Cain Brothers Newsletters: Industry Insights

“Industry Insights” is a bi-weekly email newsletter published by Cain Brothers, a division of KeyBanc Capital Markets. The newsletter features innovative and original perspectives about healthcare services, healthcare IT, and life sciences from our team of experienced investment bankers. Read the latest newsletter content below, and subscribe to start receiving the newsletter in your inbox.

Pharma Services Market Pulse

The pharma services market is showing signs of an improving environment as we approach year-end 2025, with stabilizing biotech dynamics and resilient regulatory activity providing tailwinds for contract research organizations (CROs), contract development and manufacturing organizations (CDMOs), and commercialization specialists. After a volatile start to the year marked by funding constraints, macroeconomic pressures, and regulatory uncertainty out of the FDA and Washington, Q3 rebounds in the key indicators we track suggest renewed momentum in the sector. This shift positions the sector for further growth in 2026, particularly in oncology, rare diseases, and advanced therapies, as biotechs and pharma sponsors prioritize efficient, integrated services amid selective capital allocation.

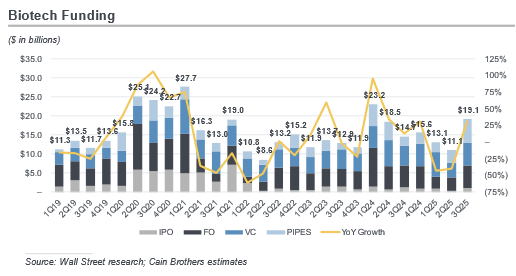

Biotech funding is one of the most important leading indicators for pharma outsourcing businesses like contract CROs and CDMOs, as it provides a near-real-time pulse on the financial health of their customers and the viability of molecules or projects in development. It also provides a lens into the broader pipeline of what will eventually fill the larger funnel of future projects that are set for outsourcing. Quarterly data shows a resurgence in biotech investing, with over $19 billion raised in Q3 2025 alone. This represents 31% year-over-year growth and 73% sequentially. Last quarter’s totals are a near-match in the total that was raised in the first six months of the year. A more favorable and cooperative follow-on market helped drive totals not seen since Q1 of 2024 and before that, the peak of the pandemic investment cycle. A sustained uptick could extend runways for cash-strapped biotechs, boosting service bookings, while highlighting consolidation opportunities in underserved modalities.

Clinical trial starts, another key front-end indicator, surged beyond pre-pandemic levels in 2025, reflecting broadening innovation pipelines and increased sponsor confidence — and, importantly, spending of recently raised funds. Quarterly trial starts have rebounded steadily since bottoming in Q1 2024 and have reached a post 2021-high in Q3 2025 at 1,310, representing over 15% growth year over year and 5% sequentially, with continued concentration in oncology, CNS, and rare diseases. This YTD volume exceeds 3,682 trials, supported by trends like decentralization and continued AI integration for efficiency. As a proxy for CRO demand, trial starts signal the flow of projects requiring outsourced expertise in design, enrollment, and execution; their rebound underscores sector resilience, offering investors visibility into near-term revenue growth for flexible, tech-enabled providers.

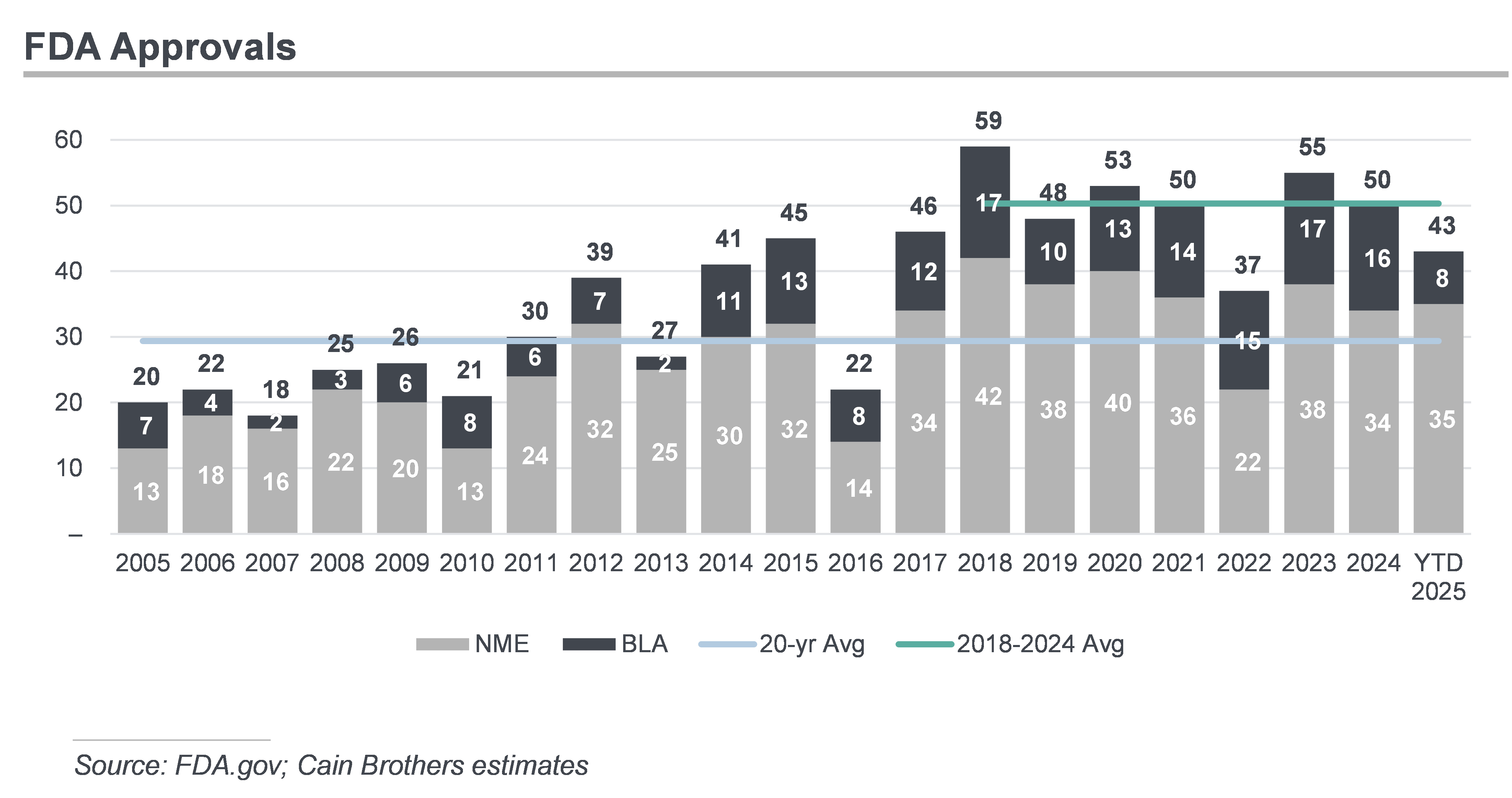

FDA approvals, indicative of commercialization services such as medical communications, pharma marketing, and market access, have held steady in 2025 at 43 novel drugs YTD through November, pacing in line with 2024 levels and averages going back to 2018. This continues the shift set in the mid-2010s, where we saw FDA approvals nearly double from ~30 annually to 50. The mix includes 35 new molecular entities (NMEs) and eight biologics license applications (BLAs), with a focus on oncology breakthroughs and orphan drugs via expedited pathways. The strength this year is notable given uncertainties surrounding RFK Jr.’s role as HHS Secretary, which has led to significant agency restructurings, staff reductions, and leadership changes at the FDA. Approvals remain vital as they validate upstream investments, driving demand for post-approval support in launch strategies and reimbursement; the relative stability amid broader health policy shifts suggests regulatory efficiency persists for assets that demonstrate safety and efficacy. This presents more clarity for pharma commercialization businesses as they make investments and plan for 2026; and, as for investors, there is confidence.

In summary, these indicators collectively forecast a more optimistic outlook for pharma services, with funding and trial rebounds offsetting earlier softness to propel front-end growth, while approvals resiliency through Washington uncertainty bolster commercialization services.

Previous Industry Insights

Archives

See our monthly industry insights below: