KeyBank Real Estate Capital’s dedicated professionals provide servicing, special servicing, and asset management for a wide variety of commercial assets. An independent, third-party service provider, our servicing division has no affiliation to B-piece buyers, brokerage firms, or loan sale companies, so we’re not subject to conflict of interest.

Our Portfolio

Our clients include a broad array of institutions including CMBS issuers and investors, Freddie Mac, Fannie Mae, GNMA and HUD, private and public fund managers, insurance and pension companies, REITs, ABS issuers, bridge/transitional, and construction lenders.

18,200

Assets under management

455+

Servicing Professionals

$438 billion

Portfolio value

as of 12/31/2023

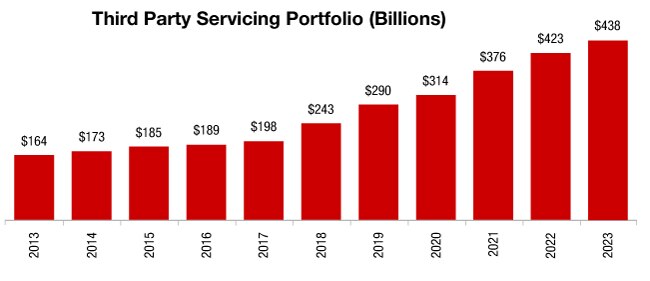

Third Party Servicing Portfolio ($Billions)

- 2013 $164

- 2014 $173

- 2015 $185

- 2016 $189

- 2017 $198

- 2018 $243

- 2019 $290

- 2020 $314

- 2021 $376

- 2022 $423

- 2023 $438