Pension Plan Sponsors: It May Be Time for a Checkup

KeyBank Institutional Advisors collaboratively engages stakeholders to understand their organizations’ strategic missions, values, and goals. Our advisors are professionals supported by subject matter experts across client disciplines/market segments. Combining our expertise with an understanding of the client, we recommend and implement customized, coordinated financial solutions.

Pension plan sponsors have had a lot to deal with these past few years and continue to monitor their plans’ funded status. During 2022, plans saw a substantial decline in asset values, which were somewhat offset by the impact of significant increases in discount rates.

During 2023, pension discount rates remained relatively flat, while asset performance was generally positive. Discount rates increased further in the fourth quarter of 2024, while asset performance continued to be strong. The following table summarizes recent changes in the FTSE Pension Liability Index, for reference. For comparison, the S&P 500 declined 18.1% during 2022 and had strong positive returns of 26.3% during 2023 and 25% during 2024. In addition, during the first quarter of 2025, while there was no significant changes in discount rates, asset performance was quite challenging and volatile largely due to the uncertainties related to the impact of tariffs on the global economy.

FTSE Pension Liability Index Discount Rate

Bar graph showing following numbers:

- 12/31/2021 - 2.83%

- 12/31/2022 - 5.02%

- 12/31/2023 - 4.83%

- 12/31/2024 - 5.54%

- 3/31/2025 - 5.52%

With all the changes in the markets and anticipated continued volatility, now it continues to be an important time for plan sponsors to review their overall funded status positions and weigh possible changes to their investment strategies. This is particularly important because interest rates are expected to come down over the next few years, which will increase pension plan liabilities. Plan sponsors may also want to explore opportunities to transfer a portion of their pension liabilities to commercial insurance carriers, as pricing for these transactions has shown signs of continued improvement. Continued inflationary pressures as well as the impact of tariffs should be closely monitored.

Liability-Hedging Strategies

With interest rates previously at historic lows, many defined benefit plan sponsors have been hesitant to incorporate liability-hedging strategies. Since there has been a recent substantial increase in interest rates, which has reduced plan liabilities, now may be an optimal time for plan sponsors to reconsider their liability-hedging strategies to manage funded status volatility.

Liability-driven investing (LDI) refocuses management of the plan’s pension assets away from an “asset only” approach and to an approach that considers both the assets and the specific liabilities of the pension plan. LDI seeks to stabilize the funded status by optimizing the performance of assets relative to plan liabilities. This is typically achieved by increasing the plan’s allocation to long-duration bonds to match the interest rate sensitivity of plan liabilities.

LDI already plays an important de-risking role for defined benefit plans that have implemented the strategy. Plan sponsors who have taken time to tactically implement LDI strategies have realized that it is not just about the current level of interest rates. In fact, they realize LDI strategies offer the opportunity to lower funded status risk and should be evaluated regularly. Plan sponsors who have not yet considered LDI should use the current market volatility to take a closer look at the benefits of preserving the economic value of LDI to manage funded asset liability volatility going forward.

Key Steps to Incorporate an LDI Strategy

- Identify the liability to be hedged.

- Quantify an acceptable hedge ratio given the current funding status.

- Establish an appropriate two-way glide path approach that uses funded status as a trigger point to adjust allocation and hedge ratio.

Four Reasons to Consider an LDI Approach

1. Rate hikes don’t affect all yields the same way

- Federal Reserve (Fed) policy has the greatest impact on the front end of the yield curve — bonds with maturities from one to five years.

- In contrast, the long end of the yield curve is more influenced by inflation and economic growth expectations, as well as general flight-to-quality risk concerns.

- Long corporate yields drive pension liability valuations. This means that Fed monetary policy influencing short rates may have less of a direct impact on funded status or de-risking strategies.

2. Even if yields rise, you can still benefit

(if other factors stay the same)

- If long yields and discount rates were to rise, the present value of a plan’s liabilities would decline.

- Assuming your hedge ratio is less than 100% and your return-seeking assets are unchanged, your funded status may increase when yields go up, despite a decline in your long bond asset value.

- When continuing to de-risk, a rise in rates means your funded status improves — just less than it would have if no action had been taken. For many, that is a better approach than maintaining higher levels of interest-rate risk, where being wrong about rates may mean a painful drop in funded status.

3. Market volatility adds risk to your funded status

- As history has shown, long bond yields can fall because of depressed expectations for inflation and growth, or amid a rise in geopolitical risk.

- These same factors can cause the equity market to decline as well, exacerbating a drop in funded status.

- De-risking is a way to reduce the potential impact from this uncertainty, regardless of where rates ultimately go.

4. Market timing is difficult, but de-risking does not have to be

- There is no way to predict yields with 100% certainty. In fact, professional forecasters have consistently predicted higher rates than actually occurred.

- Plan sponsors should stay focused on long-term goals — for many, that means de-risking over time in a methodical and consistent manner.

De-risking a pension plan helps to take market events — and market timing — out of the equation.

Incorporating an LDI Approach

LDI does not require the adoption of a 100% bond allocation in most cases. Incorporating LDI strategies with return-seeking asset (RSA) strategies can reduce plan surplus volatility more than traditional total return strategies, creating a glide path to de-risking the portfolio as the funded status of the plan improves over time. The size of the allocation to LDI strategies is generally a function of the plan’s funded status, where poorly funded plans tend to emphasize RSA more than plans with higher funded ratios.

Outsourced Chief Investment Officer

Complex investment options, costly investment technology, the increasingly global nature of financial markets, constrained budgets — no matter where you turn, the challenges you face as an institutional investor are growing each day. It is no wonder that C-level financial executives, boards of trustees, and investment committees are exploring new ways to achieve their return targets without adding to staff, systems, and operations. For many investors, the answer is an outsourced chief investment officer (OCIO) arrangement. The structure of OCIO solutions will vary depending upon the needs of an institutional investor and the desire to delegate responsibility and discretion.

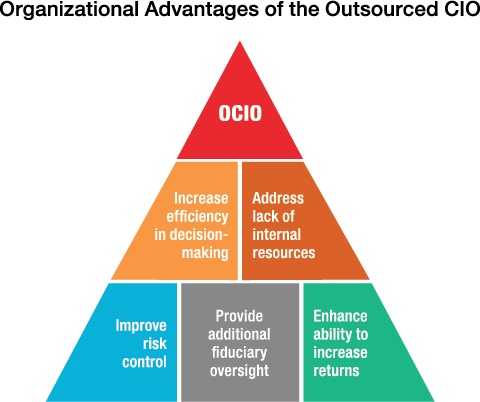

Organizational Advantages of the Outsourced CIO

- OCIO

- Increase efficiency in decision-making

- Address lack of internal resources

- Improve risk control

- Provide additional fiduciary oversight

- Enhance ability to increase returns

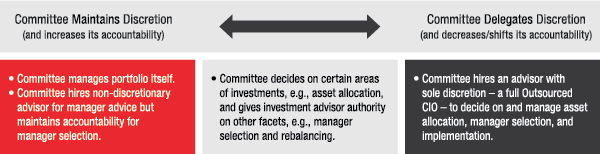

Continuum of Fiduciary Accountability

An investment committee may choose to maintain full discretion over all investment functions and use an external advisor for advice only. In this case, the investment committee retains full accountability as a fiduciary. Alternatively, the investment committee may decide instead to transfer most, but not all, of these functions to an investment advisor, employing a mixed or hybrid OCIO model.

As an example:

- The advisor is responsible for the portfolio’s investment structure and design, manager selection/ monitoring/oversight, asset allocation rebalancing, and implementation of investment decisions.

- The institution retains responsibility and accountability for all other functions, including governance, investment policy statement construction, and maintenance and asset allocation.

Furthest along the OCIO continuum is the full-discretion model, in which the advisor is responsible for all investment decisions, including asset allocation, manager selection/monitoring/oversight, and implementation. In this relationship, the institutional investor shifts the greatest amount of accountability to the investment advisor.

Graphic showing bullet points that span from Committee Maintains Discretion (and increases its accountability)at the top down to Committee Delegates Discretion (and decreases/shifts its accountability) at the bottom.

- Committee manages portfolio itself.

- Committee hires non-discretionary advisor for manager advice but maintains accountability for manager selection.

- Committee decides on certain areas of investments, e.g., asset allocation, and gives investment advisor authority on other facets, e.g., manager selection and rebalancing.

- Committee hires an advisor with sole discretion – a full Outsourced CIO – to decide on and manage asset allocation, manager selection, and implementation.

For more information on these topics and how KeyBank Institutional Advisors can meet your needs, please contact:

Craig Greenwald, National Director, Retirement Solutions

617-385-6208, craig_greenwald@keybank.com

Ken Senvisky, National Director, Institutional Investments, KeyBank Institutional Advisors

216-689-5183, kenneth_f_senvisky@keybank.com

Learn More

See how our insights and expertise can benefit your organization. Visit Institutional Advisors.