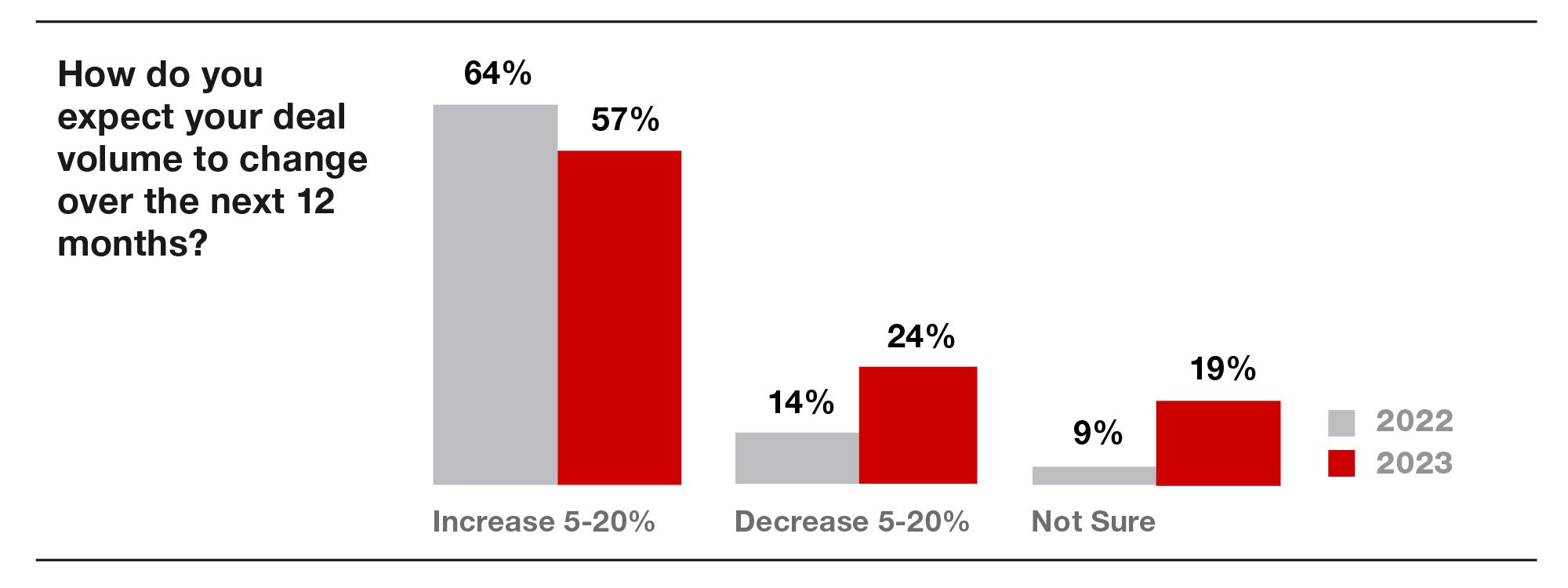

More than half of those surveyed in 2023 indicated that they feel somewhat optimistic about the direction the industry is headed over the next 12 months, and 13% feel very optimistic — a positive sentiment on par with responses to last year’s survey. The rosy perspective may have to do with the fact that most respondents are anticipating growth in the year ahead. Forty-percent predict an 11% to 20% increase in deal volume, and another 20% expect to see a more modest increase of 5% to 10%.

But not all survey respondents expressed a positive outlook. Almost 27% of those surveyed reported that their deal volume is likely to decrease over the next 12 months — nearly double the 14% who anticipated reduced deal volume in the 2022 survey. Also, while none of last year’s respondents said that they were very pessimistic about the direction the industry is headed, 7% expressed that opinion this year.

How do you expect your deal volume to change over the next 12 months?

2023 Graph

Y AXIS X AXIS

Increase 5 – 10% 18.75 %

Increase 11-20% 37.50%

Decrease 5-10% 12.50%

Decrease 11-20% 12.50%

Not sure 18.75%

Other (please specify) 0%

2022 Graph

Y AXIS X AXIS

Increase 5 – 10% 27.27%

Increase 11-20% 36.36%

Decrease 5-10% 13.64%

Decrease 11-20% 0%

Not sure 9.09%

Other (please specify) 13.64%

Refinancing emerges as a top challenge

Survey participants were allowed to select multiple answers in response to the question of what obstacles they expected to face in 2024. In last year’s survey, 75% of respondents cited staffing as a major obstacle. That number has dropped slightly this year, to 67% — in line with other research studies1 that show labor shortages easing 2. Concerns about expense control and managing rising costs have also waned as inflation has cooled and supply chain bottlenecks have subsided.

Meanwhile, worries about rising interest rates skyrocketed, with two-thirds of respondents citing that issue as a major worry in 2024, versus 41% in last year’s edition. In a related development, “Refinancing or working out expiring loans” burst onto the scene as a primary obstacle faced by leaders in the seniors housing and healthcare industry. While none of the participants in the 2022 survey expressed concern about refinancing, more than half of those surveyed (53%) this year did.

What’s behind those responses? According to a Mortgage Bankers Association survey 3, around 15% of all outstanding commercial mortgages will mature in 2024, totaling $659 billion in value. Borrowers with loans that were written when rates were closer to 2% will be forced to refinance those mortgages at rates more than double that amount or seek extensions, which experts believe will be hard to come by due to more restrictive lending terms.

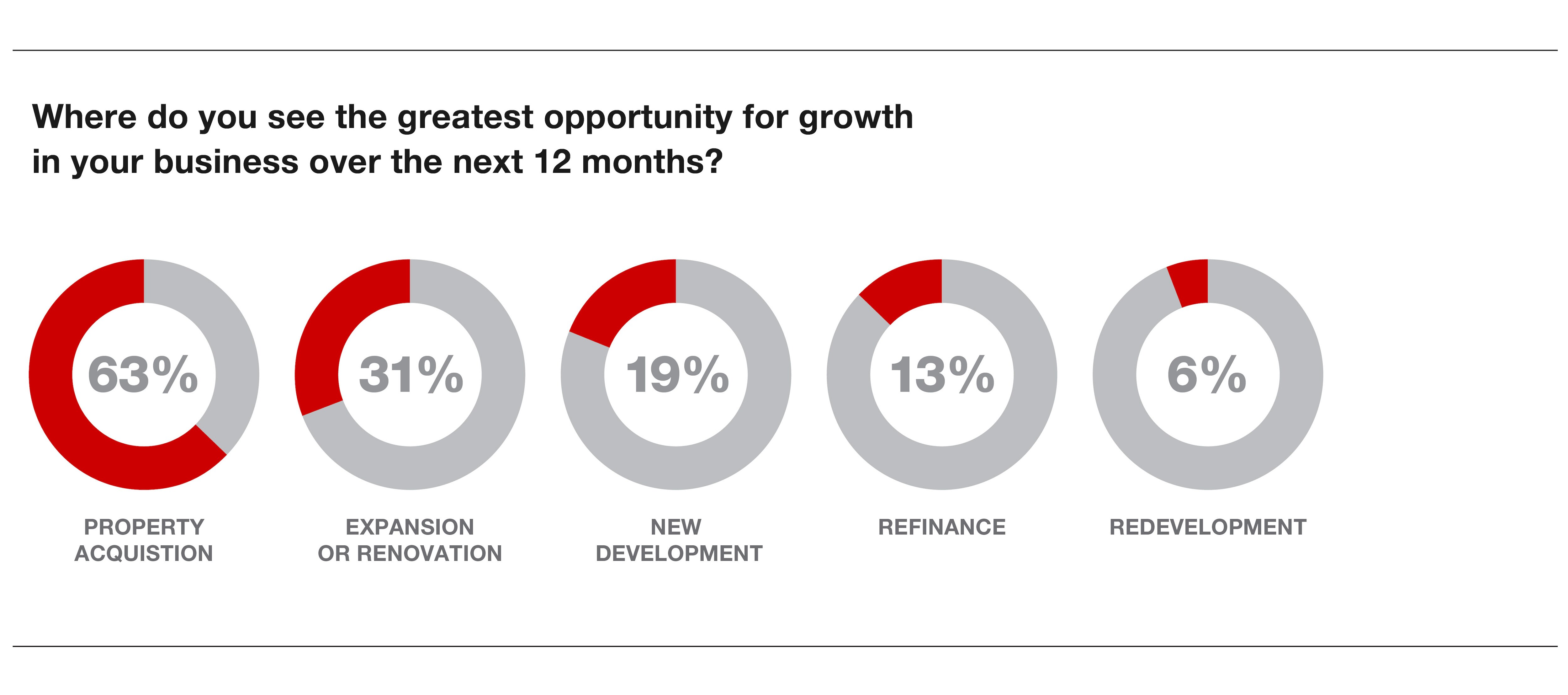

Growth opportunities shift away from new development

Until the refi dust settles and the interest rate outlook becomes clearer, seniors housing leaders appear to be setting aside more substantial new construction and redevelopment projects in favor of achieving growth by acquiring, renovating, or expanding existing structures.

When asked about their greatest opportunities for business growth in the coming year (another question that invited participants to provide more than one answer), property acquisition was the top response, named by 67% of those surveyed, up from 59% last year. Expansion or renovation ranked second, cited by one-third of respondents. Only 13% of respondents reported new development as a focus area for growth in 2024, down from 32% last year.

Where do you see the greatest opportunity for growth in your business over the next 12 months?

Y AXIS X AXIS

None or N/A 0.00%

Property Acquisition 62.50%

Property Disposition 0.00%

New Development 18.75%

Expansion or Renovation 31.25%

Redevelopment 6.25%

Refinance 12.50%

Other (please specify) 0.00%

KeyBank’s team of experts can help achieve your business goals

High interest rates and maturing debt present financial challenges across the commercial real estate spectrum, and seniors housing is no exception. But with the U.S. population getting older each year, demographic trends point to an ongoing need for housing and healthcare facilities that serve older populations, which translates to opportunities for businesses that can effectively serve that demand.

To learn more, contact our seniors housing finance experts, Jim McLaughlin and Matt Ruark, or reach out to your mortgage banker.

For a closer look at our deep expertise, visit key.com/NIC.

About KeyBank Real Estate Capital

KeyBank Real Estate Capital is a leading provider of commercial real estate finance. Its professionals, located across the country, provide a broad range of financing solutions on both a corporate and project basis. The group provides interim and construction financing, permanent mortgages, commercial real estate loan servicing, investment banking and cash management services for virtually all types of income-producing commercial real estate. As a Fannie Mae Delegated Underwriter and Servicer, Freddie Mac Program Plus Seller/Servicer, and FHA-approved mortgagee, KeyBank Real Estate Capital offers a variety of agency financing solutions for multifamily properties, including affordable housing, seniors housing, and student housing. KeyBank Real Estate Capital is also one of the nation’s largest and highest rated commercial mortgage servicers.

This article is designed to provide general information only and is not comprehensive nor is it legal, accounting, or tax advice. All credit products are subject to collateral and/or credit approval, terms, conditions, and availability and subject to change. All rights reserved. Banking products and services are offered by KeyBank N.A.