Public SaaS Company Reporting Metrics

Explore the only publicly available reporting metrics from some of the world’s most successful public SaaS businesses.

Key Metrics

Working with our SaaS IPO clients, the KeyBanc Capital Markets technology group has compiled a comprehensive database of publicly reported SaaS metrics. We’ve captured key metrics for retention and renewal rates, including company definitions, our interpretation of those definitions, and the value stated by each company at the time of IPO.

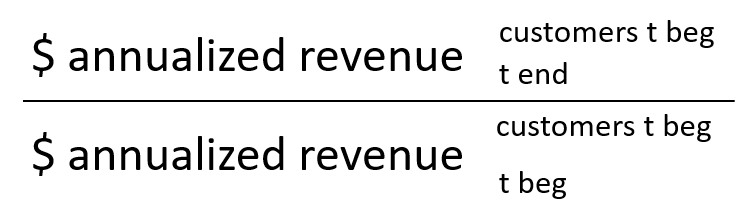

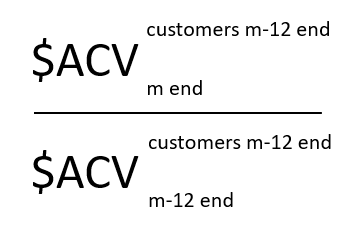

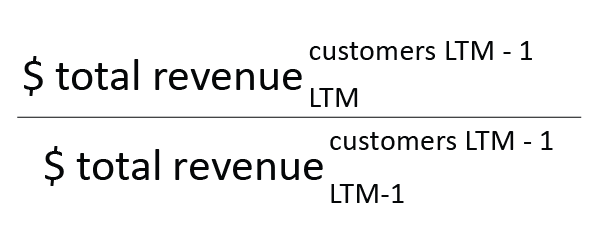

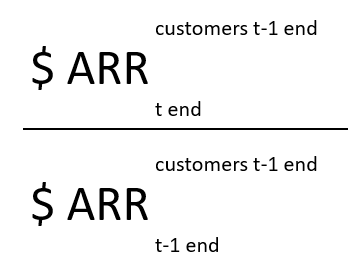

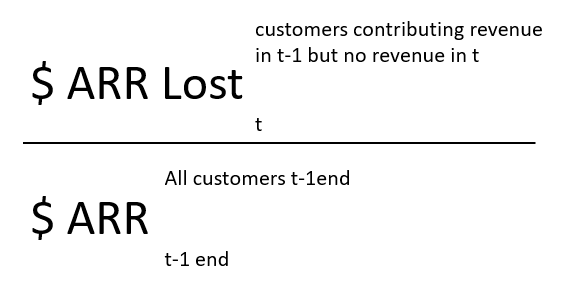

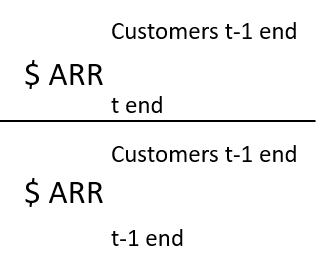

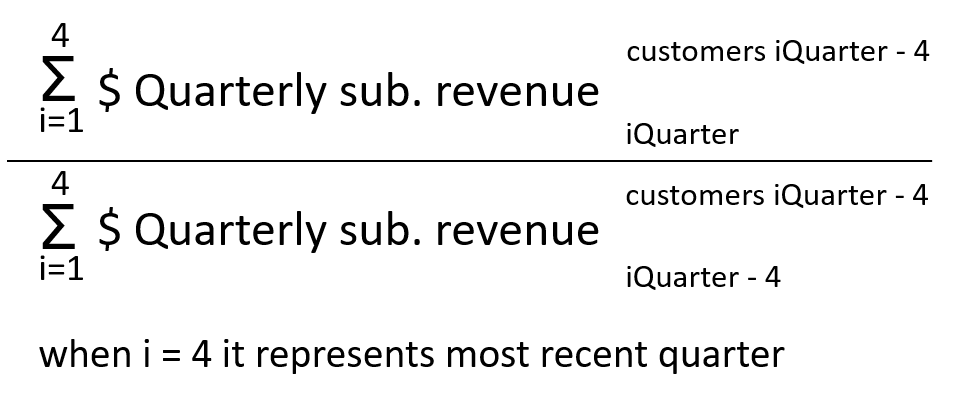

Through the data, you’ll see that some companies focus on customer count, while others reflect changes in dollar value of recurring revenue (ARR or GAAP) from existing customers. Some report gross churn, reflecting only the lost business, while others report net retention/expansion, offsetting losses with the benefit of upsells and expansions.

Request our most up-to-date public metrics.

For the latest data, email Scott Peterson, Managing Director, Software Investment Banking.

SaaS Data

SaaS Company Renewal/Retention Rates Detail

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Platform revenue retention rate |  |

144.4% | Dollar-based retention including the benefits of upsells, based on GAAP platform revenue "We measure our platform revenue retention rate for a particular period by first identifying the group of programs that our clients launched before the beginning of the prior year comparative period. We then calculate our platform revenue retention rate by comparing the revenue we recognized for this group of programs in the reporting period to the revenue we recognized for the same group of programs in the prior year comparative period, expressed as a percentage of the revenue we recognized for the group in the prior year comparative period." ( 424B4 filed on 3/27/14, Page 53 ) |

|

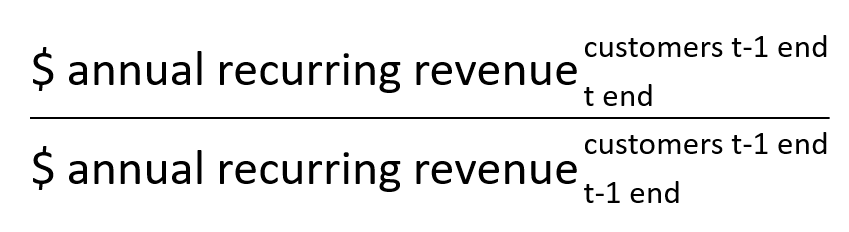

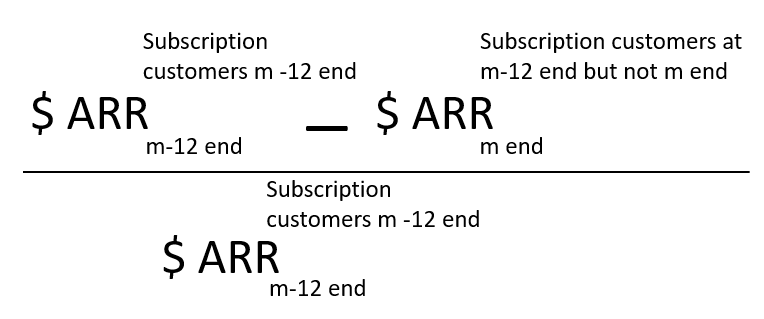

Dollar-based Net Retention Rate |  |

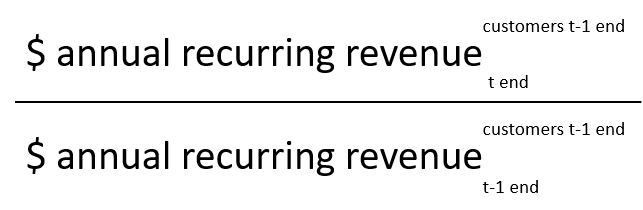

98% | Dollar-based retention including the benefit of upsells, based on annual recurring revenue "We calculate dollar-based net retention rate as (x) the annual recurring revenues under contract at the end of a period for the base set of customers from the year prior to the calculation divided by (y) the annual recurring revenues under contract one year prior to the date of calculation for that same customer base. We define annual recurring revenues under contract as the total amount of subscription revenues contractually committed to under each of our customer agreements over the term of the agreement, divided by the number of years in the term of the agreement." (S-1 filed on 6/1/18, Page 59) |

|

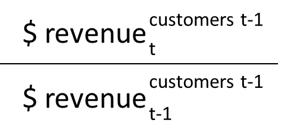

Dollar-Based Net Expansion Rate |  |

127% | Dollar-based retention rate including the benefits of upsells, based on revenue "Our Dollar-Based Net Expansion Rate increases when our customers increase usage of a product, extend usage of a product to new applications or adopt a new product. Our Dollar-Based Net Expansion Rate measures our ability to increase revenue generated from our existing customer base. To calculate Dollar-Based Net Expansion Rate for a given year, we first identify all customers in the prior year, then calculate the quotient from dividing the revenue generated from such customers in the given year by the revenue generated from the same group of customers in the prior year. We calculate our Dollar-Based Net Expansion Rate on a year-over-year basis because our revenue is subject to fluctuations from quarter to quarter." (424B4 filed on 6/26/20, Page 89) |

|

SaaS & license revenue renewal rate |  |

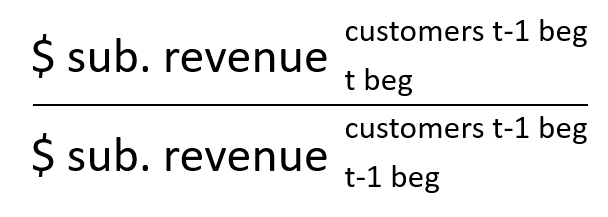

92% | Dollar-based renewal excluding the benefit of upsells, based on SaaS and license revenue "We measure our SaaS and license revenue renewal rate on a trailing 12-month basis by dividing (a) the total SaaS and license revenue recognized during the trailing 12-month period from our subscribers who were subscribers on the first day of the period, by (b) total SaaS and license revenue we would have recognized during the period from those same subscribers assuming no terminations, or service level upgrades or downgrades.' (424B4 filed on 6/26/15, Page 60 |

|

Dollar-Based Net Revenue Retention Rate |  |

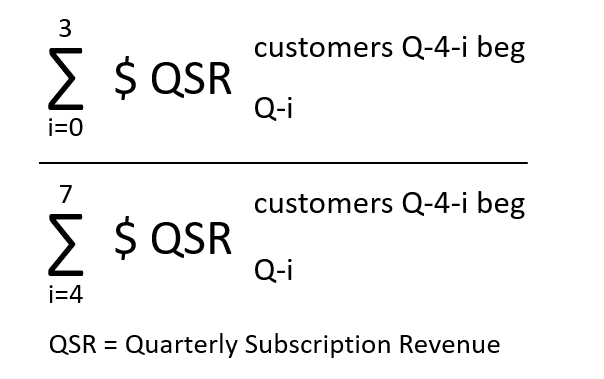

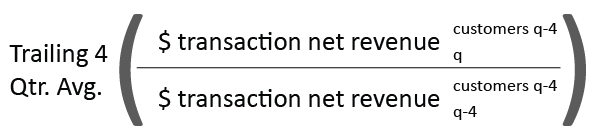

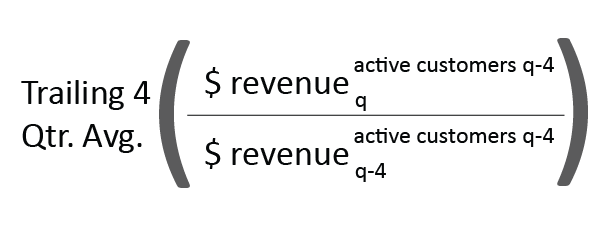

135% | Dollar-based net revenue retention rate, based on subscription revenue “Our dollar-based net revenue retention rate is a trailing four-quarter average of the subscription revenue from a cohort of customers in a quarter as compared to the same quarter in the prior year. To calculate our dollar-based net revenue retention rate, we first identify a cohort of customers, or the Base Customers, in a particular quarter, or the Base Quarter. A customer will not be considered a Base Customer unless such customer has an active subscription for the entirety of the Base Quarter. We then divide the revenue in the same quarter of the subsequent year attributable to the Base Customers, or the Comparison Quarter, including Base Customers from which we no longer derive revenue in the Comparison Quarter, by the revenue attributable to that Base Customers in the Base Quarter. Our dollar-based net revenue retention rate in a particular quarter is then obtained by averaging the result from that particular quarter by the corresponding result from each of the prior three quarters. The dollar-based net revenue retention rate excludes revenue from professional services from that cohort. (424B4 filed on 3/24/17, Page 62) |

|

Recurring revenue retention rate |  |

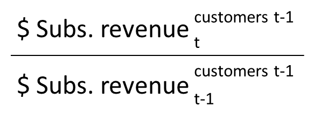

102% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "We calculate our recurring revenue retention rate by comparing, for a given quarter, subscription revenue for all customers in the corresponding quarter of the prior year to the subscription revenue from those same customers in the given quarter. For the annual rate, we utilize the average of the four quarters for the stated year." (424B4 filed on 3/20/14, Page 41) |

|

Dollar-Based Net Expansion Rate |  |

123% | Dollar-based expansion rate including the benefit of upsells, based on annual recurring revenue "Our dollar-based net expansion rate equals: the annual recurring revenue at the end of a period for a base set of customers from which we generated annual recurring revenue in the year prior to the date of calculation, divided by the annual recurring revenue one year prior to the date of the calculation for that same set of customers. Annual recurring revenue is calculated as subscription revenue already booked and in backlog that will be recorded over the next 12 months, assuming any contract expiring in those 12 months is renewed and continues on its existing terms and at its prevailing rate of utilization." (424B4 filed on 10/11/18, Page 67) |

|

Dollar-based net expansion rate |  |

133% Property Mgmt 100% Legal |

Dollar-based expansion rate including the benefits of upsells, based on GAAP revenue "Our ability to maintain and grow relationships with our existing customers can be measured by our annual dollar-based net expansion rate for a given fiscal year, which compares the revenue generated from the sale of our core solutions and Value+ services in that year and the preceding year (or base year) from our base customers. We establish our base customers by determining the customers from which we generated revenues during the month of December in the year preceding the base year. We then calculate our annual dollar-based net expansion rate for a given fiscal year by dividing (i) revenue generated from the sale of our core solutions and Value+ services in the given fiscal year from our base customers by (ii) revenue generated from the sale of our core solutions and Value+ services in the base year from our base customers. As of December 31, 2014, our annual dollar-based net expansion rate was 133% for our property manager customers and 100% for our law firm customers." (424B4 filed on 6/26/15, Page 55) |

|

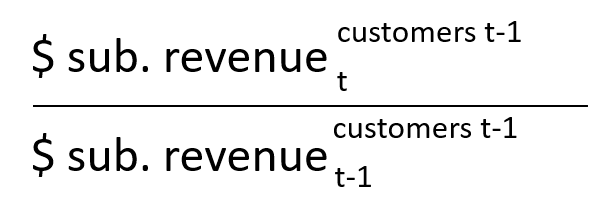

Subscription Revenue Retention Rate |  |

133% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue “A key factor to our success is the renewal and expansion of subscription agreements with our existing customers. We calculate this metric over a set of customers who have been with us for at least one full year. To calculate our subscription revenue retention rate for a particular trailing 12-month period, we first establish the recurring subscription revenue for the previous trailing 12-month period. This effectively represents recurring dollars that we should expect in the current trailing 12-month period from the cohort of customers from the previous trailing 12-month period without any expansion or contraction. We subsequently measure the recurring subscription revenue in the current trailing 12-month period from the cohort of customers from the previous trailing 12-month period. Subscription revenue retention rate is then calculated by dividing the aggregate recurring subscription revenue in the current trailing 12-month period by the previous trailing 12-month period.” (424B4 filed on 5/26/2017, Page 62) |

|

Net subscription dollar retention rate |  |

~100% | Dollar-based retention rate including the benefit of upsells, based on annual contract value "We believe that our net subscription dollar retention rate provides insight into our ability to retain and increase revenue from our customers, as well as their potential long-term value to us. Accordingly, we compare the aggregate annual contract value of our customer base at the end of the prior year, which we refer to as the base annual contract value, to the aggregate annual contract value from the same group of customers at the end of the current year, which we refer to as the retained annual contract value. We calculate our net subscription dollar retention rate on an annual basis by dividing the retained annual contract value by the base annual contract value." (424B4 filed on 9/23/2016, Page 58-59) |

|

Dollar-Based Net Retention Rate |  |

127% | Dollar-based retention rate including the benefit of upsells, based on annual contract value “Our dollar-based net retention rate compares the recurring contract value from the same set of customers across comparable periods. Given the repeat buying pattern of our customers and the average term of our contracts, we measure this metric over a set of customers who have been with us for at least one full year. To calculate our dollar-based net retention rate for a particular trailing 12-month period, we first establish the recurring contract value for the previous trailing 12-month period. This effectively represents recurring dollars that we should expect in the current trailing 12-month period from the cohort of customers from the previous trailing 12-month period without any expansion or contraction. We subsequently measure the recurring contract value in the current trailing 12-month period from the cohort of customers from the previous trailing 12-month period. Dollar-based net retention rate is then calculated by dividing the aggregate recurring contract value in the current trailing 12-month period by the previous trailing 12-month period. Recurring contracts are time-based arrangements for subscriptions and do not include perpetual license or professional services arrangements.” (S-1/A filed on 1/24/17, Page 14) |

|

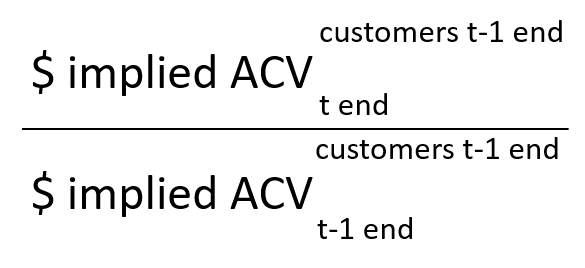

Contract renewal rate |  |

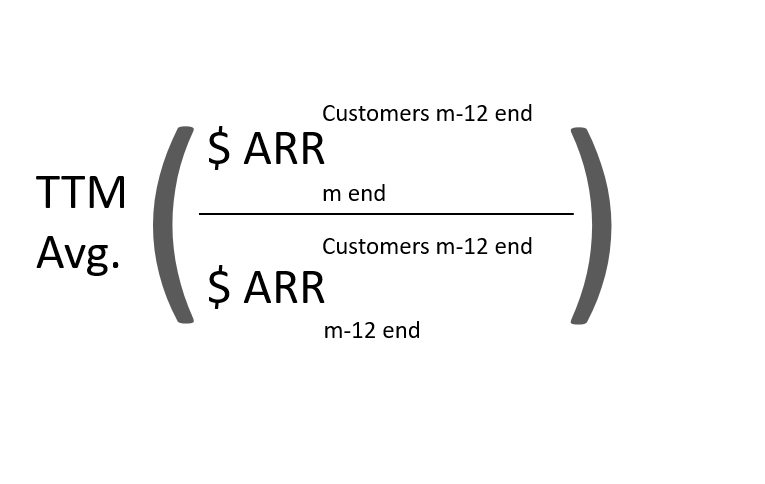

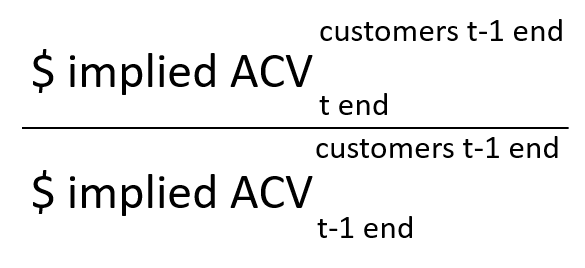

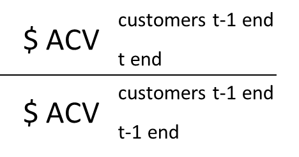

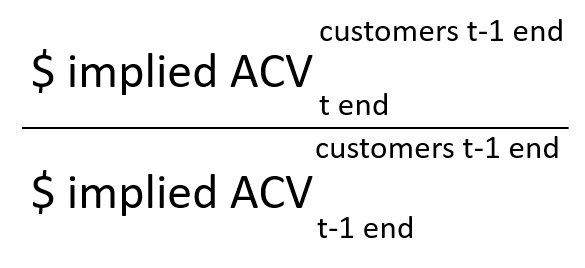

97% | Dollar-based renewal rate including the benefit of upsells, based on ACV "We have experienced a contract renewal rate of at least 97% in each of the last five years." (424B4 filed on 9/19/07) "This rate reflects the implied annualized contract value of the customers at period end who were also customers at the end of the prior period, divided by the implied annualized contract value of the customers at the end of the prior period." (athenahealth Investor Relations) |

|

Net expansion rate |  |

>100% | Dollar-based renewal rate including the benefit of upsells, based on ACV "Such expansion is measured by our average quarterly net expansion rate, which calculates the year-over-year change in quarterly spending by customers that were paying customers during the same quarter in the prior year ("Prior Year Cohorts"), which is net of lost customers or reduced usage within a customer. Our average quarterly net expansion rate has been more than 100% for each quarter during fiscal 2014 and fiscal 2015." (424B4 filed on 12/10/15, Page 63-64) |

|

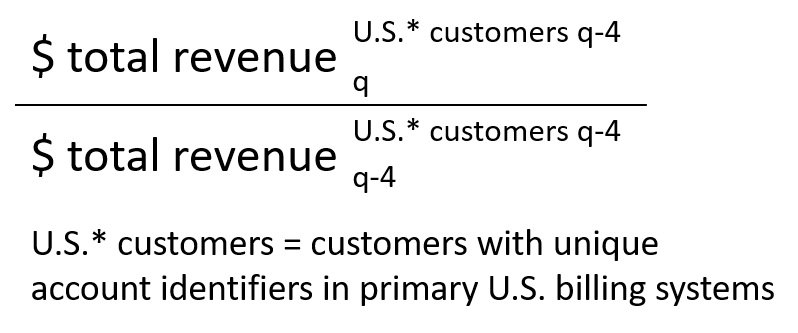

Net Revenue Retention Rate |  |

107%* | Dollar-based expansion rate including the benefit of upsells, based on annual recurring revenue "We calculate our net revenue retention rate by dividing (a) total revenue in the current quarter from any billing accounts that generated revenue during the corresponding quarter of the prior year by (b) total revenue in such corresponding quarter from those same billing accounts. This calculation includes changes for these billing accounts, such as additional solutions purchased, changes in pricing and transaction volume, and terminations, but does not reflect revenue for new billing accounts added during the one year period. Currently, our net revenue retention rate calculation includes only customers with unique account identifiers in our primary U.S. billing systems and does not include customers who subscribe to our solutions through our international subsidiaries or certain legacy billing systems, primarily related to past acquisitions." (424B4 filed on 6/15/2018, Page 56) |

|

Revenue Churn Rate |  |

<5% | Dollar-based churn, based on total revenue "We calculate our revenue churn rate by measuring the revenue contribution associated with billing accounts that cancel all of their product and service agreements with us over the measurement year. This cancelled revenue contribution for each such billing account is calculated as the revenue recognized for such billing accounts over the trailing four quarters prior to the quarter in which such billing account cancelled its product and service agreements. We then divide this cancelled revenue contribution by our total annual revenue recognized for the measurement year to calculate our revenue churn rate. Our calculation of revenue churn rate includes only customers with unique account identifiers in our primary U.S. billing systems and does not include customers who subscribe to our solutions through our international subsidiaries or legacy billing systems, primarily related to past acquisitions." (424B4 filed on 6/15/2018, Page 53) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based Net Retention Rate |  |

107% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "Our dollar-based net retention rate compares the CPaaS revenue from customers in a quarter to the same quarter in the prior year. To calculate the dollar-based net retention rate, we first identify the cohort of customers that generate CPaaS revenue and that were customers in the same quarter of the prior year. The dollar-based net retention rate is obtained by dividing the CPaaS revenue generated from that cohort in a quarter, by the CPaaS revenue generated from that same cohort in the corresponding quarter in the prior year. When we calculate dollar-based net retention rate for periods longer than one quarter, we use the average of the quarterly dollar-based net retention rates for the quarters in such period." ( 424B1 filed on 11/13/17, Page 17 ) |

|

Active client retention rate |  |

89.7% | Customer count-based retention excluding the benefit of new customers " "Active client retention rate is calculated based on the number of active clients at period end that were also active clients at the start of the period divided by the number of active clients at the start of the period." (." (424B4 filed on 2/24/12, Page 45) |

|

Software services revenue retention rate |  |

<92% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "We calculate this metric for a particular period by establishing the group of our customers that had active contracts for a given period. We then calculate our software services revenue retention rate by taking the amount of software services revenue we recognized for this group in the subsequent comparable period (for which we are reporting the rate) and dividing it by the software services revenue we recognized for the group in the prior period." (424B4 filed on 9/18/13 Page 53) |

|

Net Revenue Retention |  For accounts greater than $2K ACV |

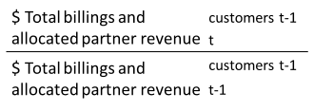

106% | Dollar-based retention rate including the benefits of upsells, based on total billings and allocated partner revenue "The total billings and allocated partner revenue for the measured period are divided by the total billings and allocated partner revenue for such accounts, corresponding period one year prior. An NRR greater than 100% implies positive net revenue retention. This methodology includes stores added to or subtracted from an account’s subscription during the previous twelve months. It also includes changes to subscription and partner and services revenue billings, and revenue reductions from stores or accounts that leave the platform during the previous one year period. Net new accounts added after the previous one year period are excluded in our NRR calculations." (S-1/A filed on 7/28/20, page 73) |

|

Net Dollar-Based Retention Rate |   |

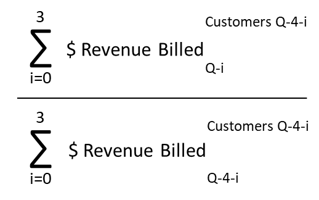

110% | Dollar-based retention including the benefit of upsells, based on billed revenue "We calculate our net dollar-based retention rate by starting with the revenue billed to customers in the last quarter of the prior fiscal year (Prior Period Revenue). We then calculate the revenue billed to these same customers in the last quarter of the current fiscal year (Current Period Revenue). Current Period Revenue includes any upsells and is net of contraction or attrition, but excludes revenue from new customers and excludes interest earned on customer funds held in trust. We then repeat the calculation of Prior Period Revenue and Current Period Revenue with respect to each of the preceding three quarters, and aggregate the four Prior Period Revenues (the Aggregate Prior Period Revenue) and the four Current Period Revenues (the Aggregate Current Period Revenue). Our net dollar-based retention rate equals the Aggregate Current Period Revenue divided by Aggregate Prior Period Revenue." ((424B4 filed on 12/12/19, Page 67) |

|

Customer Retention Rate |   |

82% | Customer count-based retention excluding the benefit of new customers "Excluding those from our financial institution partners, over 82% of customers as of June 30, 2018 were still customers as of June 30, 2019." ((424B4 filed on 12/12/19, Page 67) |

|

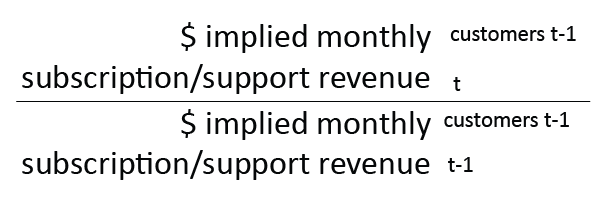

Dollar-based net revenue retention rate |  Note: Implied monthly subscription and support revenue is defined as the total amount of minimum subscription and support revenue committed to agreements divided by the number of months in the agreement |

119% | Dollar-based net revenue retention rate including the benefit of upsells, based on contracted MRR “We calculate dollar-based net revenue retention rate as the implied monthly subscription and support revenue at the end of a period for the base set of customers from which we generated subscription revenue in the year prior to the calculation, divided by the implied monthly subscription and support revenue one year prior to the date of calculation for that same customer base. (424B4 filed on 10/28/16 Page 16) |

|

Retention rate (net dollar retention rate) |  Note: Includes only customers with >$5k ACV and annual / multi-year contracts |

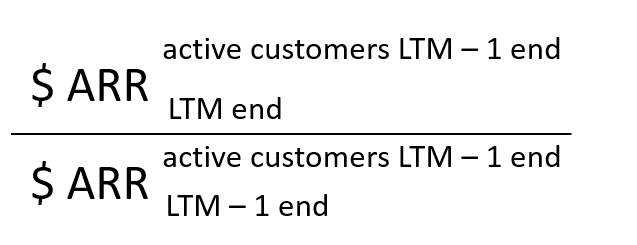

130% | Dollar-based retention including the benefit of upsells, based on ACV “We calculate our retention rate as of a period end by starting with the annual contract value (ACV) from customers with contract value of $5,000 or more as of 12 months prior to such period end (Prior Period ACV) and a subscription term of at least 12 months. We then calculate ACV from these same customers as of the current period end (Current Period ACV). Finally, we divide the aggregate Current Period ACV for the trailing 12 month period by the aggregate Prior Period ACV for the trailing 12 month period to arrive at our retention rate.” (424B4 filed on 1/23/15, Page 53 & 59) |

|

Recurring dollar retention rate |  |

93% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "We calculate the recurring dollar retention rate by dividing the retained recurring value of subscription revenue for a period by the previous recurring value of subscription revenue for the same period. We define retained recurring value of subscription revenue as the committed subscription fees for all contracts that renew in a given period. We define previous recurring value of subscription revenue as the recurring value from committed subscription fees for all contracts that expire in that same period. We typically calculate our recurring dollar retention rate on a monthly basis." (10-K filed on 3/5/13, Page 33) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Customer Retention Rate |  |

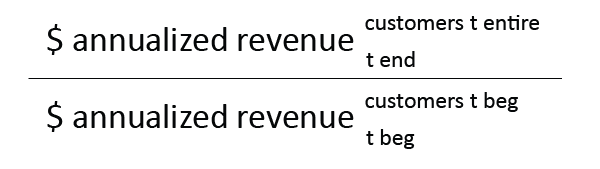

93% | Dollar-based retention excluding the benefit of upsells, based on annual recurring revenue "We calculate retention rate by comparing the annual recurring subscription and support revenue from our customers at the beginning of a measurement period to the annual recurring subscription and support revenue from those same customers at the end of a measurement period. We divide the ending annual recurring revenue by the beginning annual recurring revenue to arrive at our retention rate metric. We exclude the impact of any add-on purchases from these customers during the measurement period; accordingly, our retention rate cannot exceed 100%. In addition, the metric reflects the loss of customers who elected not to renew contracts expiring during the measurement period." (424B4 filed on 5/4/18, Page 23-24) |

|

Renewal rate |  |

82% | Customer count-based renewal excluding the benefit of new customers "We define renewal rate for a period as the percentage of customers who renew annual or multi-year subscriptions that expire during the period presented. Renewal rate excludes customers under our discontinued third-party distribution agreements and prior SMB offering with subscriptions that remain active until cancelled." (424B4 filed on 8/11/11, Page 43 ) |

|

Annual retention rate |  |

83% | Customer count-based retention excluding the benefit of new customers "We define annual retention rate as the percentage of customers on the last day of the prior year who remain customers on the last day of the current year, or for quarterly presentations, the percentage of customers on the last day of the comparable quarter in the prior year who remain customers on the last day of the current quarter." (424B4 filed on 8/11/11, Page 42-43) |

|

Annual net dollar retention rate |  |

109% | Dollar-based retention rate including the benefit of upsells, based on ACV "We calculate annual net dollar retention rate for a given fiscal period as the aggregate annualized subscription contract value as of the last day of that fiscal year from those customers that were also customers as of the last day of the prior fiscal year, divided by the aggregate annualized subscription contract value from all customers as of the last day of the prior fiscal year. We calculate annualized subscription contract value for each customer as the expected monthly recurring revenue of our customers multiplied by 12." (424B4, filed on 3/14/14, Page 49) |

|

Subscription dollar retention rate |  |

>100% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "We calculate this metric for a particular period by establishing the cohort of core customers that had active contracts as of the end of the prior period. We then calculate our subscription dollar retention rate by taking the amount of fixed subscription revenue we recognized for the cohort in the period for which we are reporting the rate and dividing it by the fixed subscription revenue we recognized for the same cohort in the prior period. We do not include any revenue from the non-core, legacy products described above, any variable subscription fees paid by our customers or any implementation fees." (424B4 filed on 5/23/13, Page 40-41) |

|

Net expansion rate |  Note: Excludes Intel (related party |

142% | Dollar-based retention including the benefit of upsells, based on subscription revenue “Our quarterly net subscription revenue expansion rate equals the subscription revenue in a given quarter from end user customers that had subscription revenue in the same quarter of the prior year, divided by the subscription revenue attributable to that same group of customers in that prior quarter. Our net expansion rate equals the simple arithmetic average of our quarterly net subscription revenue expansion rate for the four quarters ending with the most recently completed fiscal quarter. We have excluded Intel from our calculation of net expansion rate, as it is a related party. (424B4 filed on 4/28/17, Page 44) |

|

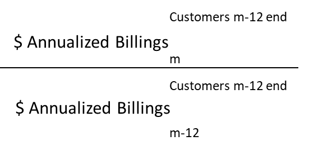

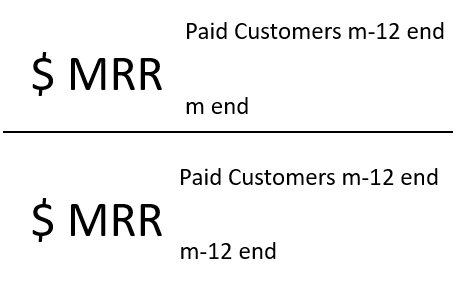

Dollar-based net retention rate |  Annualized Billings: billings for each customer in the final month of a period multiplied by 12 |

111.7% | Dollar-based retention including the benefits of upsells, based on annualized billings "To calculate dollar-based net retention for a period, we compare the Annualized Billings from paid customers 12 months prior to the Annualized Billings from the same set of customers in the last month of the current period. Our dollar-based net retention includes any expansion and is net of contraction and attrition, but excludes Annualized Billings from new customers in the current period. Our dollar-based net retention excludes the benefit of free customers which upgrade to a paid subscription between the prior and current periods, even though this is an important source of incremental growth. We believe this provides a more meaningful representation of our ability to add incremental business from existing paid customers as they renew and expand their contracts." (S-1/A filed 9/3/2019, page 86) |

|

Customer retention rate |  |

N/A | Customer count-based retention excluding the benefit of new customers "One of the best measures we have for ourselves is our customers their repeat business. Founded in 1993, on the premise of helping drive costs out of businesses through innovation, our services are now trusted by over 15,000 clients around the globe with over 15 million users and a 95% retention rate." (concur.com) |

|

Retention rate |  |

97.8% | Customer count-based retention excluding the benefit of new customers "Our monthly retention rate of unique paying customers (# of customers in a given month that continue to use the product in the following month S-1, Page 3) remains in our historical range of 97.8%, +/- 0.5%." (10-K filed on 2/28/13, Page 4) |

|

Annual dollar retention rate |  |

95.8% | Dollar-based retention excluding the benefit of upsells, based on contracted MRR "We define annual dollar retention rate as the implied monthly recurring revenue under client agreements at the end of a FY, divided by the implied monthly recurring rev., for that same client base, at the end of the prior FY and excluding implied monthly recurring revenue from clients of our CSB and Cornerstone for Salesforce solutions. This ratio does not reflect implied monthly recurring revenue for new clients added between the end of the prior FY and the end of the current FY. However, incremental sales up to and not exceeding the original renewal amount to the existing client base as of Dec. 31, 2012 are included in this ratio. We define implied monthly recurring revenue as the total amount of minimum recurring revenue to which we have a contractual right under each of our client agreements over the entire term of the agreement, but excluding non-recurring support, consulting and maintenance fees, divided by the number of months in the term of the agreement." (10-K filed on 3/1/13, Page 41) |

|

Dollar-based net retention rate |  |

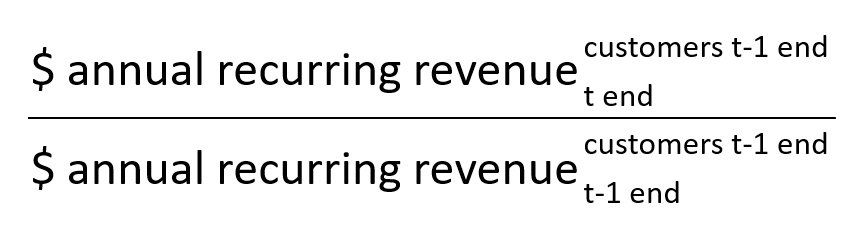

147% | Dollar-based retention including the benefits of upsells, based on annual recurring revenue "We calculate our dollar-based net retention rate as of a period end by starting with the ARR from all subscription customers as of 12 months prior to such period end, or Prior Period ARR. We then calculate the ARR from these same subscription customers as of the current period end, or Current Period ARR. Current Period ARR includes any expansion and is net of contraction or churn over the trailing 12 months but excludes revenue from new subscription customers in the current period. We then divide the Current Period ARR by the Prior Period ARR." (424B4 filed on 6/11/19, Page 21) |

|

Dollar-based Gross Retention Rate |  |

98% | Dollar-based retention excluding the benefit of upsells, based on annual recurring revenue "We calculate our dollar-based gross retention rate as of the period end by starting with the ARR from all subscription customers as of 12 months prior to such period, or Prior Period ARR. We then deduct from the Prior Period ARR any ARR from subscriptions customers who are no longer customers as of the current period end, or Current Period Remaining ARR. We then divide the total Current Period Remaining ARR by the total Prior Period ARR to arrive at our dollar-based gross retention rate, which is the percentage of ARR from all subscription customers as of the year prior that is not lost to customer churn. Our dollar-based gross retention rate reflects only customer losses and does not reflect customer expansion or contraction." (424B4 filed on 6/11/19, Page 82) |

|

Recurring dollar retention rate |  |

Sub. 97% Mktg. 115% |

Dollar-based retention including the benefit of upsells, based on GAAP recurring revenue "We calculate our recurring dollar retention rate by dividing (a) Retained Revenue by (b) Retention Base Revenue. We define Retention Base Revenue as recurring revenue by product from all customers in the prior period; and Retained Revenue as recurring revenue by product from the same group of customers in the current period, including any additional sales to those customers during the current period. We do not include non-renewable revenue such as overage fees for registrations and other miscellaneous services in this calculation." (424B1 filed on 8/9/13, Page 62) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based net retention rate |  |

146% | Dollar-based retention including the benefits of upsells, based on annual recurring revenue "We calculate dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period-end, or the Prior Period ARR. We then calculate the ARR from these same customers as of the current period-end, or the Current Period ARR. Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months, but excludes ARR from new customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the point-in-time dollar-based net retention rate. We then calculate the weighted average of the trailing 12-month point-in-time dollar-based net retention rates, to arrive at the dollar-based net retention rate." (S-1 filed 8/23/2019, page 59) |

|

Dollar-based gross retention rate |  |

>90% | Dollar-based retention excluding the benefit of upsells, based on annual recurring revenue "We calculate our dollar-based gross retention rate by first calculating the point-in-time gross retention as the previous year ARR minus ARR attrition over the last 12 months, divided by the previous year ARR. The ARR attrition for each month is calculated by identifying any customer that has changed their account type to a “free tier,” requested a downgrade through customer support or sent a formal termination notice to us during that month, and aggregating the dollars of ARR generated by each such customer in the prior month. We then calculate the dollar-based gross retention rate as the weighted average of the trailing 12-month point-in-time gross retention rates." (S-1 filed 8/23/2019, page 59) |

|

Subscription dollar retention rate |  |

>100% | Dollar-based renewal rate including the benefit of upsells, based on ACV "We calculate the subscription dollar retention rate by dividing the retained average contract value of subscription revenue by the previous average contract value of subscription revenue. We define retained average contract value of subscription revenue as the average annual contract value from committed subscription fees for all contracts that renew in a given period. We define previous average contract value of subscription revenue as the average annual contract value from committed subscription fees for all contracts that expire in that same period." (424B4 filed on 3/15/12, Page 39) |

|

Dollar-based net retention rate |  |

115% | Dollar-based retention including the benefits of upsells, based on ACV "To calculate our dollar-based net retention rate at the end of a base year (e.g., January 31, 2017), we first identify the set of customers that were customers at the end of the prior year (e.g., January 31, 2016). We then divide the ACV attributed to that set of customers at the end of the base year by the ACV attributed to that same set at the end of the prior year. The quotient obtained from this calculation is the dollar-based net retention rate." (424B4 filed on 3/28/18, Page 63) |

|

Subscription Net Revenue Retention Rate |  |

105% | Dollar-based retention including the benefit of upsells, based on subscription revenue "Our subscription net revenue retention rate compares the subscription revenue in a given period from the cohort of customers that generated subscription revenue at the beginning of the same period in the prior fiscal year, excluding customers from the cohort who canceled during the prior period. The subscription net revenue retention rate is the quotient obtained by dividing the subscription revenue generated from that cohort in a period, by the subscription revenue generated from that same cohort in the corresponding prior year period." (424B4 filed on 6/29/18, Page 57) |

|

Annualized Net Revenue Retention |  |

~100% for Dropbox Business, >90% for blend of Dropbox Business and individuals | Dollar-based retention including the benefit of upsells, based on annualized revenue "We calculate Annualized Net Revenue Retention by aggregating the annualized revenue from all paying Dropbox Business customers subscribing to a Dropbox Business plan at the beginning of the period, then aggregating the annualized revenue from those same Dropbox Business customers at the end of the period. For customers whose renewal is pending at the end of the period, we include their annualized revenue in the ending total if they resume payment within 30 days from the end of that period. Annualized Net Revenue Retention is equal to ending annualized revenue divided by beginning annualized revenue." (424B4 filed on 3/23/18, Page 68) |

|

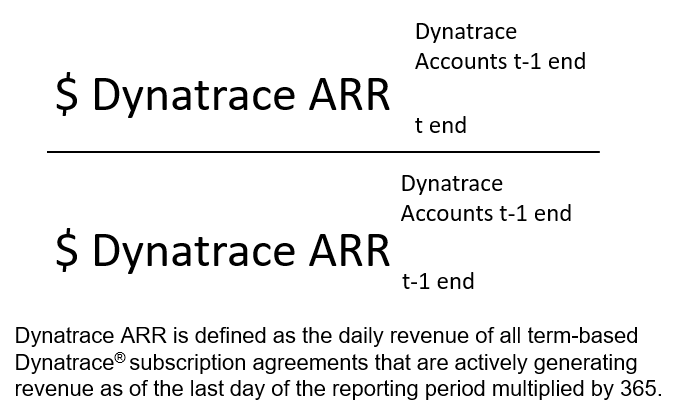

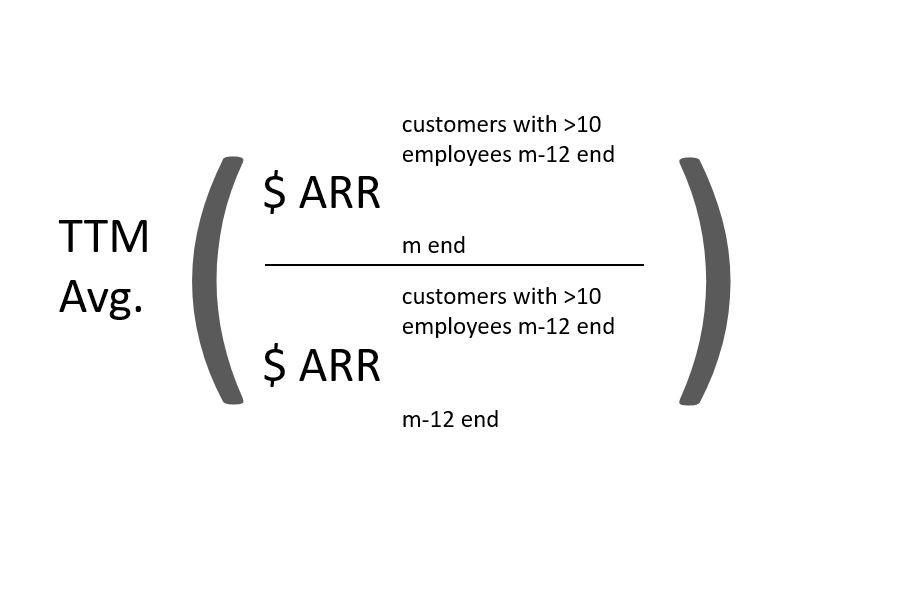

Dynatrace Dollar-Based Net Expansion Rate |  |

140% | Dollar-based net expansion rate excluding the benefit of upsells, based on Dynatrace ARR "We define the Dynatrace® dollar-based net expansion rate as the Dynatrace® ARR at the end of a reporting period for the cohort of Dynatrace® accounts as of one year prior to the date of calculation, divided by the Dynatrace® ARR one year prior to the date of calculation for that same cohort. This calculation excludes the benefit of Dynatrace® ARR resulting from the conversion of Classic products to the Dynatrace® platform, as well as any upsell generated at the time of conversion. Dynatrace® dollar-based net expansion rate has trended between 120% and 140% as of June 30, 2018, September 30, 2018, December 31, 2018 and March 31, 2019. In the period before June 30, 2018, our Dynatrace® dollar-based net expansion rate was not meaningful given the relatively small amount of Dynatrace® ARR we generated during the prior periods." (S-1/A filed on 7/31/2019, page 76) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Net dollar retention rate |  |

>100% | Dollar-based retention including the benefit of upsells, based on contracted MRR "Net Dollar Retention Rate is a measurement, expressed as a percentage, of the aggregate contracted minimum subscription revenue normalized to a monthly basis of our customer base, or Implied Monthly Recurring Revenue, as of the first day of a 12-month period in relation to that of the same customer base as of the last day of such 12-month period. Our Net Dollar Retention Rate metric is calculated by dividing (a) Implied Monthly Recurring Revenue at the end of a 12-month fiscal period by (b) Implied Monthly Recurring Revenue at the beginning of the same 12-month fiscal period." (424B4 filed on 8/1/12, Page 49) |

|

Net Expansion Rate |  |

142% | Dollar-based expansion including the benefits of upsells, based on annual contract value "To calculate an expansion rate as of the end of a given month, we start with the ACV from all [customers that have entered into annual subscription agreements] as of twelve months prior to that month end, or Prior Period Value. We then calculate the ACV from these same customers as of the given month end, or Current Period Value, which includes any growth in the value of their subscriptions and is net of contraction or attrition over the prior twelve months. We then divide the Current Period Value by the Prior Period Value to arrive at an expansion rate. The Net Expansion Rate at the end of any period is the weighted average of the expansion rates as of the end of each of the trailing twelve months." (424B4 filed on 10/5/18, Page 72-73) |

|

Revenue Retention Rate |  |

112% | Dollar-based renewal rate including the benefit of upsells, based on annual revenue "We calculate our revenue retention rate by dividing (1) total revenue in the current 12-month period from those customers who were customers during the prior 12-month period by (2) total revenue from all customers in the prior 12-month period. For the purposes of calculating our revenue retention rate, we count as customers all entities with whom we had contracts in the applicable period other than (1) customers of our wholly-owned subsidiary, Microtech, which generates an immaterial amount of our revenue in any given year and (2) in the first year following our acquisition of another business, customers that we acquired in connection with such acquisition.' (424B4 filed 9/16/2016, Page 56) |

|

Subscription revenue renewal rate |  |

110% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "Subscription revenue renewal rate is calculated by dividing (a) total subscription revenue (including revenue related to messaging utilization above our clients' contracted levels) in the current period from those clients who were clients during the prior year period, including additional sales to those clients, by (b) total subscription revenue (including revenue related to messaging utilization above our clients' contracted levels) from all clients in the prior year period. This metric is calculated on a quarterly basis and, for periods longer than one quarter, we use an average of the quarterly metrics." (424B1 filed on 3/22/12, Page 43) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based Net Expansion Rate |  |

130.4% | Dollar-based Net Expansion Rate including the benefit of upsells and expansion "We calculate DBNER by dividing the revenue for a given period from customers who remained customers as of the last day of the given period (current period) by the revenue from the same customers for the same period measured one year prior (base period). The revenue included in the current period excludes revenue from (i) customers that churned after the end of the base period and (ii) new customers that entered into a customer agreement after the end of the base period. For example, to calculate our DBNER for the year ended December 31, 2018, we divided (i) revenue for the 12 months ended December 31, 2018, from customers that entered into a customer agreement prior to January 1, 2018, and that remained customers as of December 31, 2018, by (ii) revenue for the 12 months ended December 31, 2017 from the same set of customers." (424B4 filed on 5/17/19, Page 68) |

|

Annual Revenue Retention Rate |  |

98.9% | Dollar-based churn excluding the benefit of upsell "We separately monitor customer retention and churn on an annual basis by measuring our annual revenue retention rate, which we calculate by multiplying the final full month of revenue from a customer that terminated its contract with us (a Churned Customer) by the number of months remaining in the same calendar year (Annual Revenue Churn). The quotient of the Annual Revenue Churn from all of our Churned Customers divided by our annual revenue of the same calendar year is then subtracted from 100% to determine our annual revenue retention rate. We believe this calculation is helpful in that it is based on the amount of revenue that we would expect to have received in the remaining portion of a particular period had a customer not terminated its contract with us. It is not indicative of the actual revenue contribution from churned customers in past periods. By comparing this amount to actual revenue for the period, we are able to assess our ability to replace terminated revenue by generating revenue from new and continuing customers." (424B4 filed on 5/17/19, Page 69) |

|

Dollar-based retention rate |  |

100% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "Our Dollar-Based Retention Rate is calculated by dividing our Retained Net Invoicing by our Retention Base Net Invoicing on a monthly basis, which we then average using the rates for the trailing twelve months for the period being presented. We define Retention Base Net Invoicing as recurring net invoicing from all clients in the comparable prior year period, and we define Retained Net Invoicing as recurring net invoicing from that same group of clients in the current period. We define recurring net invoicing as subscription and related usage revenue." (424B4 filed on 4/4/14, Page 47-48) |

|

Net churn |  |

89.7% | Vehicle count-based net churn including the benefit of vehicles added "We calculate our net churn for a period by dividing (i) the number of vehicles under subscription added from existing customers less vehicles under subscription lost from existing customers over that period by (ii) the total vehicles under subscription at the beginning of that period." (424B4 filed on 10/5/12, Page 10) |

|

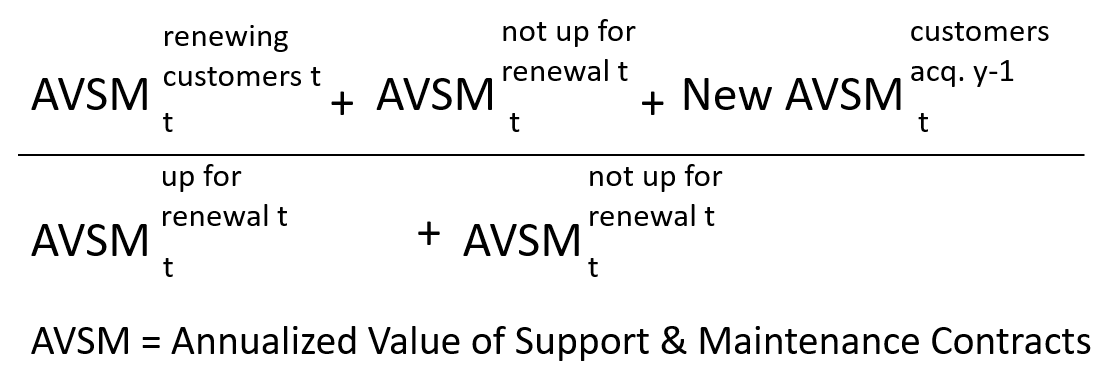

Net-Recurring Revenue Retention Rate |  |

128% | Dollar-based renewal rate including the benefit of upsells, based on support and maintenance revenue "We calculate the net-recurring revenue retention rate on support and maintenance contracts as the trailing 12 month annualized value of support and maintenance contracts renewed plus the trailing 12 month annualized value of support and maintenance contracts not subject to renewal because the scheduled expiration date of the multi-year support and maintenance contract falls outside of the 12 month period under measurement plus the annualized value of new support and maintenance contracts from end-customers acquired one year prior, in the aggregate, divided by the aggregate of the trailing 12 months annualized value of support and maintenance contracts scheduled to terminate or renew during the trailing 12 month period plus the trailing 12 month annualized value of support and maintenance contracts not subject to renewal because the scheduled expiration date of the multi-year support and maintenance contract falls outside of the 12 month period under measurement." (424B4 filed on 3/21/18, Page 51) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Subscription revenue retention rate |  |

90.3% | Dollar-based retention including the benefit of upsells, based on contracted MRR "We compare the aggregate Contractual Monthly Subscription Revenue of our customer base as of the beginning of each month, which we refer to as Retention Base Revenue, to the aggregate Contractual Monthly Subscription Revenue of the same group of customers at the end of that month, which we refer to as Retained Subscription Revenue Our Subscription Dollar Retention Rate for a given period is calculated by first dividing Retained Subscription Revenue by Retention Base Revenue for each month in the period, calculating the weighted average of these rates using the Retention Base Revenue for each month in the period, and then annualizing the resulting rates." (424B4 filed on 10/9/14, Page 47) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Net revenue retention rate |  |

>100% | Dollar-based renewal rate including the benefit of upsells, based on GAAP revenue "We calculate our net revenue retention rate by dividing the total revenue obtained from a particular customer in a given month by the total revenue from that customer from the same month in the immediately preceding year. This calculation contemplates all changes to revenue for the designated customer, which includes customer terminations, changes in quantities of users, changes in pricing, additional applications purchased or applications no longer used. We calculate the net revenue retention for our entire customer base at a given point in time. We believe our net revenue retention rate is an important metric to measure the long-term value of customer agreements and our ability to retain our customers. Our net revenue retention rate was over 100% at each of December 31, 2013 and 2014 and at each of September 30, 2014 and 2015." (424B4 filed on 11/13/15, Page 50-51) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-Based Net Retention Rate |  |

120% | Dollar-based retention rate including the benefits of upsells, based on ARR "We calculate dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period end, or Prior Period ARR. We then calculate the ARR from these same customers as of the current period end, or Current Period ARR. Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months but excludes ARR from new customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the dollar-based net retention rate." (424B4 filed on 7/23/20, page 90) |

|

Renewal rate |  |

Excl. Upsells: 95.3% Incl. Upsells: 113.6% |

Dollar-based renewal rate, based on ACV "We measure renewal rates on transactions with annual subscription values over $50,000. We calculate our renewal rates by taking the actual dollar amount of contracts renewed for a given period and comparing those actual renewals to the dollar amount of contracts expiring in that same period. The renewal rate is derived by using the actual dollar amount renewed as the numerator and the total renewable contract amount as the denominator." (424B4 filed on 12/13/11, Page 44) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based renewal ratee |  |

89.6% | Dollar-based renewal rate excluding the benefit of upsells, based on ACV "A substantial portion of our clients have renewed their subscriptions each year. During 2002, 2003 and 2004, our clients renewed approximately 80%, 97% and 89.6%, respectively, of the aggregate contract value up for renewal during each of those periods." (424B4 filed on 6/25/05, Page 32) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Member retention rate |  |

85.4% | Customer count-based retention excluding the benefit of new customers "We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year, or for quarterly presentations, the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period." (424B4 filed on 10/3/12, Page 62) |

|

Dollar-weighted average renewal rate |  |

~80% | Dollar-based renewal rate excluding the benefit of upsells, based on GAAP revenue "The dollar-weighted average renewal rate is the percent of our subscriptions, on a dollar basis, that could have terminated during a given period, in accordance with the terms of the subscription agreements but which were renewed." (424B4 filed on 7/1/09, Page 32) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Revenue retention rate |  |

>100% | Dollar-based retention including the benefit of upsells, based on GAAP revenue "We calculate our revenue retention rate metric by dividing retained revenues by retention base revenues. We define retention base revenues as revenues from all advertisers in the corresponding prior period, and we define retained revenues as revenues from all advertisers from the prior period that remain advertisers in the current period. This metric is calculated on a quarterly basis, and for annual periods, we use an average of the quarterly metrics." (424B4 filed on 3/22/13, Page 45-46) |

|

Subscription dollar retention rate |  |

~100% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "We compare the aggregate monthly subscription revenue of our customer base in the last month of the prior year fiscal quarter, the Retention Base Revenue, to aggregate monthly subscription revenue generated from the same group in the last month of the current quarter, the Retained Subscription Revenue. Our Subscription Dollar Retention Rate is calculated on an annual basis by first dividing Retained Subscription Revenue by Retention Base Revenue, and then using the weighted average Subscription Dollar Retention Rate of the four fiscal quarters within the year." (424B4 filed on 5/17/13, Page 52) |

|

Dollar-based net revenue retention rate |  Note: All subsidiaries and divisions of a parent are counted as a single customer |

119% | Dollar-based net revenue retention including the benefit of upsells, based on subscription revenue "We calculate our dollar-based net revenue retention rate by dividing (i) subscription revenue in the trailing 12-month period from those customers who were on our platform during the prior 12-month period by (ii) subscription revenue from the same customers in the prior trailing 12-month period. For the purposes of calculating our dollar-based net revenue retention rate, we count as a single customer all subsidiaries and divisions of a single parent." (424B4 filed on 7/18/19, Page 74) |

|

Revenue retention rate |  Note: Annualized revenue measured on a constant currency basis |

108% | Dollar-based retention including the benefit of upsells, based on constant currency revenue "We calculate our revenue retention rate by annualizing revenue on a constant currency basis recorded on the last day of the measurement period for only those customers in place throughout the entire measurement period. We include add-on, or upsell, revenue from additional employees and services purchased by existing customers. We divide the result by revenue on a constant currency basis on the first day of the measurement period for all customers in place at the beginning of the measurement period. The measurement period is based on the trailing twelve months. The revenue on a constant currency basis is based on the average exchange rates in effect during the respective period." (424B4 filed on 11/19/15, Page 46-47) |

|

Dollar-based net expansion rate |  |

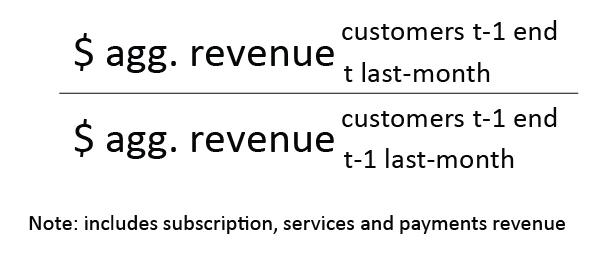

109% | Dollar-based expansion including the benefit of upsells, based on GAAP subscription revenue "We calculate our dollar-based net expansion rate by dividing our retained revenue net of contraction and churn by our base revenue. We define our base revenue as the aggregate monthly subscription, services and payments revenue of our subscriber base as of the date one year prior to the date of calculation. We define our retained revenue net of contraction and churn as the aggregate monthly subscription, services and payments revenue of the same subscriber base included in our measure of base revenue at the end of the annual period being measured." (424B4 filed on 6/19/15, Page 15) |

|

Net ARR Expansion Rate |  |

128% | Net ARR expansion rate including the benefit of upsells, based on GAAP subscription revenue "We define ARR as the subscription revenue we would contractually expect to receive from customers over the following 12 months assuming no increases or reductions in their subscriptions. ARR excludes MongoDB Atlas, professional services and other self-service products… We examine the rate at which our customers increase their subscriptions with us, called net ARR expansion rate. We calculate net ARR expansion rate by dividing the ARR for a given period from customers who were also customers at the close of the same period in the prior year, the base period, by the ARR from all customers at the close of the base period, including those who churned or reduced their subscriptions." (424B4 filed on 10/19/17, Page 62-63) |

|

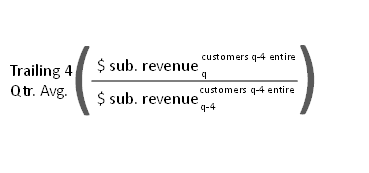

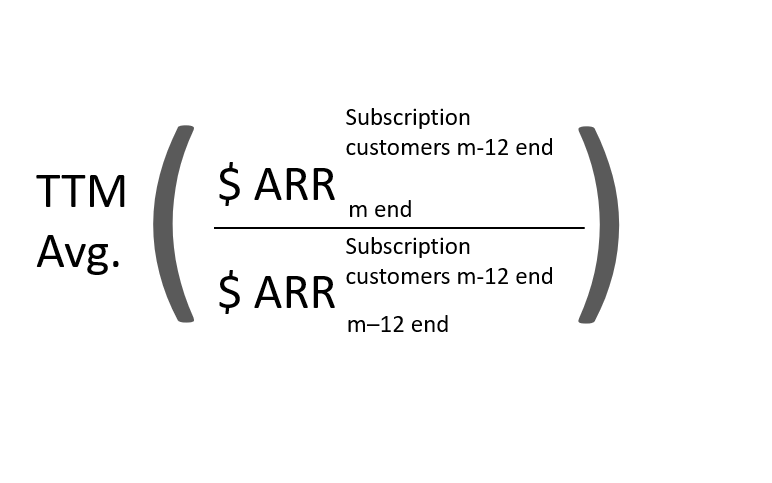

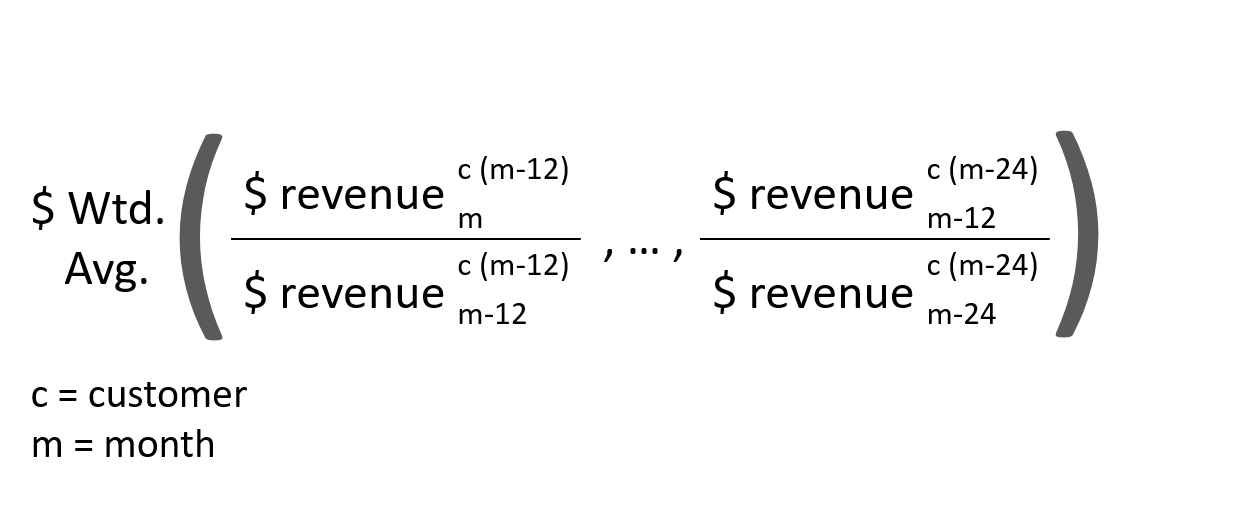

Dollar-based net retention rate |  c = customer |

117% | Dollar-based retention rate, based on subscription and support revenue “We calculate our dollar-based net retention rate for all periods on a trailing four-quarter basis. To calculate our dollar-based net retention rate, we first calculate the subscription and support revenue in one quarter from a cohort of customers that were customers at the beginning of the same quarter in the prior fiscal year, or Cohort Customers. We repeat this calculation for each quarter in the trailing four-quarter period. The numerator for dollar-based net retention rate is the sum of subscription and support revenue from Cohort Customers for the four most recent quarters, or Numerator Period, and the denominator is the sum of subscription and support revenue from Cohort Customers for the four quarters preceding the Numerator Period. (424B filed on 3/16/17, Page 60) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Subscription Revenue Retention Rate |  |

147% | Dollar-based retention rate including the benefits of upsells, based on subscription revenue “We calculate our subscription revenue retention rate as total subscription revenues in a fiscal year from customers who purchased any of our solutions as of January 31 of the prior fiscal year, expressed as a percentage of total subscription revenues for the prior fiscal year." (424B4 filed on 7/14/20, page 53) |

|

Dollar-based net expansion rate |  |

115% | Dollar-based expansion including the benefit of upsells, based on GAAP subscription revenue run-rate "To calculate our annually dollar-based net expansion rate, we first establish the base period monthly recurring revenue from all our customers at the end of a month. This represents the revenue we would contractually expect to receive from those customers over the following month, without any increase or reduction in any of their subscriptions. We then (i) calculate the actual monthly recurring revenue from those same customers at the end of that following month; then (ii) divide that following month's recurring revenue by the base month's recurring revenue to arrive at our monthly net expansion rate; then (iii) calculate a quarterly net expansion rate by compounding the net expansion rates of the three months in the quarter; and then (iv) calculate our annualized net expansion rate by compounding our quarterly net expansion rate over an annual period." (424B4 filed on 12/12/14, Page 43) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based retention rate |  |

123% | Dollar-based retention rate including the benefit of upsells, based on ACV “We calculate our Dollar-Based Retention Rate as of a period end by starting with the ACV (Annual Contract Value) from all customers as of twelve months prior to such period end, or Prior Period ACV. We then calculate the ACV from these same customers as of the current period end, or Current Period ACV. Current Period ACV includes any upsells and is net of contraction or attrition over the trailing twelve months but excludes revenue from new customers in the current period. We then divide the total Current Period ACV by the total Prior Period ACV to arrive at our Dollar-Based Retention Rate. Our Dollar-Based Retention Rate has consistently exceeded 100%, which is primarily attributable to an expansion of users and up-selling additional products within our existing customers. Larger enterprises often implement a limited initial deployment of our platform before increasing their deployment on a broader scale.” (424B4 filed on 4/7/17, Page 64) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Dollar-based Net Retention Rate |  |

140% | Dollar-based retention including the benefits of upsells, based on ARR "We calculate dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of 12 months prior to such period end, or Prior Period ARR. We then calculate the ARR from these same customers as of the current period end, or Current Period ARR. Current Period ARR includes any expansion and is net of contraction or attrition over the last 12 months but excludes ARR from new customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at the dollar-based net retention rate." (424B4 filed on 4/11/19, Page 58) |

|

Total ARR Churn Rate |  |

<5% | Dollar-based churn excluding the benefit of upsells, based on ARR "Our ARR churn rate represents lost revenue from customers that contributed no revenue in the measurement period but did contribute revenue in the equivalent prior year period." (424B4 filed on 4/11/19, Page 55) |

|

Revenue retention rate |  |

91% | Dollar-based retention excluding the benefit of upsells, based on GAAP subscription revenue "Our average annual revenue retention rate tracks the percentage of revenue that we retain from our existing clients. We monitor this metric because it is an indicator of client satisfaction and revenue for future periods." (424B4 filed on 4/15/14, Page 51) Note: No formula provided. Formula shown is assumed based on characterization of rate as demonstrating revenue "retrieved from our existing clients" |

|

Annual revenue retention rate |  Note: Recurring revenue ex-interest income and professional services |

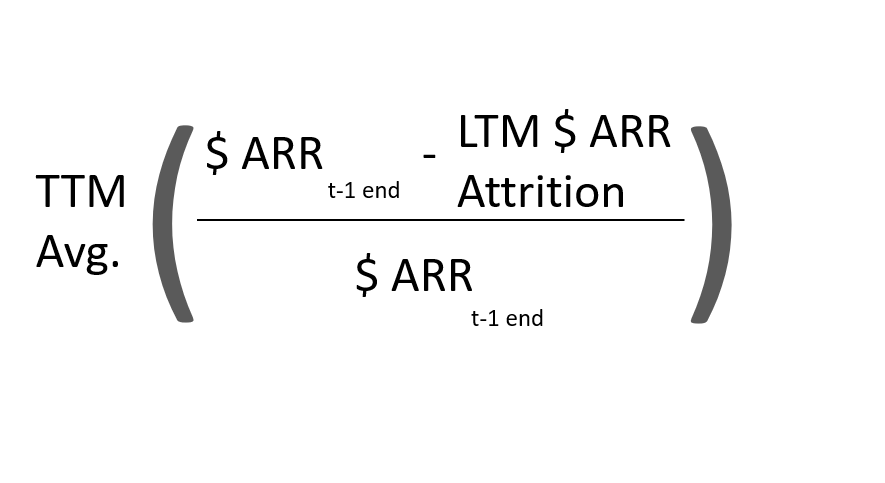

>92% | Dollar-based retention including the benefit of new customers, based on GAAP revenue "We calculate our annual revenue retention rate as our total revenue for the preceding 12 months, less the annualized value of revenue lost during the preceding 12 months, divided by our total revenue for the preceding 12 months. We calculate the annualized value of revenue lost by summing the recurring fees paid by lost clients over the previous twelve months prior to their termination if they have been a client for a minimum of twelve months. For those lost clients who became clients within the last twelve months, we sum the recurring fees for the period that they have been a client and then annualize the amount. Interest income excluded." (424B4 filed on 3/19/14, Page 46) |

|

Dollar-based Net Retention Rate |  |

115% | Dollar-based retention rate including the benefit of upsells, based on ARR "We calculate our dollar-based net retention rate as of the end of a reporting period as follows: Denominator: We measure ARR as of the last day of the prior reporting period. Numerator: We measure ARR as of the last day of the current reporting period from customers with associated ARR as of the last day of the prior reporting period. The quotient obtained from this calculation is our dollar-based net retention rate." (S-1/A filed on 9/9/2019, page 76) |

|

Dollar-Based Net Expansion Rate |  |

158% | Dollar-based net revenue retention rate, based on subscription revenue "We calculate our dollar-based net expansion rate for all periods on a trailing four-quarter basis. To do so, we calculate our dollar-based net expansion rate as of each quarter end by starting with the subscription revenue from customers as of the prior year's same quarter (the "Prior Period Subscription Revenue"). We then calculate subscription revenue from these same customers as of the current quarter end (the "Current Period Subscription Revenue"). Finally, to assess net expansion level for common groups of customers over time, we divide the aggregate Current Period Subscription Revenue for the trailing four quarters by the aggregate Prior Period Subscription Revenue for the trailing four quarters resulting in our dollar-based expansion rate." (424B4 filed on 4/20/18, Page 66) |

|

Dollar-based Net Retention Rate |  |

120% | Dollar-based retention rate including the benefit of upsells, based on subscription revenue in the trailing four-quarter period "To calculate our dollar-based net retention rate, we first calculate the subscription revenue in one quarter from a cohort of customers that were customers at the beginning of the same quarter in the prior fiscal year, or cohort customers. We repeat this calculation for each quarter in the trailing four- quarter period. The numerator for dollar- based net retention rate is the sum of subscription revenue from cohort customers for the four most recent quarters, or numerator period, and the denominator is the sum of subscription revenue from cohort customers for the four quarters preceding the numerator period. Dollar- based net retention rate is the quotient obtained by dividing the numerator by the denominator." (424B4 filed on 5/17/18, Page 91) |

|

Retention rate |  |

90% | Dollar-based retention excluding the benefit of upsells, based on GAAP subscription revenue "We derive this retention rate by calculating the total annually recurring subscription revenue from customers currently using our SaaS platform and dividing it by the total annually recurring subscription revenue from these current customers as well as all business lost through non-renewal." (424B4 filed on 4/20/12, Page 46) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Revenue retention rate |  |

128% | Dollar-based retention including the benefit of upsells, based on GAAP revenue "We calculate our revenue retention rate as the total revenues in a calendar year from customers who were installed customers as of December 31st of the prior year, expressed as a percentage of the total revenues during the prior year from those installed customers." (424B4 filed on 3/20/14, Page 48) |

|

Churn |  |

3.5% | Dollar-based churn including the benefit of upsells, based on MRR "We define churn as the amount of any monthly recurring revenue losses due to customer cancellations and downgrades, net of upgrades and additions of new solutions, during a year, divided by our monthly recurring revenue at the beginning of the year." (424B4 filed on 3/20/14, page 48) |

|

Dollar-Based Net Retention |  |

122% | Dollar-based retention including the benefit of upsells, based on subscription revenue "To calculate our net retention rate, we first calculate the subscription revenue in one quarter from a cohort of customers that were customers at the beginning of the same quarter in the prior fiscal year, or cohort customers. We repeat this calculation for each quarter in the trailing four-quarter period. The numerator for net retention rate is the sum of subscription revenue from cohort customers for the four most recent quarters, or numerator period, and the denominator is the sum of subscription revenue from cohort customers for the four quarters preceding the numerator period." (S-1/A filed on 11/05/18, Page 64-65) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

Renewal rate |  |

127% | Customer count-based retention including the benefit of upsells "We calculate our renewal rate by comparing the number of paid seats of all of our existing customers at the beginning of a twelve-month period to the number of paid seats for those same customers at the end of such period, taking into account nonrenewals, upgrades and downgrades. We exclude seats sold to new customers." (424B4 filed on 4/12/13, Page 43) |

|

Subscription dollar retention rate |  |

>100% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "Our Subscription Dollar Retention Rate metric is calculated by dividing (a) Retained Subscription Revenue by (b) Retention Base Revenue. We define Retention Base Rev. as subscription rev. from all customers in the prior period and Retained Subscription Rev. as subscription rev. from that same group of customers in the current period." (424B4 filed on 4/21/11, Page 40) |

|

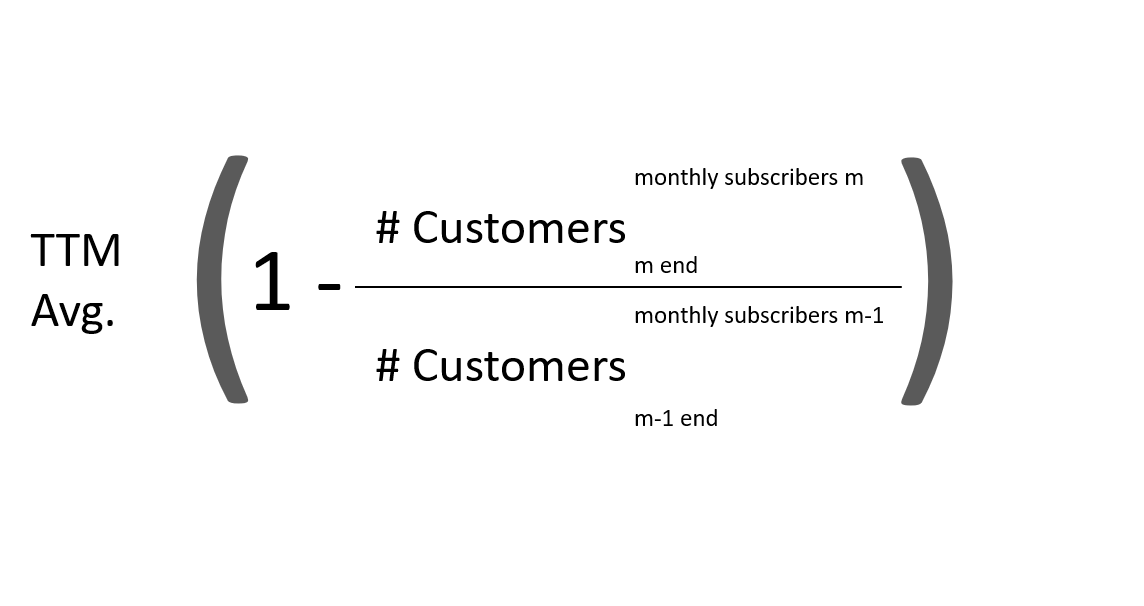

Net monthly subscription dollar retention rate |  |

~99% | Dollar-based retention including the benefit of upsells, based on MRR "We define our Net Monthly Subscription Dollar Retention Rate as (i) one plus (ii) the quotient of Dollar Net Change divided by Average Dollar Monthly Recurring Subscriptions. We define Dollar Net Change as the quotient of (i) the difference of our Monthly Recurring Subscriptions at the end of a period minus our Monthly Recurring Subscriptions at the beginning of a period minus our Monthly Recurring Subscriptions at the end of the period from new customers we added during the period, (ii) all divided by the number of months in the period. We define our Average Monthly Recurring Subscriptions as the average of the Monthly Recurring Subscriptions at the beginning and end of the measurement period." (424B4 filed on 9/27/13, Page 59) |

| Company | Defined Term | Metric Formula | Rate at IPO | Definition |

|

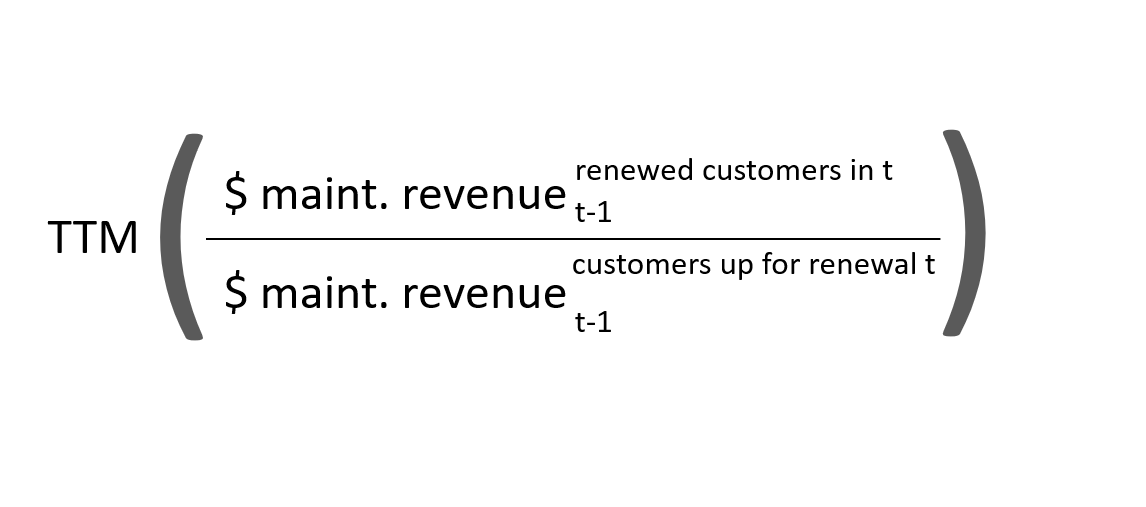

Maintenance renewal rate |  |

>95% | Dollar-based retention excluding the benefit of upsells, based on GAAP maintenance revenue "We measure our maintenance renewal rate for our IdentityIQ customers over a 12-month period on a gross retention basis. Our maintenance renewal rate is calculated by taking the total prior period maintenance revenue from customers that have renewed in the current period and dividing that figure by the total prior period maintenance revenue for all customers with contracts that were up for renewal. By definition, our calculation does not take into account incremental revenue from price increases, expanding the number of identities, cross-selling additional solutions or upselling additional modules." (424B4 filed on 8/17/17, Page 63) |

|

Dollar-based attrition rate |  Note: Excludes Marketing Cloud service offerings |

Not Reported at IPO High-teens (as of first disclosure- 8/20/2009) Most Recent: 8-9% |

Dollar-based attrition rate reflecting trailing period revenue lost "Our typical subscription contract term is 12 to 36 months, although terms range from one to 60 months, so during any fiscal reporting period only a subset of active subscription contracts is eligible for renewal. We calculate our attrition rate as of the end of each month. Our current attrition rate calculation does not include the Marketing Cloud service offerings. Our attrition rate was between eight and nine percent as of July 31, 2016. We expect our attrition rate to remain consistent as we continue to expand our enterprise business and invest in customer success and related programs." (First 10-Q disclosing attrition filed on 11/25/13) |

|

Average annual customer renewal rate |  |

100% | Dollar-based renewal rate excluding the benefit of upsells, based on ACV (Reported from S-1 filed 9/24/10 to 2012 10-K filed 3/8/13; no longer reported) "Our average annual customer renewal rate, on a net dollar basis, reflects the percent of contracts that could have terminated during a period but which were renewed. This figure excludes upsells." (SciQuest Investor Relations) |

|

Recurring revenue retention rate |  |

100% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue (Started reporting from 2013 onwards) "We have changed a little bit, we are going to start giving a metric which is basically a same-store sales metric. And the primary reason for that is as we look at other SaaS companies that's what all of them are doing." - Rudy C. Howard - Chief Financial Officer, Q4 2013 results earning transcript. "We calculate recurring revenue retention rates for a particular period by comparing the subscription revenue for all customers at the end of the prior period to the subscription revenue for those same customers at the end of the current period." (10-K filed on 2/21/14, Page 10) |

|

Net revenue retention rate |  |

102% | Dollar-based retention including the benefit of upsells, based on monthly recurring revenue of managed security clients "To calculate our revenue retention rate for any period, we compare the monthly recurring revenue of our managed security client base at the beginning of the period, which we call our base recurring revenue, to the monthly recurring revenue from that same cohort of clients at the end of the period, which we call our retained recurring revenue" (424B4 filed on 4/22/16, Page 55) |

|

Subscription Net Dollar Retention Rate |  |

116% | Dollar-based retention including the benefit of upsells, based on GAAP subscription revenue "Our subscription net dollar retention rate compares the subscription revenue from a set of customers in a period to the same period in the prior year. To calculate the subscription net dollar retention rate for a period, we first identify the cohort of customers that were customers in the equivalent prior year period. Subscription net dollar retention rate for a period is the quotient obtained by dividing the subscription revenue generated from that cohort in a period, by the subscription revenue generated from that same cohort in the corresponding prior year period." (424B4 filed on 11/15/17, Page 66) |

|

Renewal rate |  |

96% | Dollar-based renewal rate excluding the benefit of upsells, based on ACV "We calculate our renewal rate by subtracting our attrition rate from 100%. Our attrition rate is equal to the annual contract value from customers that are due for renewal in the period and did not renew, divided by the total annual contract value from all customers due for renewal during the period. Annual contract value is equal to the first twelve months of expected subscription revenues under a contract." (424B4 filed on 6/29/12, Page 39) |

|

Monthly billings retention rate |  |

101% | Billings-based retention including the benefit of upsells "Monthly Billings Retention Rate, or MBRR, is calculated as of the end of each month by considering the cohort of merchants on the Shopify platform as of the beginning of the month and dividing total billings attributable to this cohort in the then-current month by total billings attributable to this cohort in the immediately preceding month. Billings includes billings from subscriptions, apps (net of referral fees), transaction fees and fees for Shopify Payments. For annual and quarterly fiscal periods, we report the average MBRR over the preceding 12 months." (424B4 filed on 5/21/15, Page 55) |

|

Net Dollar Retention Rate |  |

138% | Dollar-based retention including the benefit of upsells, based on MRR "We calculate Net Dollar Retention Rate as of a period end by starting with the MRR from all Paid Customers as of twelve months prior to such period end, or Prior Period MRR. We then calculate the MRR from these same Paid Customers as of the current period end, or Current Period MRR. Current Period MRR includes expansion within Paid Customers and is net of contraction or attrition over the trailing twelve months, but excludes revenue from new Paid Customers in the current period, including those organizations that were only on Free subscription plans in the prior period and converted to paid subscription plans during the current period. We then divide the total Current Period MRR by the total Prior Period MRR to arrive at our Net Dollar Retention Rate." (424B4 filed on 6/20/19, Pages 71-72) |

|

Dollar-based net retention rate |  |

All Customers:130% Customers w/ ACV ≥ $5,000: 149% |

Dollar-based renewal excluding the benefit of upsells, based on ACV "We calculate dollar-based net retention rate as of a period end by starting with the ACV from the cohort of all customers as of the 12 months prior to such period end, or Prior Period ACV. We then calculate the ACV from these same customers as of the current period end, or Current Period ACV. Current Period ACV includes any upsells and is net of contraction or attrition over the trailing 12 months, but excludes subscription revenue from new customers in the current period. We then divide the total Current Period ACV by the total Prior Period ACV to arrive at the dollar-based net retention rate. The cohort for customers with ACV of $5,000 or more represents ~54% of total ACV as of January 31, 2018." (424B4 filed on 4/27/18, Page 60) |

|

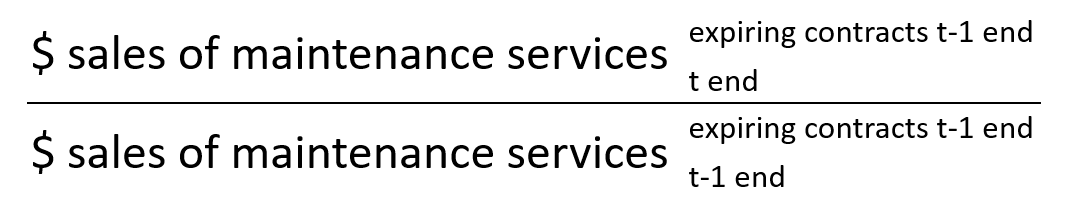

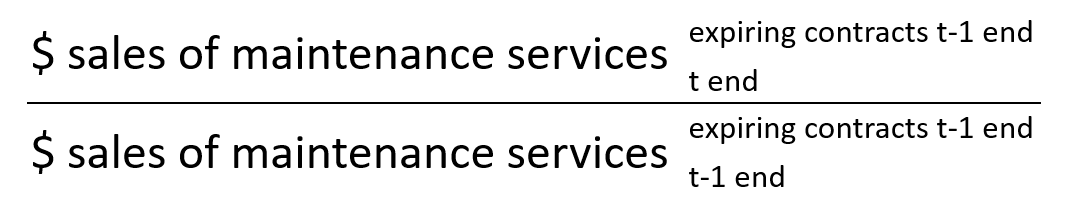

Net retention rate for subscription products |  |

105% | Dollar-based retention including the benefit of upsells, based on subscription revenue "We define our net retention rate for subscription products as the implied monthly subscription revenue at the end of a period for the base set of customers from which we generated subscription revenue in the year prior to the calculation, divided by the implied monthly subscription revenue one year prior to the date of calculation for that same customer base." (424B4 filed on 10/22/18, Page 68) |

|

Maintenance renewal rate for perpetual license products |  |

Low- to Mid- ~90% | Dollar-based renewal including the benefit of upsells, based on sales of maintenance services "We define our maintenance renewal rate as the sales of maintenance services for all existing maintenance contracts expiring in a period, divided by the sum previous sales of maintenance services corresponding to those services expiring in the current period. Sales of maintenance services includes sales of maintenance renewals for a previously purchased product and the amount allocated to maintenance revenue from a license purchase." (424B4 filed on 10/22/18, Page 68) |

|

Dollar-Based Net Retention Rate |  |

All Custs: 108% Excl. SMBs: 118% |

Dollar-based retention including the benefit of upsells, based on organic ARR "We calculate dollar-based net retention rate by dividing the organic ARR from our customers as of December 31st in the reported year by the organic ARR from those same customers as of December 31st in the previous year. This calculation is net of upsells, contraction, cancellation or expansion during the period but excludes organic ARR from new customers." (424B4 filed on 12/13/19, Page 69) |

|

Dollar-based retention rate |  |

>110% | Dollar-based retention including increases in transaction volume, based on transaction net revenue "Revenue from our sellers has grown consistently over time, resulting in strong dollar-based retention rates. Transaction revenue net of transaction costs for each of our 18 quarterly seller cohorts (dating back to the second quarter of 2010) has grown year over year in every quarter since the first quarter of 2012. Over the past four quarters, retention of transaction revenue net of transaction costs for our cohorts has, on average, exceeded 110% year over year." (424B4 filed on 11/19/15, Page 106) |

|

Customer retention rate |  |

>90% | Customer count-based retention including the benefit of new customers "We calculate our customer retention rate by subtracting our attrition rate from 100%. We calculate our attrition rate for a period by dividing the number of customers lost during the period by the sum of the number of customers at the beginning of the period and the number of new customers acquired during the period." (424B4 filed on 4/20/07, Page 32) |

|

Organization-al Dollar-Based Net Retention Rate |  |

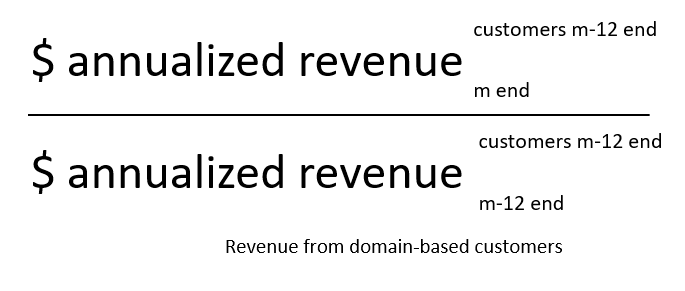

>95% | Dollar-based retention including the benefits of upsells, based on annualized revenue "We calculate organizational dollar-based net retention rate as of the end of a period by starting with the annualized revenue from the cohort of all domain-based customers as of the 12 months prior to the end of such period, or the Prior Period Annualized Organizational Revenue. We then calculate the annualized revenue from these same customers as of the end of the current period, or the Current Period Annualized Organizational Revenue. We then divide Current Period Annualized Organizational Revenue by Prior Period Annualized Organizational Revenue to calculate our organizational dollar-based net retention rate. Organizational dollar-based net retention rate reflects upsells, contraction and attrition within our domain-based customers that are included in the relevant cohort." (424B4 filed on 9/28/18, page 73) |

|

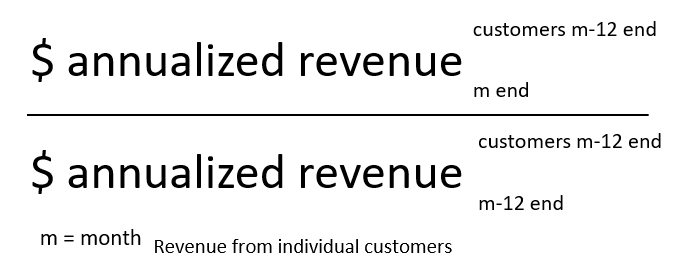

Individual Dollar-Based Net Retention Rate |  |