The Great Grid Rush: A frantic scramble for power

At the intersection of business growth, climate change, and unprecedented power demand, the need to revolutionize our power infrastructure has never been more urgent. The KeyBanc Capital Markets Utilities, Power, and Renewables team is at the forefront of this transformation, leveraging decades of sector expertise. In this report, we dive into the current state of electrical load growth, critical resources to meet the demand, and challenges that must be overcome before it’s too late.

Then and now: Power in the U.S.

U.S. electricity consumption has been surprisingly flat for longer than two decades. Over the past few years, however, demand for power dramatically spiked and is now reaching unparalleled, alarming growth.

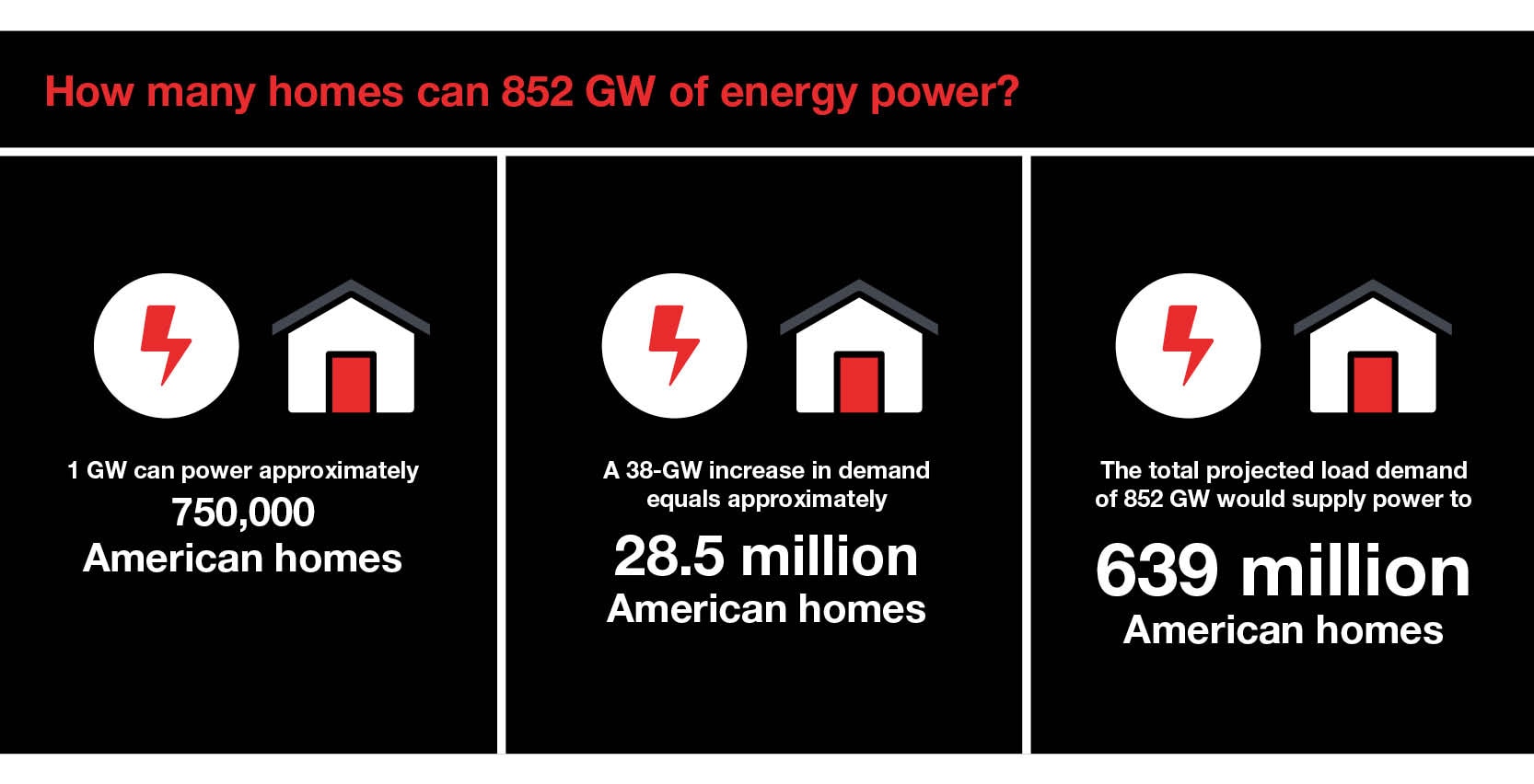

A comprehensive report by Grid Strategies in December 2023 showed the forecast for U.S. electricity demand nearly doubled in one year. The resulting five-year forecast for load demand increased from 835 gigawatts (GW) in 2022 to 852 GW in 2023, indicating a projected 38 GW increase in load demand by 2028.1

CHART 3 – HOW MANY HOMES CAN 852 GW OF ENERGY POWER?

1 GW CAN POWER APPROXIMATELY 750,000 AMERICAN HOMES

A 38-GW INCREASE IN DEMAND EQUALS APPROXIMATELY 28.5 MILLION AMERICAN HOMES

THE TOTAL PROJECTED LOAD DEMAND OF 852 GW WOULD SUPPLY POWER TO 639 MILLION AMERICAN HOMES

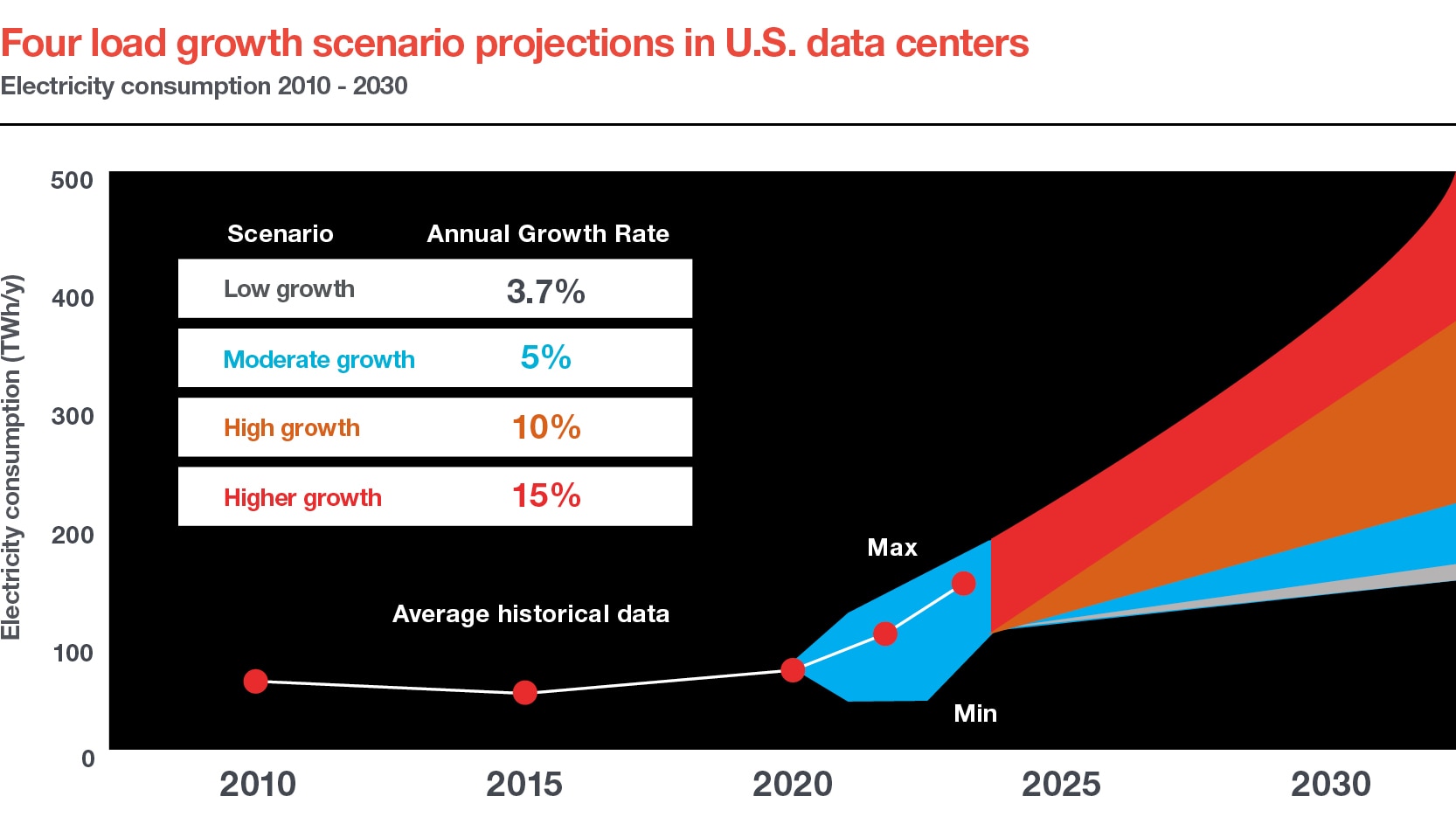

Based on public information about data centers, public estimates of industry growth and recent electricity demand forecasts, experts prepared four growth scenarios illustrated below.2

CHART 1 – FOUR LOAD GROWTH SCENARIO PROJECTIONS IN US DATA CENTERS

ELECTRICITY CONSUMPTIOIN 2010 -2030

SCENARIO |

ANNUAL GROWTH RATE |

LOW GROWTH |

3.7% |

MODERATE GROWTH |

5% |

HIGH GROWTH |

10% |

HIGHER GROWTH |

15% |

Source: NERC, 2022 Long-Term Reliability Assessment (2022)

Given the broader trends of rising electricity demand and constrained capacity, the U.S. will need to add approximately 250 (terawatts) of generation to meet the projected data center demand growth by the end of the decade.

Sophie Karp, Managing Director, Senior Analyst, Electric Utilities & Alternative Energy, KeyBanc Capital Markets

What’s driving the increase? Three key culprits

As cutting-edge technologies and U.S. policies spark continued innovation, the manufacturing, industrial, and data center sectors are requiring vast amounts of energy to operate efficiently. As a result, the demand for electricity is soaring. In stark contrast, as the aging fleet of coal and natural gas plants is being retired, the gap between energy supply and demand continues to grow. This juxtaposition highlights the tension between the burgeoning energy needs of modern technology and the decline of older, less clean power sources. A closer look at each source helps illustrate the conundrum of these disparate sources of historical grid pressure.

1. Industrial and manufacturing expansion

As U.S. policy incentives create a surge in manufacturing, new and upgraded domestic industrial facilities are emerging at a fast pace. Over 200 new manufacturing facilities were announced in the past year alone.3 Manufacturing-related construction spending grew by 32% year over year in February 2024 — a staggering 181% versus pre-pandemic levels.4 The increase in construction is driving greater demand for the underlying electrical equipment, combined with increased power consumption needed to support these new facilities.

Simultaneously, the retooling of existing industrial and manufacturing facilities has spurred a new wave of retrofitting automated machinery. This modernization effort is leading to increased power needed to support advanced technologies and automation, further contributing to overall load growth.

2. Data centers and GenAI

More alarming is the spiraling load growth created by data centers, with significant expansion commitments totaling more than $150 billion.5 Per Goldman Sachs Global Investment Research, data centers are expected to account for 8% of total load demand by 2030, up from 3% now. This necessitates an estimated 47 GW of capacity to support U.S. data center load demand growth through 2030.6 As the fast-growing generative artificial intelligence (GenAI) race continues to gain footing across the U.S., data center load growth is only forecast to increase.

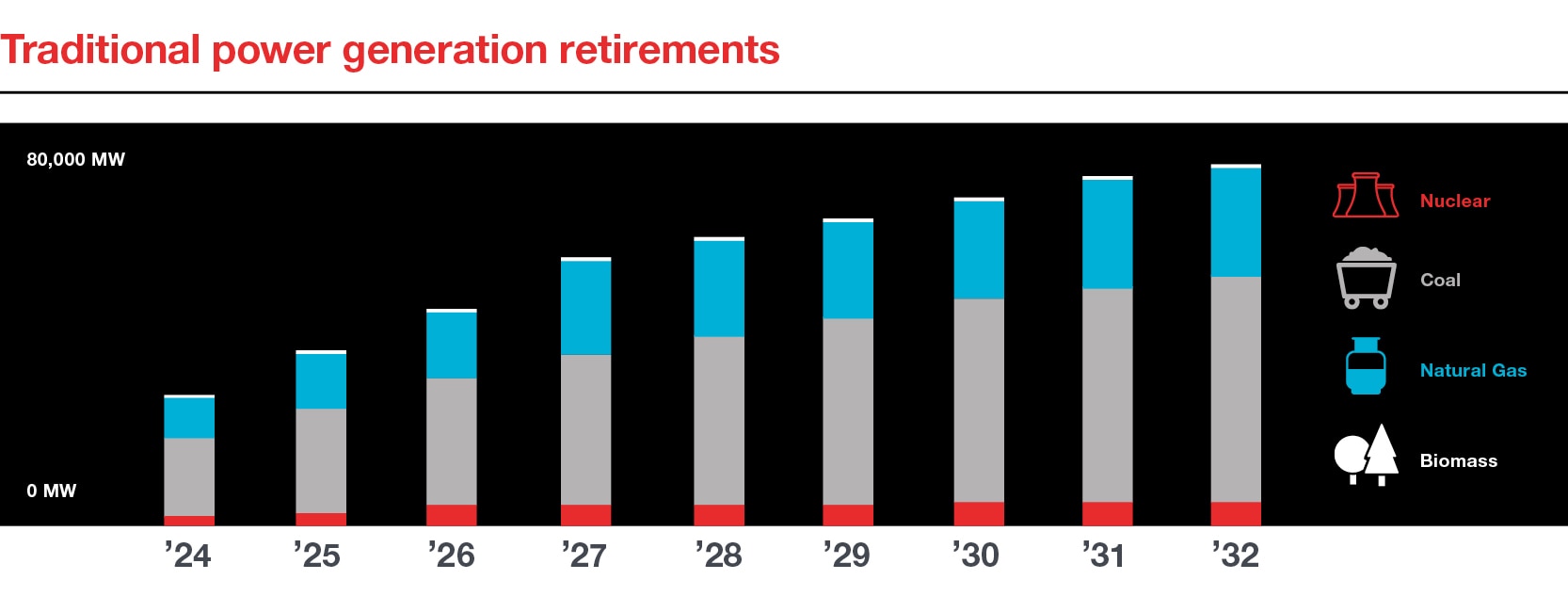

3. The retirement of traditional power generation sources

The collective increases in load demand coincide with rising power generation retirements resulting from environmental stewardship and natural attrition. The primary sources of these retirements include coal and natural gas plants, followed by nuclear and biomass power generation. As load demand from all sources continues to increase, these retirements pose additional challenges for maintaining grid reliability at a time when their capacity contribution is needed most.

GRAPH 2 - Traditional power generation retirements

Source: NERC, 2022 Long-Term Reliability Assessment (2022)

Resources to tackle the energy boom

Fortunately, there are a range of power generation resources — existing and planned — to help meet load demand growth through 2030. Two key areas of focus are the renewables industry and the grid infrastructure nationwide.

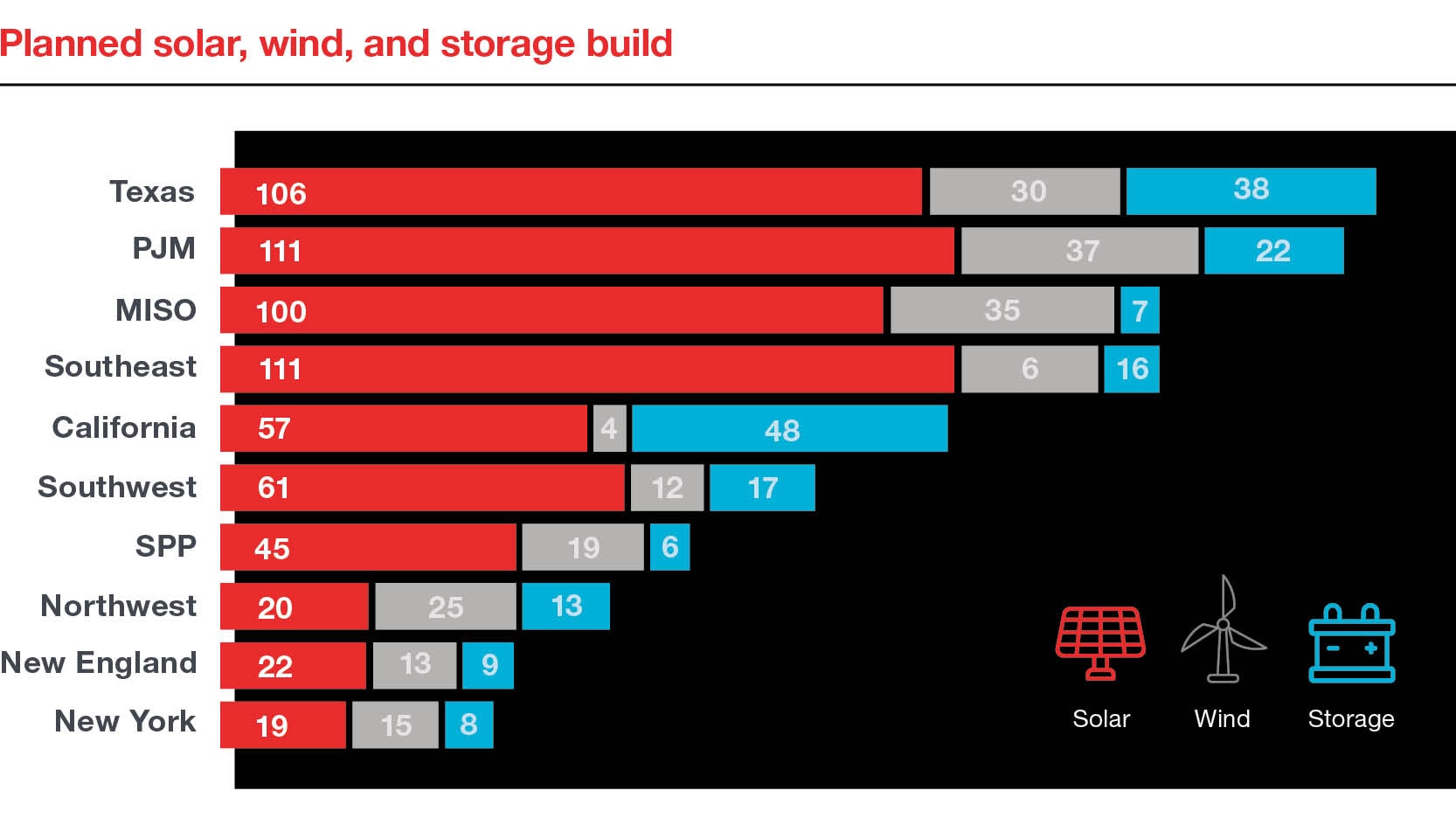

Renewables: Solar, wind, and storage capacity

BloombergNEF estimates that between 2024 and 2035, the U.S. grid will add approximately 1 terawatt (TW) of new solar and wind capacity, along with around 221 GW of battery storage capacity.7 To give this some perspective, New York City consumes approximately 11,000 megawatt hours a day. The upcoming 1.22 TW of additional capacity could power NYC for just over seven years. Even with planned power plant retirements, this surge will boost U.S. power generation capacity by 80% by 2035.

CHART 4 – PLANNED SOLAR, WIND, AND STORAGE BUILD

TEXAS

SOLAR - 106

WIND - 30

STORAGE - 38

PJM

SOLAR - 111

WIND - 37

STORAGE - 22

MISO

SOLAR - 100

WIND - 35

STORAGE - 7

SOUTHEAST

SOLAR - 111

WIND - 6

STORAGE - 16

CALIFORNIA

SOLAR - 57

WIND - 4

STORAGE - 48

SOUTHWEST

SOLAR - 61

WIND - 12

STORAGE - 17

SPP

SOLAR - 45

WIND - 19

STORAGE - 6

NORTHWEST

SOLAR - 20

WIND - 25

STORAGE - 13

NEW ENGLAND

SOLAR - 22

WIND - 13

STORAGE - 9

NEW YORK

SOLAR - 19

WIND - 15

STORAGE - 8

Source: BloombergNEF

Grid infrastructure and transmission upgrades

Threading together currently separate regional energy networks to allow energy sharing during extreme weather events and peak energy demand is paramount to improve grid reliability.

Utilities and regional transmission organizations (RTOs) are investing heavily in expanding the grid and upgrading grid infrastructure to meet rising demand. A major focus is on building new transmission connections among regions to enable power sharing during peak periods. The North American Electric Reliability Corporation (NERC) forecasts this will lead to substantial transmission line growth.8 This expansion is essential for transporting renewable energy from generation sites to consumption areas, underscoring the importance of high-capacity voltage lines in supporting grid stability.

Capital investment to meet load growth

Of course, all these resources to address load growth come with an ever-increasing demand for investment. Capital investment in the clean energy supply chain, including clean-tech factories and metal mines/refineries, is critical. Combined spending in this space rose to $135 billion in 2023, with an expected increase of 66% in 2024.9 In addition to 200 planned industrial and manufacturing facilities, these industries have collectively reported approximately $481 billion in spend commitments.10 As the generative AI race deepens load demand across the U.S., a projected $50 billion in necessary capital investment will be needed to support data center load demand through 2030.11

Inflation Reduction Act (IRA) contributions

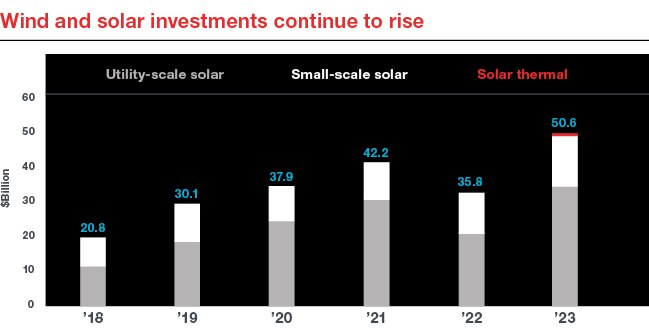

The Inflation Reduction Act of 2022 plays a crucial role in supporting rising electricity demand through its incentives and support for renewable energy projects. As key components of the IRA continue to be implemented in 2024 and beyond, and the industry continues to mature, investment in this sector will continue to grow. By offering significant tax credits for wind, solar and storage initiatives, the IRA makes it easier for developers to invest in and implement renewable energy projects. The following chart shows considerable increase in wind and solar investments the same year the IRA was passed into law.

CHART 5 – WIND AND SOLAR INVESTMENTS CONTINUE TO RISE

’18 – 20.8 Billion

’19 – 30.1 Billion

’20 – 37.9 Billion

’21 – 42.2 Billion

’22 – 35.8 Billion

’23 – 50.6 Billion

Source: BloombergNEF

Renewable energy industry growth is undeniable as developers, investors, and the broader market increasingly leverage the IRA’s tools to create economically viable projects that help alleviate the load growth crisis. For example, the IRA’s transferability feature has gained significant popularity over the past year. This feature enables project developers to sell their tax credits to other entities, increasing the liquidity of renewable energy projects and making them more attractive to developers and investors.

We see tremendous investment opportunities in the renewable energy sector. This will be fueled by stimulus from the Inflation Reduction Act as well as by significant power demand growth from GenAI compute.

Randy Paine, Head of KeyBanc Capital Markets and Key Institutional Bank

U.S. utility grid infrastructure investments

Utilities are investing heavily in grid upgrades to support the growing renewable energy load and to ensure the infrastructure can handle rising demand while maintaining reliability. For instance, the Edison Electric Institute (EEI) has outlined historical and anticipated capital expenditures for U.S. utilities through 2025 specifically designated to upgrade grid infrastructure. Additionally, protections for that $35 trillion investment in transmissions will be needed by 2030.12 These investments are crucial to facilitate necessary electrification, maintaining the grid and integrating renewable integration sources. Furthermore, to advance the North American Electric Reliability Corp.’s (NERC’s) mission of ensuring a reliable and secure North American bulk power system, NERC has developed a strategic three-year plan with an average annual budget increase of 11.4%.13

Major load growth logjams

Despite the healthy investment appetite from myriad sources to meet the upward spiral of demand, the industry faces several challenges. Extreme weather events, rising input costs, application backlogs, and interconnection delays and expenses are significant headwinds today, and are expected to continue for some time.

Permitting and interconnection bottlenecks

Building new generation assets takes time. Power generation development is a complex process that requires site selection and acquisition, environmental impact studies, multistep permitting, equipment acquisition, and engineering and construction.

While wind and solar projects are typically the easiest and fastest to execute, natural gas plants take longer to obtain permits and involve equipment that may need to be ordered several years in advance. Nuclear developments take the longest time to implement because of complexities in designing, permitting, and building a nuclear facility. The most recently commissioned nuclear power plant took more than 10 years to complete, and no new projects are underway. Instead, new plans to revive sites such as Three Mile Island14 are emerging as a faster way to meet massive energy needs, including for Microsoft.

Across the seven U.S. Independent System Operators (ISOs), only 11% of wind, solar, and battery storage grid capacity applications have been permitted as of January 2024. And, among the large influx of projects in recent years, most of them have been built and awaiting grid interconnection for three years.

It will take time. The increase in load will lead to greater sales rates, higher investments, and higher earnings growth, but we believe it will take several years for regulated utilities to get comfortable with the durability of this trend and work through regulatory implications.

Sophie Karp, Managing Director, Senior Analyst, Electric Utilities & Alternative Energy, KeyBanc Capital Markets

Ironically, states with the greatest density and demand tend to be the last to get online. California and New York, for instance, have the lowest chances of securing an interconnection permit — exacerbating the growing disconnect between supply and demand in regions where load demand is highest and continues to grow.

Combined with rising interconnection costs, grid blocks are many and complicated, putting downward pressure on project economics.

Electrical equipment backlog more than doubles

The delivery time for transformers has increased to approximately 120 weeks, up from around 50 weeks in 2021. Large transformers, substation power, and generator step-up (GSU) transformers now have lead times ranging from 80 to 210 weeks.15

Pricing increases

Despite global price declines from oversupply, potential new import tariffs on solar cells from Southeast Asia and batteries from China might keep U.S. equipment costs high. Transformer prices have risen 60%–80% since 2020, with continued increases expected. Commodity prices for raw materials, such as grain-oriented electrical steel (GOES) and copper, have also seen significant rises.16

Mining for miracles

In sum, ever-advancing technologies and the means to deploy them create a power paradox. From manufacturing to power-hungry generative AI data centers, the resulting load growth and current grid infrastructure are under incredible strain.

While enough new generation capacity is being built to meet energy needs through the end of the decade, significant investment is needed now to ensure our grid can accommodate growing electricity demand.

As a leading lender and advisor in the renewable energy market for more than two decades, KeyBanc Capital Markets is poised to move with the trend over time. Energy is a very capital-intensive industry. Key has the expertise to support a diverse mix of solutions to help build a clean, reliable, and affordable energy grid.

Learn more about our industry-leading renewable energy practice

To speak to an expert, contact Andy Redinger, Managing Director and Head of Utility, Power and Renewable Energy, KeyBanc Capital Markets

Explore our recent deals and visit key.com/energy to discover how we can help you stay ahead of energy trends.