Exploring Irrevocable Life Insurance Trusts (ILITs)

The Key Wealth Institute is a team of highly experienced professionals representing various disciplines within wealth management who are dedicated to delivering timely insights and practical advice. From strategies designed to better manage your wealth, to guidance to help you better understand the world impacting your wealth, Key Wealth Institute provides proactive insights needed to navigate your financial journey.

Life insurance can be a useful, tax-efficient tool for ensuring the transfer of wealth and assets across generations — but finding the right structure to support your estate planning goals is crucial. As you begin your estate planning process, an irrevocable life insurance trust (ILIT) can provide a host of tax and non-tax advantages, as well as greater control over a life insurance policy that a last will and testament may not provide.

What is an ILIT?

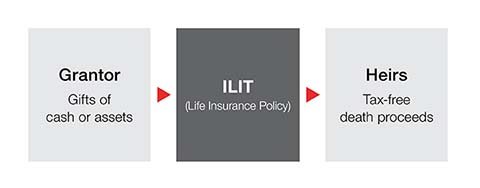

An ILIT is a trust created to own and control one or more life insurance policies, typically insuring the life of the person or persons creating the ILIT, known as the grantor. For premium payments, the grantor typically funds the trust by gifting cash or other assets. If the trust is structured and managed properly, the life insurance death benefit received by the ILIT will not be subject to income tax or estate tax upon the death of the insured(s).

Chart showing these items flowing into each other in the following order:

- Grantor - Gifts of cash or assets

- ILIT - Life Insurance Policy

- Heirs - Tax-fee death proceeds

For more information about trusts, contact your Key Private Bank Advisor