Key Questions: Will the Fed Achieve Complete “Inflation Totality”?

The Key Wealth Institute is a team of highly experienced professionals representing various disciplines within wealth management who are dedicated to delivering timely insights and practical advice. From strategies designed to better manage your wealth, to guidance to help you better understand the world impacting your wealth, Key Wealth Institute provides proactive insights needed to navigate your financial journey.

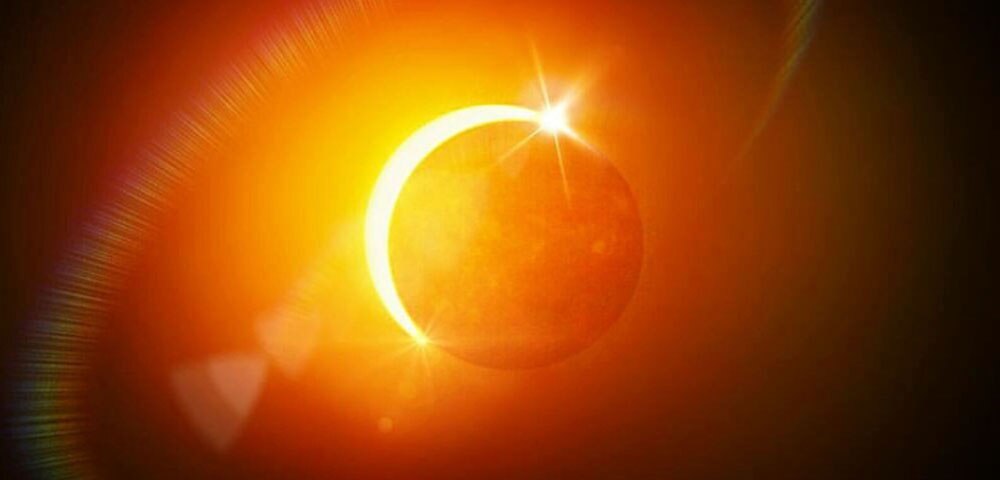

According to a clay tablet found in modern Syria, the first solar eclipse was recorded more than 1,000 years before the birth of Christ. However, some accounts suggest that an eclipse may have occurred considerably earlier. Regardless of the precise date humans first observed the passage of the moon between the Earth and the sun, solar eclipses have coincided with historically significant events, including the exact date of Good Friday (although there is debate over this, too).

Nevertheless, a few days from now, on a specific date and at an exact time, scientists and recreational stargazers alike will tilt their heads skyward and observe the moon completely blocking the sun. If the moon were in a completely circular orbit, total solar eclipses would occur relatively frequently, roughly once per month.

However, because the moon’s orbit is not completely circular, total solar eclipses are rare, on average occurring every 2–3 years. Moreover, for a solar eclipse to be considered “total,” the moon must completely block the sun from the Earth. In simple terms, 99.99% blockage is not considered “total”; 100% obstruction is required. During a total solar eclipse, complete totality occurs on a very narrow path on the surface of the Earth referred to as the “path of totality.”1

Given these stringent requirements, combined with the profound rarity of a total solar eclipse, complete solar eclipses are heralded as major economic events. According to one source (the self-proclaimed “world’s only solar eclipse journalist”), the solar eclipse set to occur on April 8, 2024, will have an equivalent impact of “50 Super Bowls happening at the same time across the country,”2 with several of the 15 states that fall within the path of totality projecting an economic boon of well over $100 million. “Totality will be totally huge!” would be an understandable refrain uttered by many economic development officers nationwide.

Just as rare as a total solar eclipse might be, the possibility of inflation completely returning to the oft-cited 2% target of the Federal Reserve (“the Fed”) may be just as rare. While we profess some glibness when making this statement, loyal readers might acknowledge that we’ve written extensively on the topic, and perhaps justifiably so, for inflation has been a vexing issue for policymakers, business leaders, and consumers for much of the past four years. Furthermore, inflation hurts everyone and is the main reason behind some people’s gloomy assessment of the US economy despite record-high stock prices and near-record lows in unemployment.

In seeking to fulfill one-half of its congressionally established mandate of “price stability” (the other half being “maximum employment”), the Fed targets inflation of 2%, a target established a mere 12 years ago. And inflation was comfortably close to that target for the first nine of those years. Following the Covid-19 pandemic, however, inflation behaved dramatically differently, like so many other things.

At its peak, inflation would increase to nearly 7%, and while it has receded, the latest reading of 3.8% is still clearly above the Fed’s target. In two more recent inflation reports, inflation was higher than expected.3

Meanwhile, the Fed’s recent update on the economy acknowledged that inflation was proving more difficult to slay, suggesting “inflation totality” (or 2%) may also be difficult to achieve. Yet, in the same update, the Fed also upped its outlook for economic growth while maintaining its stance that interest rates would be lowered sometime later this year. In doing so, one might argue that by acknowledging inflation is “stickier” at the same time that interest rates will be lowered, the Fed may implicitly be altering its 2% target, or changing its definition of “totality” (to extend our metaphor).

In our view, the Fed is unlikely to officially make such a move for three reasons. First, while the Fed is a political institution, it takes great measures to remain non-partisan, and because this is an election year, it would be highly uncharacteristic for the Fed to alter such a pivotal policy amid election-year theatrics. Relatedly, in seeking to remain independent, the Fed also guards its integrity carefully. And third, there is still the possibility that the Fed’s 2% goal will be achieved.

As we cited in our 2024 Outlook, “We do not believe that inflation will quickly fall to, and remain at or below, the Fed’s 2% target for a prolonged period of time, absent another economic shock that results in a spike in unemployment.” If anything, based on the ongoing economic resilience, the Fed may alter its forecast for rate cuts without altering its 2% inflation target. This would likely be a jolt to many market participants. And thus, just as people are strongly advised to refrain from staring directly at the sun without proper equipment, investors should refrain from assuming too much risk and navigating what may be some bumpy market conditions ahead without a properly diversified portfolio.

For more information, please contact your advisor.